Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Apr, 2025

|

President Donald Trump holds up a chart while speaking during a "Make America Wealthy Again" trade announcement event in the Rose Garden at the White House on April 2. |

Life insurers were some of the hardest hit among the US insurance industry amid a Wall St. sell-off following the White House's April 2 announcement of steep tariffs on a multitude of countries.

The European Union now faces tariffs of 20%, while UK exports to the US will receive a 10% tariff. China reacted quickly and said it will impose a 34% reciprocal tariff on all US imports.

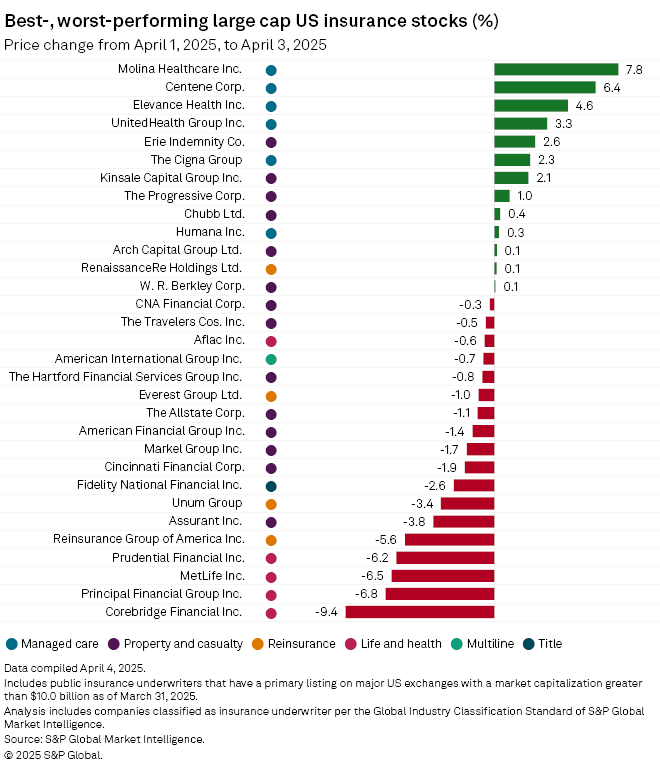

Among US insurers, Corebridge Financial Inc., Principal Financial Group Inc. and MetLife Inc. saw some of the steepest drops in share price following the announcement. From April 1 through April 3, Corebridge was down 9.4%, PFG fell 6.8% and Metlife decreased 6.5%.

Shares continued their slide today with the three life insurers all trading down by more than 10% for the week as of 1 p.m. ET.

Robust health

In contrast, a handful of managed care insurers were able to stay in positive territory, chief among them Molina Healthcare Inc., which rose 7.8% from April 1 to April 3. Molina was followed by Centene Corp., up 6.4%, Elevance Health Inc., up 4.6%, and UnitedHealth Group Inc., which rose 3.3%. This upward trajectory contrasts with the difficulties experienced by some managed care insurers following a tough fourth quarter.

Managed care companies are likely to see little impact from the tariffs, according to a research note from J.P. Morgan analyst Lisa Gill, due to repricing efforts and the nature of the business.

"We would expect that [managed care companies] should be broadly insulated from increased costs on imported goods and any updated reimbursement rates should be reflected with a lag, allowing contracts where [managed care companies] bear risk to adjust plan design to reflect the increased costs," Gill wrote.

An additional barrier for managed care companies is that pharmaceuticals have not yet been specifically tariffed, Gill wrote, pointing to research done by her colleagues.

Among property and casualty insurers, the threat of rising inflation for auto parts from Mexico and Canada has been a concern, as well as the price of lumber and other building materials.

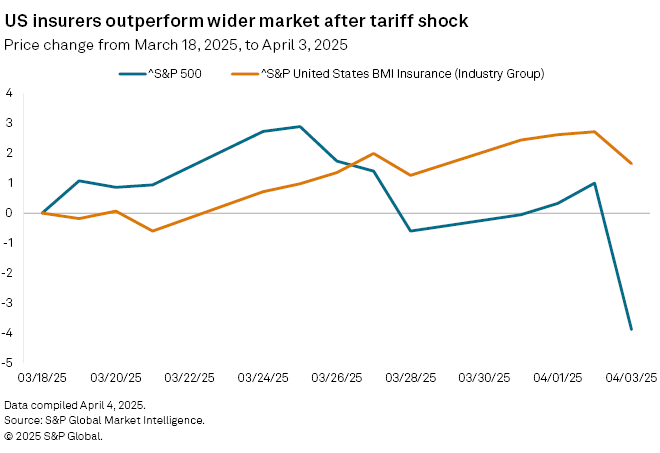

However, the US insurance industry as a whole was relatively resilient compared to the wider market in the days following the tariff announcement. From April 1 to April 3, the S&P 500 fell 4.2% while the S&P Insurance Index fell 0.78%.