Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Apr, 2025

Mainland Chinese lenders dominated the latest S&P Global Market Intelligence ranking of the world's 100 largest banks by assets, with M&A a key factor in the list.

State-owned Industrial and Commercial Bank of China Ltd., Agricultural Bank of China Ltd., China Construction Bank Corp. and Bank of China Ltd. occupied the top four spots in what was an unchanged top eight from a year ago. Twenty-one banks based in mainland China placed in the ranking, with seven in the top 20.

Overall, 38 banks rose in the ranking, while 37 fell and 25 were in unchanged positions. Four made the latest list after not being in the top 100 in 2024.

M&A a key factor

Fifteen banks were assigned figures pro forma for recent pending acquisitions or disposals.

Capital One Financial Corp.'s assets were adjusted $147.64 billion higher to account for its acquisition of Discover Financial Services. It rose one notch in the ranking to 57th place with assets of $637.78 billion.

Nationwide Building Society rose eight notches to 70th place with assets of $498.77 billion. The UK mutual closed its acquisition of Virgin Money UK in October 2024 in what was the largest UK bank deal since 2008, Market Intelligence had reported.

M&A's influence on the size of banks in the past year is arguably most prominent in Europe, where lenders are looking to build scale through acquisitions and to streamline operations and business models by shedding low-performing assets and units.

France-based Société Générale SA fell three places to 22nd in the ranking, with its assets adjusted lower by $27.36 billion due to some being held for sale as of 2024-end. Meanwhile, HSBC Holdings PLC is selling multiple assets under a restructuring effort, and its assets dropped by $27.23 billion as a result. However, HSBC remained the biggest bank in Europe and the seventh-largest globally.

Unlisted French bank Groupe BPCE saw its assets increase by a little over $6 billion due to its acquisition of Bank Nagelmackers and a SocGen unit. Netherlands-based ABN AMRO Bank NV's assets were adjusted higher after its acquisition of a private bank.

National Bank of Canada and State Street Corp. joined the ranking after being absent in 2024, with National Bank of Canada taking the 92nd spot and State Street taking 93rd. National Bank closed its acquisition of Canadian Western Bank in February, the same month State Street said it was buying Japan-based Mizuho Financial Group Inc.'s units in the US and Luxembourg. Mizuho fell one spot to 18th place.

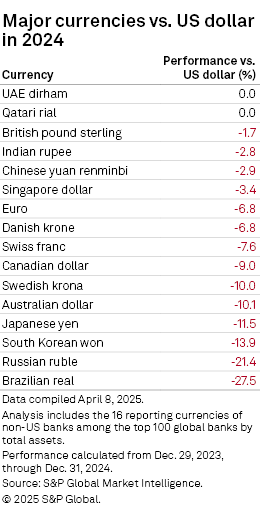

For the latest ranking, company assets were adjusted on a best-efforts basis for pending mergers, acquisitions and divestitures as well as M&A deals that closed after the end of the period. To be eligible for inclusion in pro forma adjustments, the amount of assets being transferred had to be at least $1 billion, unless otherwise noted. Assets reported by non-US-dollar filers were converted to dollars using period-end exchange rates. Total assets were taken on an as-reported basis, and no adjustments were made to account for differing accounting standards. The majority of banks were ranked by total assets as of Dec. 31, 2024. In the previous ranking, published April 18, 2024, most company assets were as of Dec. 31, 2023, and were adjusted for pending and completed M&A as of March 31, 2024.

To view an Excel spreadsheet containing the world's 100 largest banks, click here.

Asian banks on the up

The prominent positions of the mainland Chinese banks on the list come even as the country's economy braces for the impact of the international trade dispute and amid a lingering downturn in its real estate sector.

Beijing authorities have said they will infuse four of the biggest six banks with 500 billion yuan in aggregate core Tier 1 capital to boost liquidity and enable further loan growth to support economic growth.

|

Major Indian, Singaporean and Australian rose in the Market Intelligence ranking. State Bank of India climbed four places to 43rd place while Singapore's DBS Bank Ltd. rose to 58th place. DBS is reportedly eyeing acquisitions in Malaysia and Indonesia, bolstering its position as the biggest lender in Southeast Asia.

Melbourne-based ANZ Group Holdings Ltd. advanced seven spots to 41st place, having completed its acquisition of Suncorp Bank at the end of July 2024. The deal included about 3,000 employees and 1.2 million customers.

Impact of tariffs

Banking stocks slid in early April after US President Donald Trump announced a 10% baseline duty and higher tariffs for select countries.

"While a recession may be avoided, world trade volumes are likely to suffer significantly, affecting economic performance through 2025 and beyond," Oxford Economics said April 8.

Higher tariffs would mean higher prices, impacting consumer spending, dragging down loan growth and ultimately weighing on banks' profits. An economic slowdown would hamper borrowers' ability to make loan repayments, affecting banks' asset quality.

The most significant impact in the coming quarters "will be higher reserves for loan losses as the odds of recession rise," Reuters quoted Wells Fargo analyst Mike Mayo as saying.

Increased market volatility may also make companies cautious and less willing to embark on deals big or small.

Some large M&A transactions have not yet been factored into the ranking as deals or approvals are yet to be struck.

Italy's UniCredit SpA is still seeking to acquire smaller domestic peer Banco BPM, while in Spain, Banco Bilbao Vizcaya Argentaria SA is still seeking approvals for its proposed acquisition of Banco de Sabadell.

In Japan, Sumitomo Mitsui Trust Group Inc.'s sale of its Sumitomo Mitsui Trust Loan & Finance unit is still pending.