Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 May, 2025

By Zia Khan and Beenish Bashir

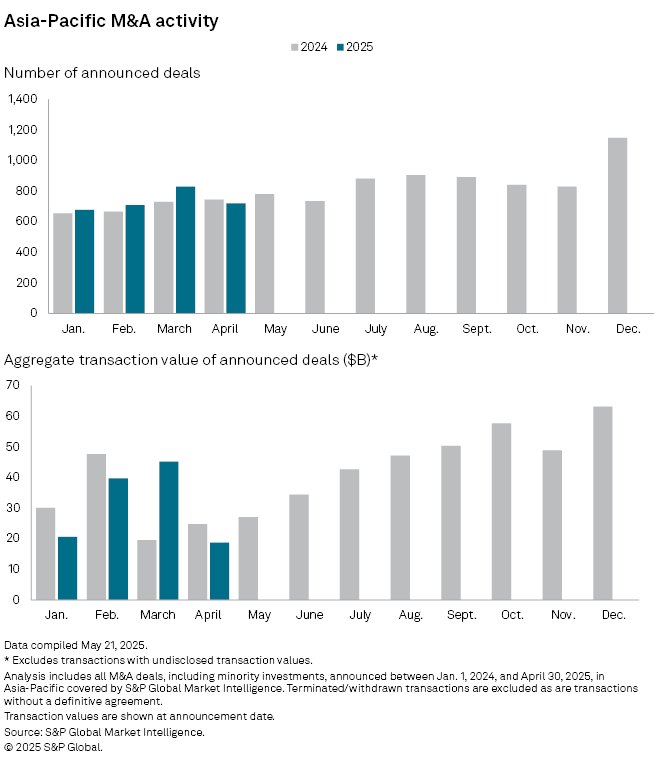

Deal activity in Asia-Pacific fell 3.4% in April from a year ago as tariff-related uncertainties and geopolitical risks create a murky outlook for M&A in the region.

Total deal count fell to 719 from 744 transactions in April 2024, dragged down by steep declines in the technology, media and telecommunications and consumer sectors, according to data compiled by S&P Global Market Intelligence on a best-efforts basis. The number of technology, media and telecommunications deals fell to 82 from 147, while deals in the consumer sector fell to 71 from 113, more than offsetting increases seen in other sectors such as healthcare, where the count more than doubled to 51 from 19.

The aggregate transaction value of announced deals plunged to $18.70 billion, the lowest level in at least 16 months, data show.

"[The] outlook for M&A in Asia-Pacific is murky," said Raghu Narain, head of Asia-Pacific investment banking for Natixis CIB. "The second half of the year will be more challenging as the full impact of tariffs flows through global economies."

Narain said the combination of tariff-related issues, overall uncertainty in the global macroeconomic or geopolitical context and heightened volatility, both in fixed income and equity markets, is impacting investor sentiment, confidence, and thus appetite for dealmaking.

M&A activity also fell 22.5% year over year in the industrials sector, while the decline in the financials sector was more modest, at 14%.

Robust big market

Still, dealmakers remained active in mainland China, Asia-Pacific's biggest market, helping to dent some of the decline in activity.

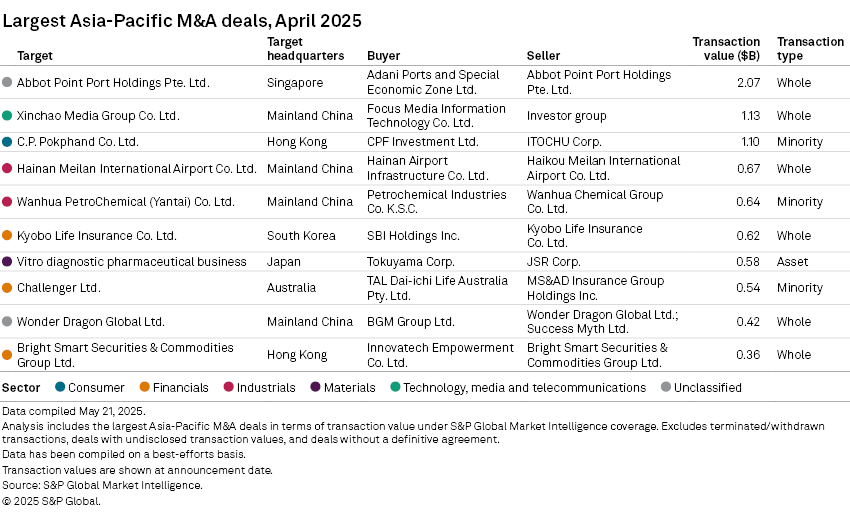

The total deal count in mainland China rose 17.5% year over year to 181 in April, including some of the largest deals by value. The deals included Focus Media Information Technology Co. Ltd.'s acquisition of Xinchao Media Group Co. Ltd. for $1.13 billion and Petrochemical Industries Co. K.S.C.'s purchase of a minority stake in Wanhua PetroChemical (Yantai) Co. Ltd. for $640 million.

Narain sees heightened multinational company activity from Europe into mainland China, particularly in the healthcare space.

Further, Narain added that mainland Chinese deal flow is accelerating this year due to asset divestitures, outbound acquisitions in the natural resources sector and domestic consolidation.

India, another major economy in the region, also saw its deal count increase by 4.3% to 96 in April.

Meanwhile, deal count in Australia and Japan dropped 30.8% and 7.4%, respectively.

Hong Kong added two of the 10 largest deals in April, including CPF Investment Ltd.'s acquisition of a minority stake in Hong Kong-headquartered C.P. Pokphand Co. Ltd. for $1.10 billion. Japan, Singapore, Australia and South Korea added one each to the list.

Adani Ports and Special Economic Zone Ltd.'s acquisition of Singapore-based Abbot Point Port Holdings Pte. Ltd. for $2.07 billion ranked as the largest M&A deal in Asia-Pacific in April.