Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Apr, 2025

UBS Group AG's clients have refrained from making big decisions about their assets in the wake of the market turmoil following the US announcement of higher import tariffs.

Trading volumes exceeded their pandemic-time peaks by around 30% on some days in early April, UBS CEO Sergio Ermotti said April 30 during the Swiss bank's first-quarter earnings call. With conditions now stabilizing, clients have taken a "wait-and-see attitude," Ermotti said.

UBS is the world's largest wealth manager, and the Americas contribute the most to the revenue of its flagship global wealth management division. It also seeks to boost its operations in Asia-Pacific.

Trading benefits in Q1

Volatile markets helped the group's trading desks, with its global markets business — which comprises equities, foreign exchange, rates and credit — delivering a 32% year-over-year increase in first-quarter revenue to $2.47 billion. This marked the best quarter on record for the global markets business, CFO Todd Tuckner said during the earnings call.

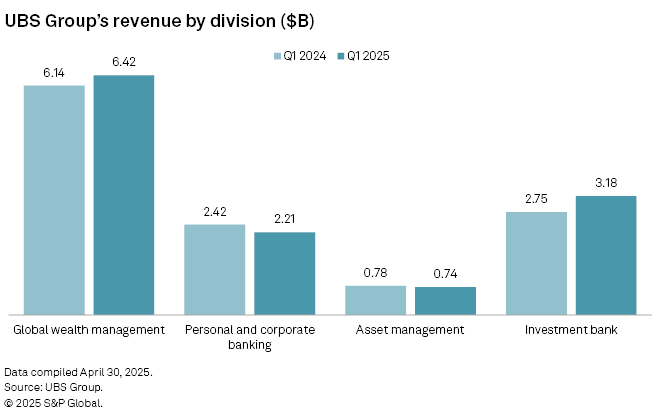

UBS' global wealth management business also reported higher revenue, to $6.42 billion from $6.14 billion. The personal and corporate banking division reported a nearly 9% decline in revenue, largely due to the impact of lower interest rates.

Exposures to Swiss clients that would be affected by higher tariffs are "well-contained," Tuckner said. The personal and corporate banking division, which houses the Swiss banking activities, is still expected to book 2025 credit loss allowances (CLA) of roughly $350 million.

The bank is closely monitoring US trade policy developments and their first- and second-order effects on the Swiss loan book, and would update its CLA expectations when appropriate, Tuckner said.

Uncertain markets

The bank warned that in the face of macroeconomic uncertainty, second-quarter net interest income (NII) at its global wealth division is expected to decrease sequentially by a low-single-digit percentage. The same is anticipated in the Swiss-franc NII of its personal and corporate banking division.

Market uncertainty could also affect the timing of the execution of transactions in the pipeline at its global banking division, which includes advisory and capital markets.

"Looking ahead, the economic path forward is particularly unpredictable," Ermotti said. "The prospect of higher tariffs on global trade presents a material risk to global growth and inflation… a prolonged period of discussions and speculation will come at a cost."

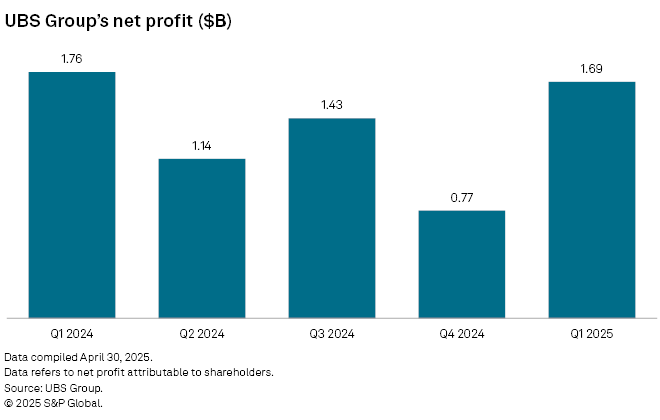

UBS' quarterly net profit attributable to shareholders fell 4% year over year to $1.69 billion but was ahead of the $1.59 billion consensus estimate of Visible Alpha, a part of S&P Global Market Intelligence.

UBS posted an overall decent result in the quarter, Citi Research analyst Andrew Coombs said in a note, though it mostly benefited from heightened trading activity in the investment bank and wealth management division, which may not be sustainable.

The bank's outlook remains uncertain and likely to be volatile, according to RBC Capital Markets analysts.