Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 May, 2025

By Ranina Sanglap and Beenish Bashir

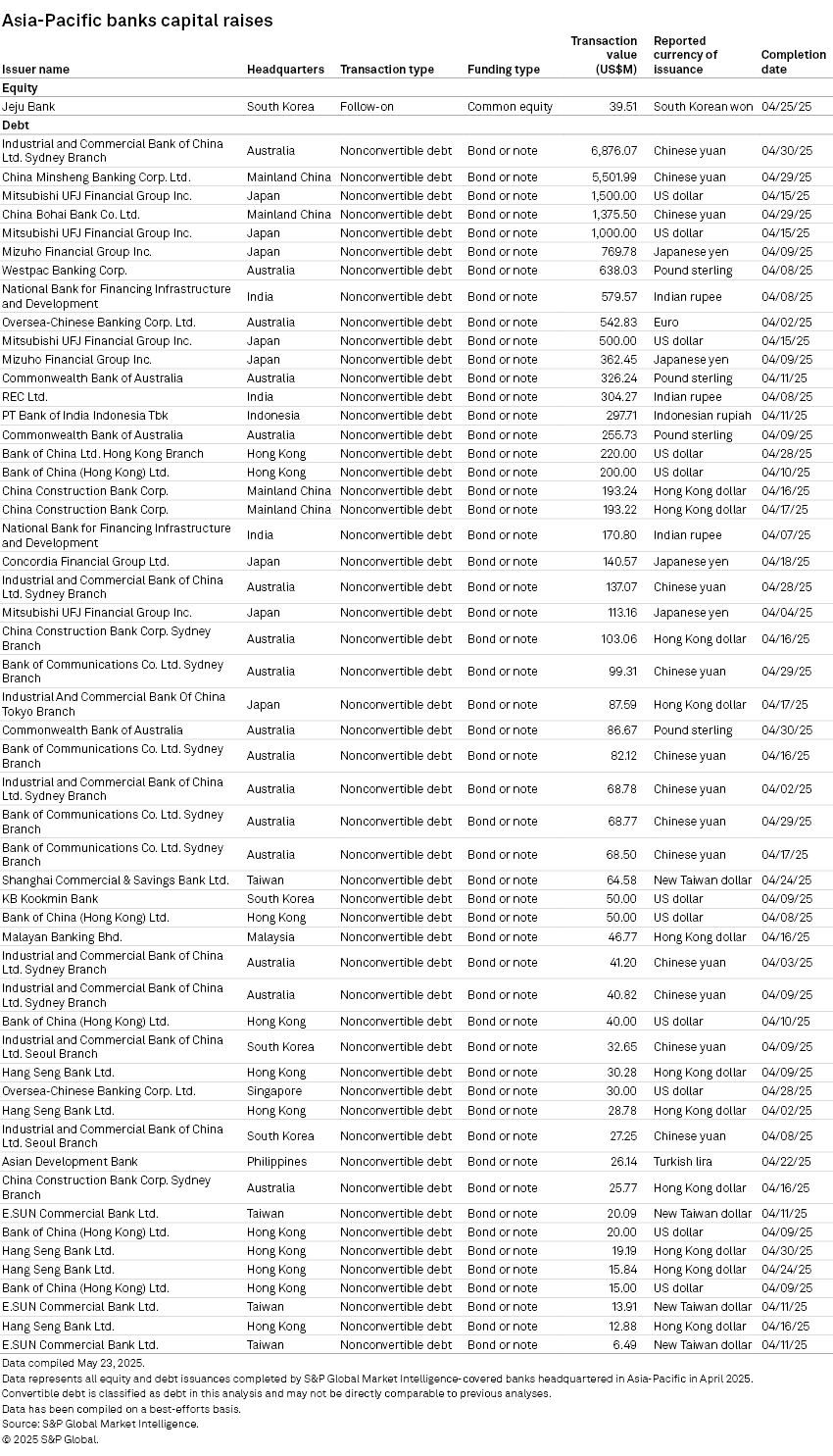

Banks in the region raised a total of $23.52 billion in April, compared with $38.00 billion in the same month a year ago, according to S&P Global Market Intelligence data compiled on a best-efforts basis. The April total, however, represented a 41.3% increase over the $16.65 billion banks raised in March.

The aggregate debt figures covered in the analysis include bonds, senior debt and preferred securities.

"New issues from [mainland Chinese] banks accelerated in April following a relatively quiet [first quarter] for new issues," Iris Jiang, credit analyst at Eastspring Investments, said in an email. "We think banks largely delayed their issuance plans in the first quarter due to improved capital adequacy ratios for most banks in 2024, planned capital injections into major state-owned banks by the Chinese government and lower bond maturities in the first quarter."

Active lenders

In aggregate, mainland Chinese banks and their units accounted for about 65% of the debt raised by the region's banks in April.

Led by Industrial and Commercial Bank of China Ltd., the world's largest bank by assets, mainland Chinese banks and their overseas units completed multiple debt offerings in April, including three billion-dollar-plus ones, and raised $15.30 billion in aggregate proceeds, Market Intelligence data showed. The debt issuances included ICBC's $6.88 billion Tier 2 note offering, China Minsheng Banking Corp. Ltd.'s $5.50 billion debt sale and China Bohai Bank Co. Ltd.'s $1.38 billion offering.

Japan's two megabanks — Mitsubishi UFJ Financial Group Inc. and Mizuho Financial Group Inc. — and Concordia Financial Group Ltd. raised a total of $4.39 billion in debt, or about 18.6% of the April total. Mitsubishi UFJ Financial Group raised the lion's share among Japanese lenders at $3.11 billion in four offerings.

Looking ahead, banks' loan growth will be a key factor in determining how much debt capital they raise, analysts said.

"We expect banks to continue raising capital in order to meet their debt maturity requirements," said Desmond Lim, credit analyst at Eastspring Investments. "But the extent of capital raising will likely depend on their loan growth outlook, which could slow because of an uncertain macroeconomic outlook."

Lone equity issuance

Meanwhile, the region's banks were still cautious in tapping equity markets to raise funds.

South Korea's Jeju Bank was the only Asia-Pacific bank to complete a follow-on equity offering in April, raising $39.51 million.