Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Apr, 2025

By Claire Lawson and Ronamil Portes

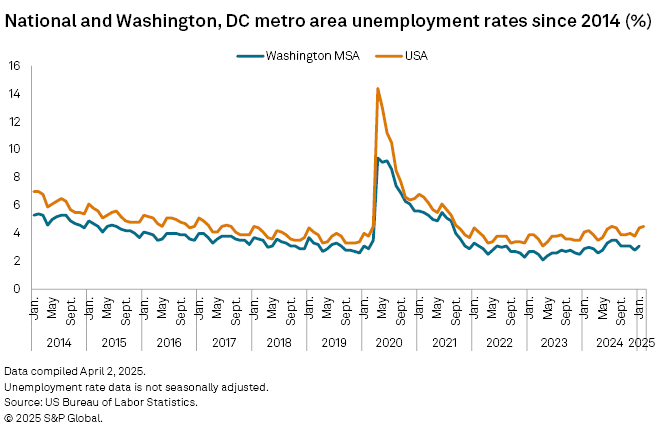

Washington, DC metro area banks could face a regional recession as the area grapples with federal layoffs and spending cuts.

Layoffs and funding cuts, along with their knock-on effects, could give rise to credit quality issues and shrinking deposits at highly exposed banks, while shifting variables complicate downtown and suburban commercial real estate, industry observers say.

"It's going to be a very slow motion car wreck," Janney Montgomery Scott Director of Research Chris Marinac said in an interview. "I don't know if we know if this is a 50-car pileup or if this is just an accident."

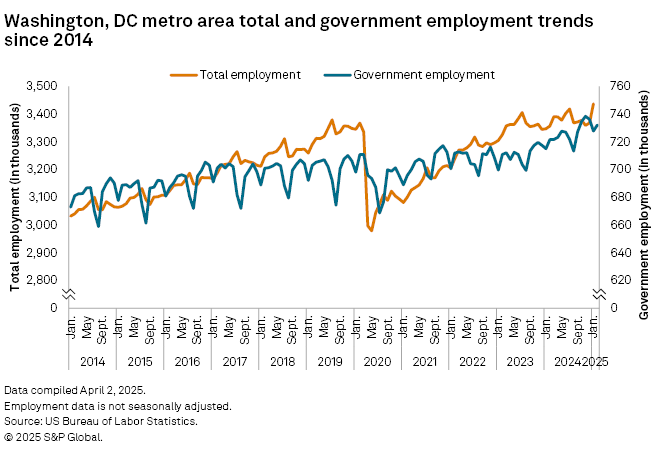

As the Department of Government Efficiency (DOGE) slashes federal programming, government contractors and nonprofits across the Washington, DC metro area have been laying off employees and losing significant funding. Federal workers make up 9.1% of the area's total labor force, according to a report by Urban Institute, a DC-based think tank.

Funding cuts affecting contractors are more likely to raise alarm bells for local banks, Christopher Olsen, managing partner

As of April 4, a total of 13 government contractors had issued notices of layoffs in Virginia and Maryland in advance of 2,245 people losing their jobs, according to Washington Technology.

Marinac said the local banking industry should get ready for a recession.

"We have to prepare for banks having credit issues and therefore, having to spend money to build reserves and/or charge off loans and then replace reserves," he said. "There's still a storm on the horizon that we don't yet know."

Cross currents

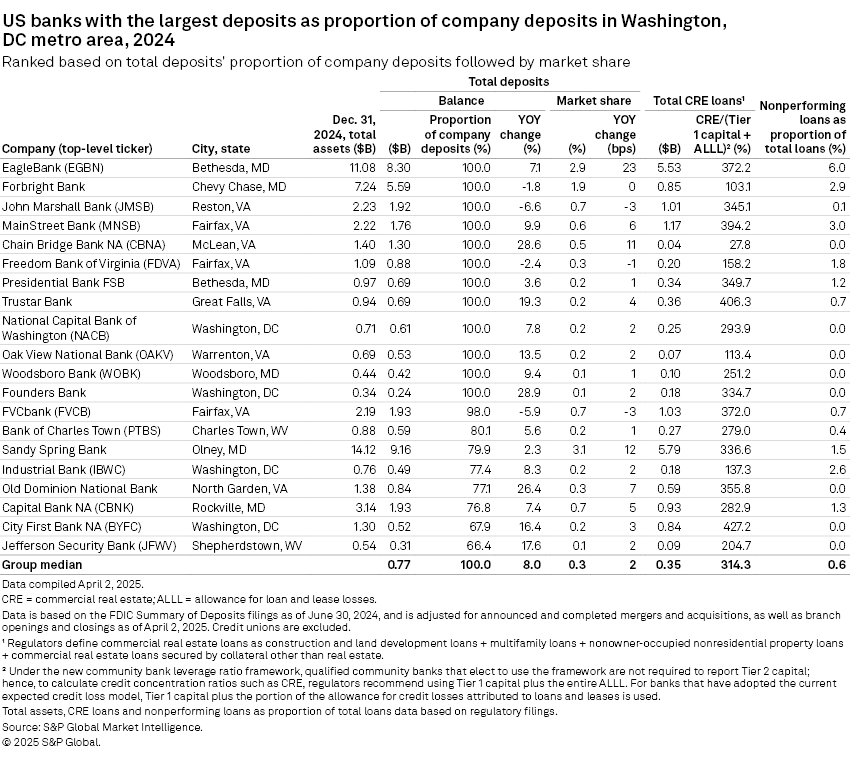

There are 12 banks based solely in the Washington, DC metropolitan statistical area, including EagleBank, Forbright Bank and John Marshall Bank, the three largest banks by deposits solely in the district.

Larger banks United Bankshares Inc., Truist Financial Corp., WesBanco Inc. and M&T Bank Corp. are also highly exposed to the metro area, Marinac said.

Executives at banks exposed to the region say they are monitoring the situation there. F.N.B. Corp. Chief Credit Officer Gary Guerrieri said in an April 17 earnings conference call that the company is checking in weekly on its mortgage and consumer assets, though it believes its exposure is manageable and the effect of the government actions is temporary.

Fulton Financial Corp. has historically been cautious of government leases on real estate because of the potential for cancellation. As a result, its exposure to Washington, DC metro commercial real estate loans linked to the government is limited, Chairman and CEO Curtis Myers said in an April 16 earnings call.

Between federal return-to-office mandates, contractors' woes and DOGE's attempts to sell government buildings, the commercial real estate lending landscape could look different in the future.

"I do think it pulls two ways," EagleBank Chief Credit Officer Jan Williams said in a fourth-quarter earnings call. "It appears the administration believes that the private sector can provide occupancy to the government less expensively than the government is providing it to itself and do a better job. I don't think it's a huge surprise that this administration would want to privatize that activity,"

Return to office, however, could lead to a rise in government leasing, she said.

"There has to be someplace for them to go. So for properties that have significant floor plates available that are in the B-plus, A-minus area, that might be something that could see an uptick with the federal government leasing," Williams said.

Contractor difficulties, meanwhile, will play out in the city's surrounding suburbs, and banks receiving payments from suburban landlords could see those cash flows start to dwindle, Olsen said.

Hunkering down

Smaller banks may choose to consolidate to weather the storm. Banks with $1 billion to $4 billion in assets would be likely candidates for mergers as they seek to reach the $5 billion to $10 billion asset range, Olsen said.

In a larger deal, Sandy Spring Bank's acquisition by Atlantic Union Bankshares Corp. was completed April 1. Sandy Spring, with $14.12 billion in assets at year-end 2024, held 79.9% of its deposits in the DC metro area.

Banks are likely to shore up reserves in preparation for market changes, Marinac said.

"You have to build the reserves to cover either the losses you've already taken or what you perceive to be those losses," he said. While area banks have been conservative on reserves in recent years, "it's conservatism for past history for a very robust, stable DC market," Marinac added. "And right now, it's not stable and it's not robust."