Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Apr, 2025

|

A truck carrying vehicles prepares to cross into the US from Canada at the Ambassador Bridge in Windsor, Ontario, on March 8. Changes to the availability and cost of autos and auto parts produced in Canada and Mexico are expected to rise as President Donald Trump's tariffs take effect. |

Insurance stocks have once again been caught up in the broader market's volatility, which has extended into its third week since President Donald Trump announced wide-sweeping global tariffs on countries all over the globe at the start of April.

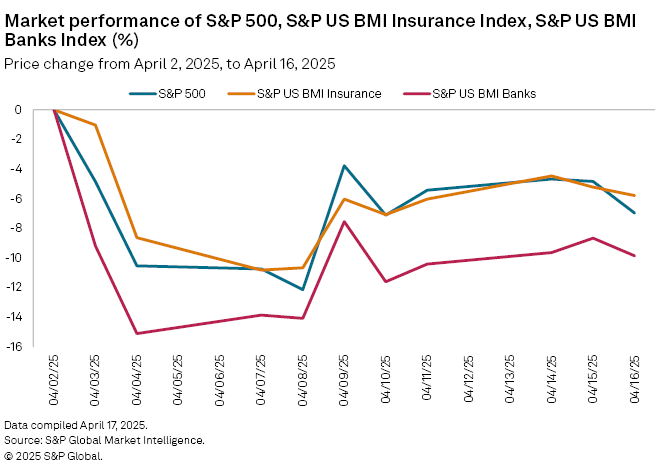

Apart from some managed care players, most insurers faced difficulties during the month, with the insurance index declining 5.56% from April 2 through April 16. Insurance fared only slightly better than the S&P 500 index, which fell 6.97%, and much better than the banking index, which fell 10.87% during the same period.

Even with the unpredictable ups and downs, analysts expect insurers to emerge from this period of volatility in a good position, especially if tariffs do not end up being as high as initially proposed.

Property and casualty

Property and casualty (P&C) carriers were hit just as hard as the rest of the insurance sector, when Trump announced his tariffs after the market closed April 2.

The S&P Composite 1500 Property & Casualty Insurance Index had fallen 8.4% to $1448.55 from $1581.44 by the April 4 close, then slid further April 7 to $1412.51 for a 10.7% drop. That trend reversed itself April 9 after Trump announced a 90-day pause for the tariffs, with the index jumping 5.8% and steadily rising after that.

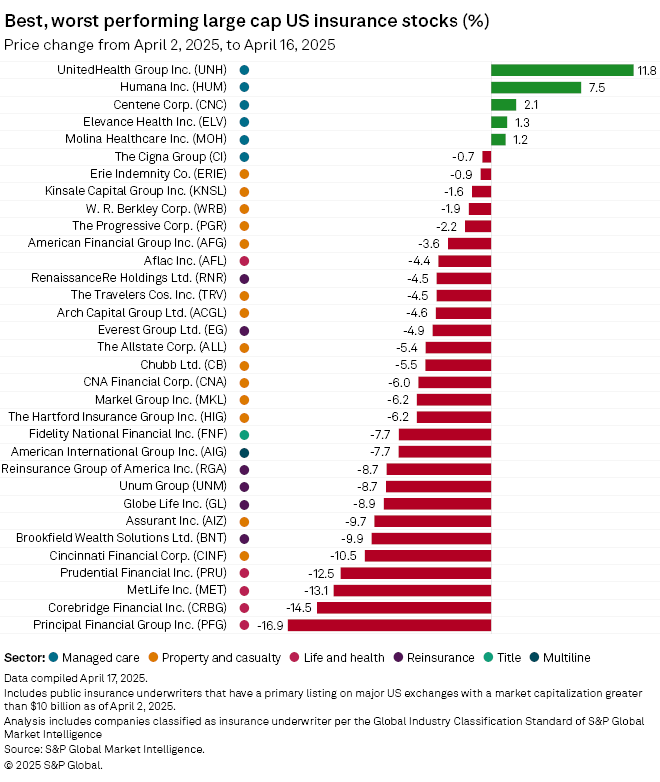

The top P&C movers remained in negative territory as of market close April 16 but had outperformed other sectors since April 2, save for managed care companies.

Erie Indemnity Company was down 0.9%, while Kinsale Capital Group Inc. was off 1.6%. W. R. Berkley Corp. and The Progressive Corp. were still down 1.9% and 2.2%, respectively.

Keefe Bruyette and Woods analyst Meyer Shields said that P&C companies are not as affected by tariffs because there are not many lines of business subject to them. He said concerns such as property and auto physical damage have a relationship with the impact of tariffs, but liability lines like medical malpractice and workers' compensation do not.

"In the aggregate, there are certainly some lines that do, but not enough to really overwhelm the industry, which also has time to adjust rates in response," Shields said in an interview. "Even if ... tariffs kick in right away, I think that you'll see insurance companies respond with rate increases to offset that."

Life insurers

US life insurers were mostly trading in positive territory this week, with the majority of names finishing up or flat as of the close of business April 16.

Brighthouse Financial Inc. and CNO Financial Group Inc. shares were among the top performers in the group for the week. Brighthouse's shares rose roughly 4%, while CNO's stock gained about 3.5%.

On the flip side, Principal Financial Group Inc. was among the worst performers, with its shares falling 1.3% as of the close of business April 16. About seven life insurers, including Voya Financial Inc., MetLife, Inc., Aflac Inc. and Prudential Financial Inc., finished flat.

Life insurers' first-quarter earnings season is set to kick off next week with Principal Financial scheduled to report April 24.

Managed care

A handful of managed care insurers were able to stay in positive territory, chief among them UnitedHealth Group Inc., which was the top performer during the period. It was followed by Humana Inc., Centene Corp. and Elevance Health Inc.

Managed care companies are likely to see little impact from the tariffs due to repricing efforts and the nature of the business, according to a research note from J.P. Morgan analyst Lisa Gill published earlier in the month.

"We would expect that [managed care companies] should be broadly insulated from increased costs on imported goods and any updated reimbursement rates should be reflected with a lag, allowing contracts where [managed care companies] bear risk to adjust plan design to reflect the increased costs," Gill wrote.

However, the tides may soon change for managed care following UnitedHealth's first-quarter results, which sent the sector leader's stock into a freefall.