Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Apr, 2025

By Ben Meggeson and David Hayes

Italy's banks have strong capital buffers and relatively low NPA ratios as they enter a period of economic uncertainty brought about by new US tariffs.

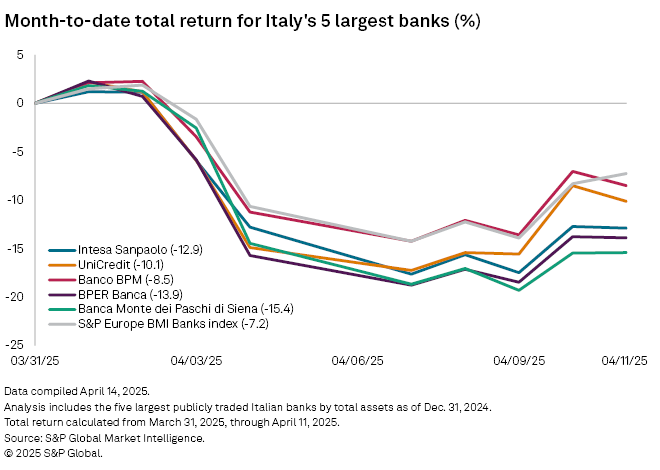

The US on April 2 announced sweeping global tariffs, prompting a selloff of shares on global markets. Italian bank stocks were hit particularly hard amid concerns the tariffs would severely impact the country's exports. The steepest tariffs were paused, but the EU still faces a 25% tariff on automobiles and a 10% blanket levy.

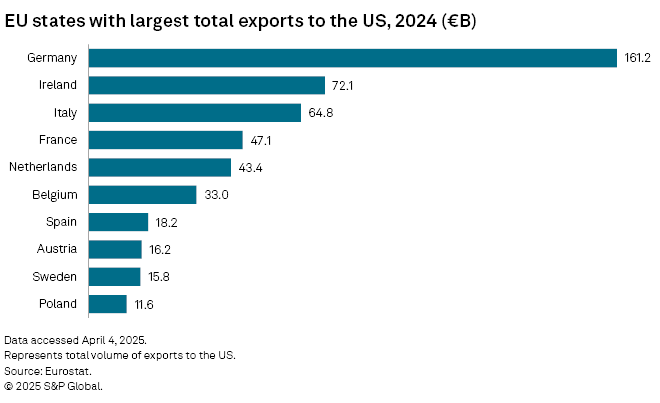

Italy has the third-highest level of total exports to the US among EU countries, with €64.8 billion in 2024. These include large amounts of pharmaceutical products and cars, which are among the EU's most exported goods to the US.

Higher tariffs could lead to a higher cost of risk for European banks due to potential weaker economic growth and high levels of market volatility, Morningstar DBRS said in an April 15 commentary. It noted that banks' cost of risk is currently at a low level.

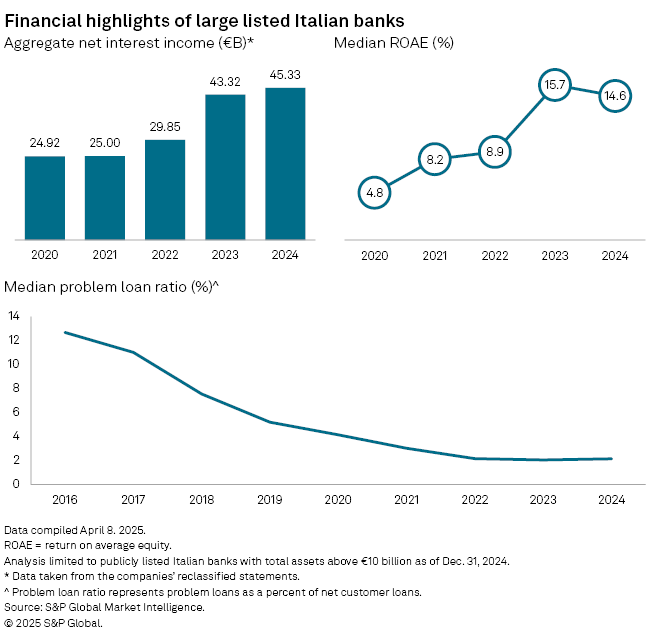

Italian banks' financial health has improved markedly since the aftermath of the global financial crisis of 2009 and the ensuing European sovereign debt crisis. The median problem loan ratio of the biggest listed lenders has declined from 13% in 2016 to just over 2% in 2024, S&P Global Market Intelligence data shows. Banks have also generated large amounts of net interest income due to higher interest rates in recent quarters, bolstering profits.

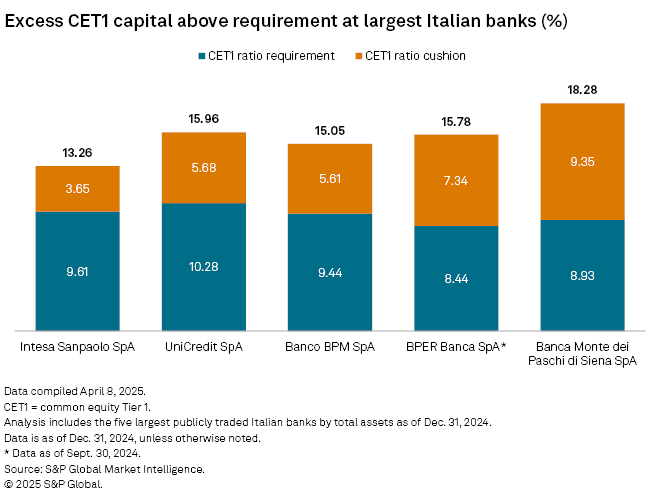

The five largest — Intesa Sanpaolo SpA, UniCredit SpA, Banco BPM SpA, BPER Banca SpA and Banca Monte dei Paschi di Siena SpA — have common equity Tier 1 (CET1) ratio cushions of between 3.65% and 9.35%. The median for European banks is 6.13% as of end-2024, according to Market Intelligence data.

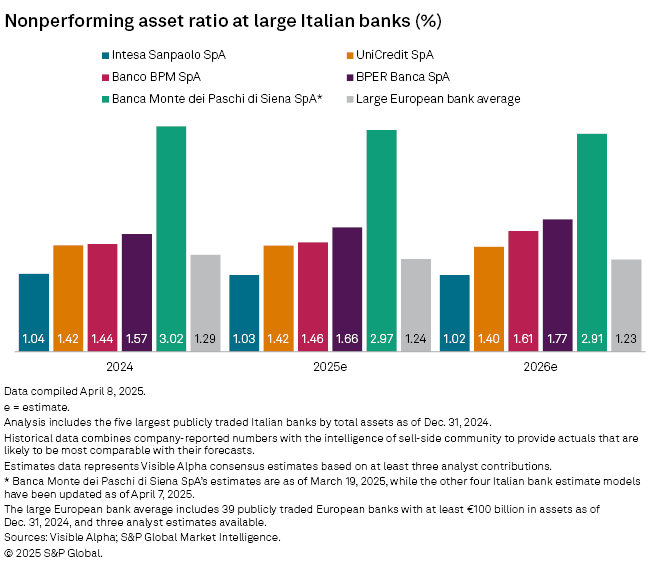

The nonperforming asset ratios of Banco BPM and BPER Banca are expected to increase slightly this year and next, according to estimates from Visible Alpha, part of S&P Global Market Intelligence. Those of Monte dei Paschi, and the more internationally focused Intesa Sanpaolo and UniCredit, are expected to decline slightly.

The estimates for Monte dei Paschi were last updated on March 19, before the US tariff announcement. The estimates for the other banks were updated as of April 7.

Large Italian banks' loan growth is expected to remain constrained due to a more challenging economic environment, Morningstar DBRS said in a separate April 8 report. This could crimp revenues, but better asset quality and stronger revenue diversification should help to offset the effects.

Italy's banks are well positioned to boost fee income at a time when NII growth is slowing due to lower interest rates.