Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 May, 2025

By Audrey Elsberry and Robert Clark

Total investment banking revenue increased year over year for the largest US players in the first quarter, but the outlook for the remainder of 2025 has become murkier.

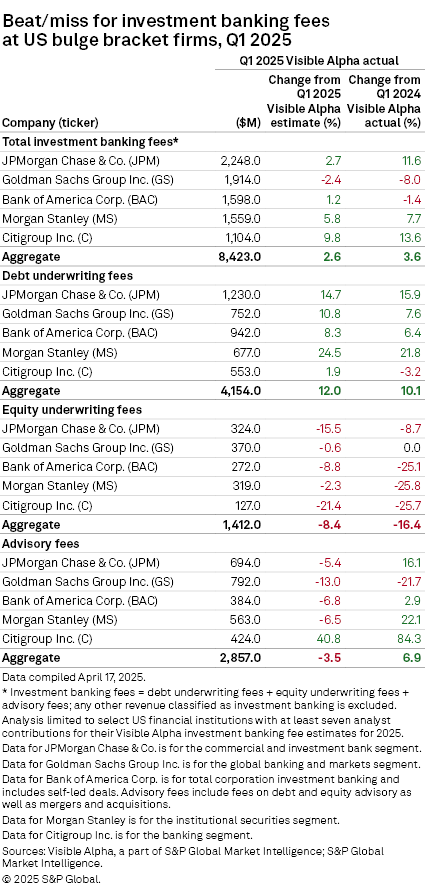

Aggregate investment banking revenue beat analyst expectations by 2.6% and grew 3.6% year over year to $8.42 billion when combining the first-quarter results of Bank of America Corp., Citigroup Inc., Goldman Sachs Group Inc., JPMorgan Chase & Co. and Morgan Stanley, according to data from Visible Alpha, a part of S&P Global Market Intelligence. However, between April 10 and April 17, analysts covering those companies slashed full-year 2025 estimates for equity underwriting and advisory fees, both of which had already been lowered before the earnings season.

|

On an aggregate basis, estimates for total investment banking fees fell 4.2% during that one-week period. The reductions came even though earnings reports were largely positive and many of the banks reported elevated client activity. However, dealmaking has become more challenging in the aftermath of the marketwide selloff that followed President Donald Trump's sweeping tariff announcement, which added uncertainty to the economic environment.

"Our clients are simply waiting on more clarity on trade policy and the regulatory environment before committing to deals," Bank of America CFO Alastair Borthwick said during the company's April 15 earnings call.

Other executives expressed a similar sentiment about their investment banking business. During Goldman Sachs' April 14 earnings call, executives said the company recorded a notable increase in its deal backlog, driven by the advisory business. Chairman and CEO David Solomon said if the landscape became constrained that would add risk to M&A activity, but he expects a significant number of deals through the rest of the year.

"I don't see anything at the moment that leads me to believe that it's a fundamental shift in that activity," Solomon said.

Analysts, however, reduced 2025 advisory revenue estimates for four of the five investment banking businesses. The only one to see an increase was Citigroup, whose 2025 advisory revenue estimates increased 11.6% from April 10 to April 17.

Citigroup had a banner first quarter for its M&A business, with total advisory fees jumping 84.3% year over year, according to the company's earnings release. CEO Jane Fraser said the company advised multiple large transactions that closed in the first quarter, including Altair Engineering Inc.'s $10.14 billion sale to Siemens Product Lifecycle Management Software Inc., which was announced in October 2024 and closed March 26.

While Fraser said Citigroup's M&A clients have now largely put deal talks on hold, the executive was bullish on the company's advisory business. "We're seeing the benefits of our current investment," Fraser said during the company's April 15 earnings call.

But Citigroup was the only one of the five to report a year-over-year decline in debt underwriting for the first quarter. Still, analysts raised debt underwriting fee estimates for all five in the wake of earnings.

The debt capital markets business line was a driver for the investment banking fee revenue growth in the first quarter. "Strong investor demand and tight credit spreads supported active issuance," Morgan Stanley CFO Sharon Yeshaya said during the company's earnings conference call.

Among the group, Morgan Stanley and JPMorgan saw the biggest increase in their debt underwriting revenue estimates for 2025.

JPMorgan CFO Jeremy Barnum said on the company's April 11 earnings call that the tariff policy is leading corporate clients to turn away from more strategic priorities, and the implication on the investment banking pipeline is that it will focus more on short-term work.

Barnum added that some sectors have more complicated problems to solve than others, and smaller clients face more challenges than bigger corporates, which have more experience and resources dealing with uncertainty. Overall, he said many have a wait-and-see attitude.

"It's hard to make long-term decisions right now," Barnum said.