Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Apr, 2025

By Abbie Bennett and Gaurang Dholakia

The Midcontinent ISO region is forecast to have significantly more generating capacity added than retired in 2025, but concerns about resource adequacy remain, particularly as load forecasts continue to grow.

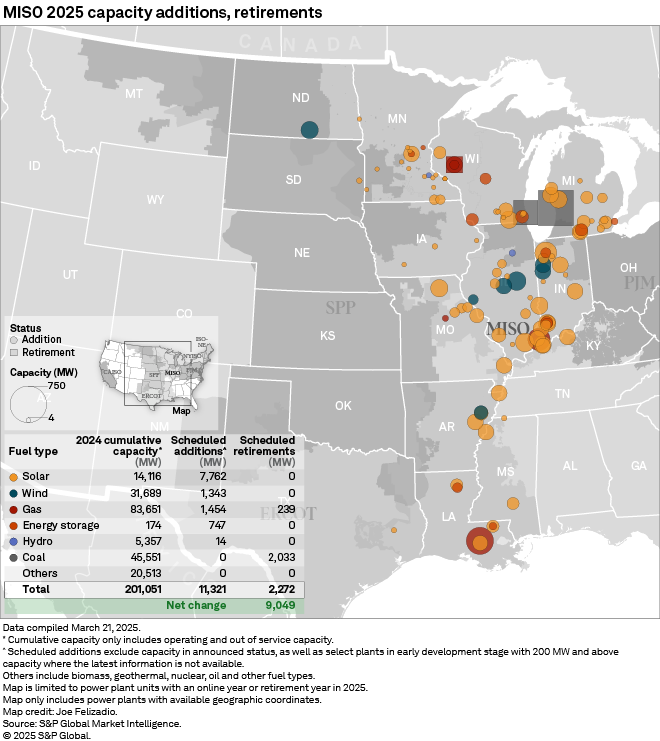

The scheduled net addition of 9,049 MW in 2025 includes 11,321 MW of new capacity offset by 2,272 MW of retirements. Developers anticipate adding 7,762 MW of solar, 1,343 MW of wind, 1,454 of gas, 747 MW of energy storage and 14 MW of hydro capacity, according to an analysis of S&P Global Market Intelligence data. According to the analysis, 2,033 MW of coal-fired generation and 239 MW of gas are expected be retired.

MISO updated its load forecasts in December 2024 to reflect new drivers of growth such as datacenters, industrial and transportation, as well as growing uncertainty regarding the magnitude and timing of growth as the grid operator faces tightening reserve margins and a shifting resource mix.

"Projected load growth from all forms of electrification within MISO's footprint is expected to be approximately three times higher than previously forecast," the ISO said in a presentation accompanying the December 2024 load forecast, estimating that datacenters could total 23 GW to 37 GW by 2044. MISO's peak demand is expected to increase by about 1% to 2% per year until 2044, on a compound annual growth rate basis, materially higher than the 0.4% to 1.1% previously forecast.

Utilities in MISO are largely retiring fossil capacity in exchange for investments in renewable energy resources that are either contracted or added to rate base, though the ISO is expected to add significantly more gas generation in 2025 than in the prior two years. Those exchanges could leave MISO with capacity strain and even potential shortfalls.

"MISO is in a similar position [to prior years]," said Katherine Nelson, a senior analyst for energy research for S&P Global Commodity Insights. "It's a slow, slow system to change. It's a very sensitive system to the weather. If we have a bad summer, there are going to be problems. But maybe they'll get lucky. I think it's going to be a tight system again" this year.

Increasing gas capacity in 2025 may be the beginning of a growing trend in MISO and across the country as power demand surges due to electrification and the expansion of datacenters and domestic manufacturing, analysts said.

"We're forecasting way, way more gas is going to be needed," Nelson said. "The hopes of a more lower-carbon system are getting smaller and smaller because we really need gas for it right now. There's nothing else that's going to provide it."

But MISO is "starting off disadvantaged in the datacenter explosion" because of its existing capacity constraints, Nelson said.

"MISO has known they've been tight and been acting on it longer" than some other ISOs, said Tanya Peevey, also a Commodity Insights senior analyst for energy research. "MISO's been able to be more active in terms of adjusting for tightness" than in areas that have seen more stakeholder pushback on prices, such as PJM Interconnection. "So I think MISO has had a little bit more of a runway to react."

MISO in March submitted a request to the Federal Energy Regulatory Commission for an expedited resource additions study process to accelerate getting generation online, Nelson said, though any changes may not come in time to affect resource adequacy in 2025.

FERC reforms

In 2024, MISO's highlighted the need for continued market reforms, spokesperson Brandon Morris told Platts, part of Commodity Insights.

Since then, FERC approved the "Reliability Based Demand Curve" to reduce volatility in auction clearing prices, increase the stability of the capacity revenue stream over time and render capacity investments less risky, "thereby encouraging greater investment and at a lower financing cost," Morris said. This year's auction will include those changes.

"I'm a little bit skeptical that anything major is going to change," Nelson said of the FERC reforms. "It feels like a lot of little pieces. ... I feel like those effects are going to be smaller, but maybe cumulative. They will add up, but I'm a little bit skeptical that it would change too much.

"The story will continue that a lot of generators are going to be staying online, that we're going to continue seeing reversals of retirements and that the existing plants will keep generating longer," Nelson added.

Retirements

About 2,272 MW of generation capacity is scheduled to retire in the MISO region in 2025, including the coal units of the 1,411-MW J.H. Campbell plant in Ottawa County, Michigan. The three-unit Campbell plant began operation in 1962. CMS Energy Corp.'s Consumers Energy Co. owns about 96.3% of Campbell, while Michigan Public Power Agency owns 2.7% and Wolverine Power Supply Cooperative Inc. owns about 1%.

Consumers Energy plans to replace those shuttered coal units with gas-fired and renewable power.

In Wisconsin, the 622-MW South Oak Creek coal- and gas-fired plant in Milwaukee County is scheduled to retire. The plant, which entered service in 1959, is owned by WEC Energy Group Inc.'s Wisconsin Electric Power Co. Its two remaining units began operating in 1965 and 1967, according to Market Intelligence data.

In 2023, the utility delayed retirement of four units of South Oak Creek to 2024 and 2025, citing tight capacity in the Midwest and supply chain issues delaying renewable projects.

WEC planned to add generation at the site of South Oak Creek to help power a Microsoft Corp. project. Wisconsin Electric filed a petition with state regulators in 2024 to add 1.1 GW to 1.2 GW of gas-fired generating capacity as the parent company shuts down its coal fleet and accommodates increasing customer demand.

Four units at the 239-MW Wheaton gas- and oil-fired plant in Chippewa County, Wisconsin, are also set to retire this year. The plant is owned by Xcel Energy Inc.'s Northern States Power Co. and entered service in 1973. It has four units in operation, and a fifth is set to be completed in October 2025. The newest unit is expected to have a total capacity of about 210 MW, nearly replacing the full generation of the retiring units.

Additions

Solar additions far outstrip any other resource for MISO in 2025, with the 7,763 MW of anticipated solar more than five times the next largest generation source, gas.

MISO's largest expected capacity additions in 2025 include the 730-MW Magnolia Power Generating Station, a combined-cycle gas plant in Iberville County, Louisiana, owned by Blackstone Inc.'s Kindle Energy LLC. The plant is expected to be completed in May, according to Market Intelligence data.

Another large addition is two new units totaling 460 MW at the A.B. Brown plant in Posey County, Indiana, owned by CenterPoint Energy Inc.'s Southern Indiana Gas and Electric Co. The plant, which entered service in 1991, has two existing gas units. The two additional units are scheduled to be online in May.

The largest solar addition was the 435-MW Dunns Bridge Solar II in Jasper County, Indiana. NiSource Inc. subsidiary Northern Indiana Public Service Co. LLC owns about 80% of the facility and Blackstone owns about 20%. The solar project entered service in January.

Dunns Bridge, which has a related battery storage facility, was previously owned by NextEra Energy Inc. subsidiary NextEra Energy Resources LLC.

Transmission

MISO has also faced transmission constraints, though it has been among the most-forward looking in terms of planning transmission expansion, Commodity Insights' Peevey said.

"Of the ISOs, I think they're the most proactive in trying to plan out — especially in a regional sense — their transmission considering their connections to regions around them and trying to have a more holistic view," Peevey said. "They're further along in that planning ... there's a clear effort to get the transmission online and I think it's being effective compared to other areas."

Transformer supply has also hampered MISO efforts to expand transmission, a common problem across power markets, Peevey said.

"There's a lot of old transmission that needs to be updated, but I think they're ahead of the game compared to other regions, especially considering their size footprint," Peevey added.

Forward prices

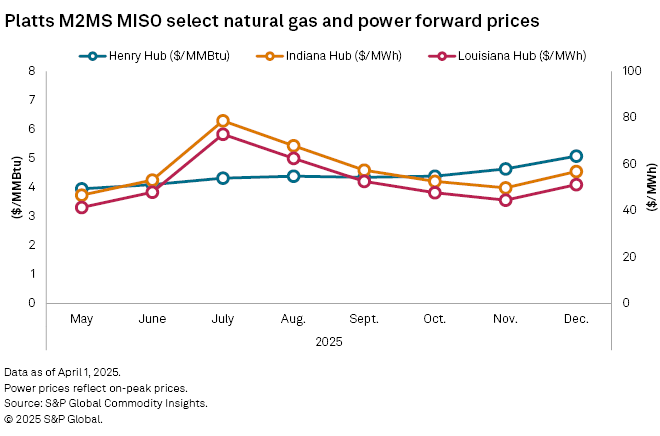

MISO forward power prices at the Louisiana Hub are set to peak in July for the summer at $72.85/MWh and in December for the winter at $51.20/MWh, according to Platts M2MS data.

MISO Indiana Hub forward prices are forecast to peak in July for the summer at $78.65/MWh and in December for the winter at $56.80/MWh.

Henry Hub wholesale gas forward prices are set to peak at $4.39/MMBtu in August and $4.39/MMBtu in October, with a winter peak at $5.08/MMBtu in December.