Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 May, 2025

By Beata Fojcik

Raiffeisen Bank International AG (RBI) launched a review of its loan portfolio in the face of potentially higher US tariffs on imports, with its risk chief saying the Austrian lender could take additional provisions as a result.

Vienna-based RBI has increased overlays — additional provisions or reserves set aside by banks to cover potential future losses and manage financial risks — to €451 million, excluding its Russian business, and could further increase this in the coming months, Chief Risk Officer Hannes Mösenbacher said during the bank's May 6 first-quarter earnings call.

RBI's analysis assumed a blanket 25% tariff on all exports from the EU to the US and found that the the automotive, chemicals, machinery and metals industries would be the most impacted. Only about 2% of the bank's corporate exposure are linked to industries projected to experience a volume drop exceeding 3% due to the tariffs.

"For now, it appears that the impact is fairly limited, but as we go through individual exposures, we may decide to recognize some further overlays in the second quarter," Mösenbacher said. He also said the bank's first-quarter credit risk for its core business excluding Russia was "very benign."

2025 targets maintained

RBI's nonperforming exposure (NPE) ratio for the core business improved to 1.9% at the end of March from 2.1% three months before. Yet, it maintained its 2025 risk cost guidance of as much as 50 basis points amid macroeconomic and geopolitical uncertainty.

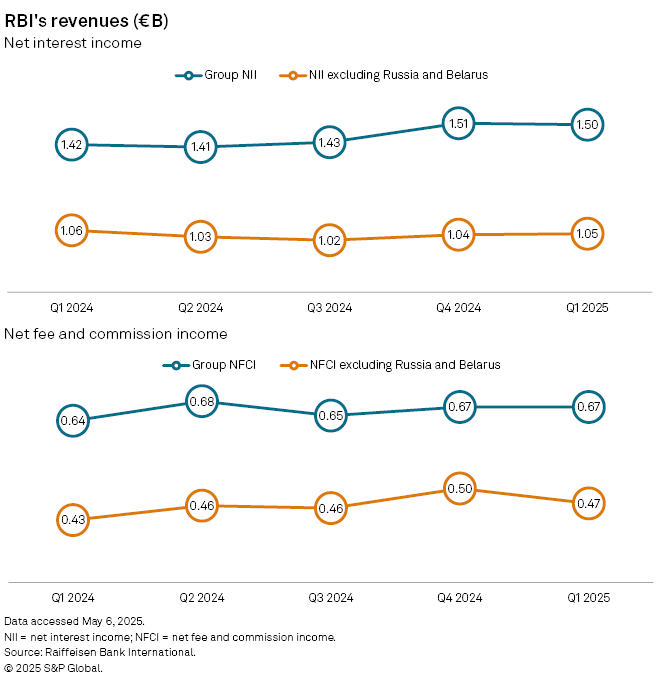

The lender also maintained its other 2025 targets for its core business, including a net interest income of €4.15 billion, a net fee income of €1.95 billion, a consolidated return on equity of roughly 10% and a loan growth of 6% to 7%.

RBI's first-quarter core net interest income ticked down to €1.05 billion from €1.06 billion year over year, while net fee and commission income grew about 8% to €466 million from €431 million.

RBI's quarterly consolidated group profit rose 6% to €705 million. Excluding Russia, however, the bank's consolidated profit was down 14.1%, to €260 million from €303 million a year ago. Its adjusted consolidated ROE for the quarter was 7.3%

The bank's quarterly financial performance exhibited a "somewhat low-quality beat," Citi Research said in a note.

Russia update

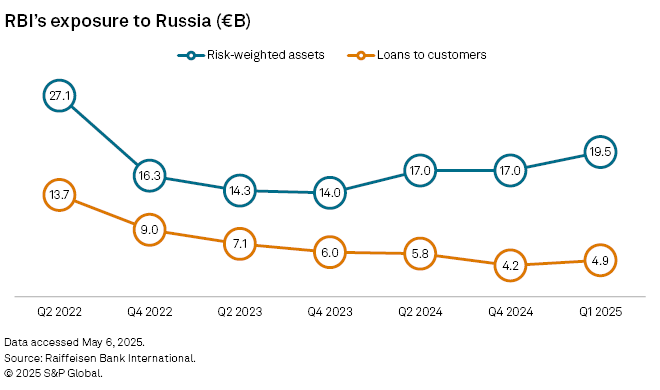

RBI is the largest remaining European bank still operating in Russia but CEO Johann Strobl said the bank has shrunk its loan book there by 4% in the first three months of 2025. Deposits have also declined by 9% though the balance sheet grew due to the appreciation of the ruble.

The business shrinking and de-risking continues regardless of geopolitical developments, and RBI continues to work on a full or partial sale of its Russian business, engaging with several interested parties. "It remains to be seen if recent geopolitical developments might facilitate an exit from Russia," Strobl said.

Strobl also said a Russian court partially reinforced an earlier ruling requiring the Russian unit to pay damages to Rasperia Trading for the canceled acquisition of Rasperia's stake in Vienna-based construction firm Strabag.

The ruble equivalent of €1.9 billion covering the damages was transferred from the Russian unit to Rasperia, while the remaining €170 million covering the accrued interest may be withdrawn at any time, Strobl noted. "Once the interest part of the verdict has also been enforced, we expect the ban on the transfer of the [Russian unit's] shares to be lifted," Strobl added.

RBI has said it does not expect any impact beyond the €840 million provision already recorded in the fourth quarter of 2024. It plans to appeal the verdict in the next instance in Russia and is preparing a claim against Rasperia in Austria.