Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 May, 2025

By Zoe Sagalow and Gaby Villaluz

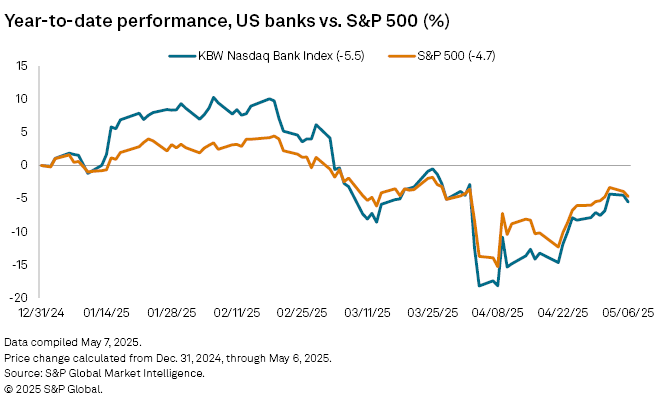

US bank stocks rose slightly after the Federal Reserve said May 7 that it would keep the federal funds rate in the target range of 4.25% to 4.5%.

"The risks of higher unemployment and higher inflation appear to have risen, and we believe that the current stance of monetary policy leaves us well-positioned to respond in a timely way to potential economic developments," Fed Chair Jerome Powell told reporters on May 7 after the rate announcement.

Inflation might be short-lived or more persistent, Powell said, adding, "If the large increases in tariffs that have been announced are sustained, they're likely to generate a rise in inflation, a slowdown in economic growth and an increase in unemployment."

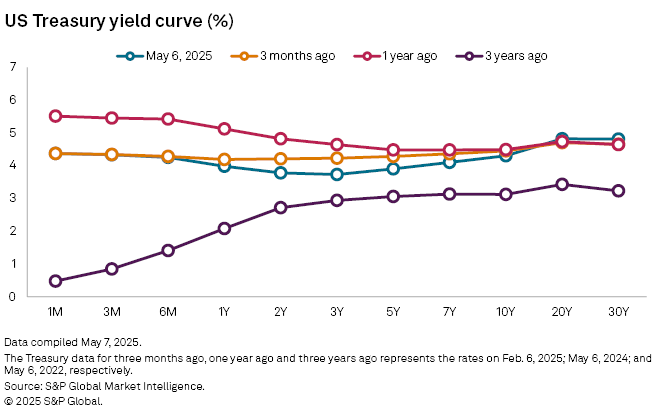

Since September 2024, the Fed has lowered interest rates by 100 basis points. Before that, rates were at their highest level in decades.

The KBW Nasdaq Bank Index rose 0.35% in May 7 trading, while the S&P 500 rose 0.43%.

The biggest bank stock movers for the day included Citigroup Inc., up 1.12%; First Citizens BancShares Inc., up 0.94%; and East West Bancorp Inc., up 0.88%.

The consumer price index rose 2.4% in March from a year earlier — a smaller increase than the 2.8% in February. Tariff announcements and President Donald Trump's pressure on the Fed have led to market volatility and uncertainty. While some tariffs remain, the bulk are still in a 90-day pause until early July.

"The new administration is in the process of implementing substantial policy changes in four distinct areas — trade, immigration, fiscal policy and regulation," Powell said. "The tariff increases announced so far have been significantly larger than anticipated. All these policies are still evolving, however, and their effects on the economy remain highly uncertain."