Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Apr, 2025

HSBC Holdings PLC sees opportunities to attract new clients and increase market share in the trade business as fresh tariffs trigger a reshuffle of global supply chains.

The group's network of over 5,000 trade specialists across more than 50 markets and its diverse offerings put HSBC in a "unique position" to support customers as the business landscape shifts, CEO Georges Elhedery said during a first-quarter earnings call April 29.

"In an environment like this one, we expect to deepen relationships with clients. We expect to acquire new clients and to consolidate our position as a leading trade bank," Elhedery said.

HSBC has not seen a material impact on business since the tariff announcements in April, as clients are currently in a "wait-and-see mode" and "not making decisions in panic," Elhedery said.

However, large capital expenditure and investments have slowed, and there is a notable slowdown of trade between the US and China, Elhedery said. This means loan growth will remain muted, yet drawdowns have not increased so far, the CEO noted.

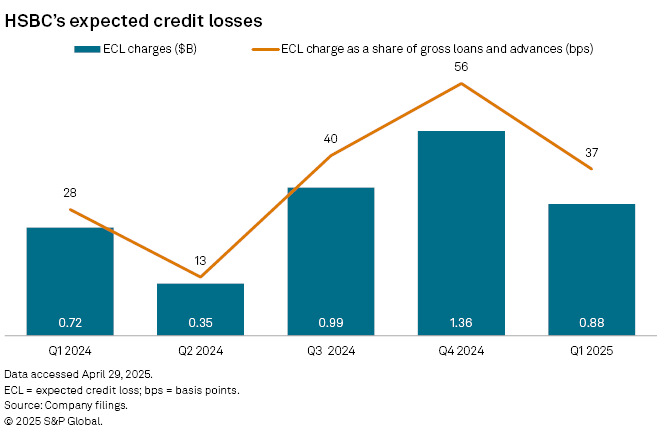

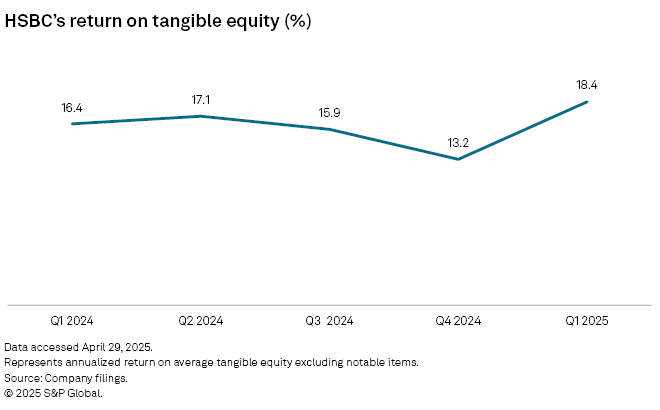

While HSBC hiked its provisions for expected credit losses (ECL) in the first quarter of 2025, it also confirmed its guidance for a mid-teens return on tangible equity (ROTE) excluding notable items in each of the years between 2025 and 2027.

The group remains confident it would be able to meet its ROTE targets even if the trade and global economic environment deteriorates further, Elhedery said. This is on the basis of downside risk scenarios HSBC recently ran to assess the earnings impact of significantly higher tariffs and related slowdown in global GDP growth, the CEO said.

'Vote of confidence'

HSBC increased ECL provisions to $876 million in the first quarter of 2025 from $720 million a year ago to reflect "heightened uncertainty and a deterioration in the forward economic outlook due to geopolitical tensions and higher trade tariffs," it said in its earnings release. Yet, it kept unchanged its target for ECL as a share of average loans in the range of 30 basis points to 40 basis points in 2025, including assets held for sale.

The group posted ROTE excluding notable items of 18.4% for the quarter, compared to 13.2% in the previous three months and 16.4% a year ago.

HSBC also reiterated its guidance for banking net interest income (NII) of around $42 billion and targeted operating cost growth of some 3% in 2025.

"The fact that full-year guidance is staying put after a strong quarter reflects the challenges ahead, but it's also a solid vote of confidence from the top," Matt Britzman, senior equity analyst at Hargreaves Lansdown, said in an April 29 note to clients. "Loan demand might stay sluggish, but with multiple income streams, HSBC isn't leaning too hard on one part of the business. In a choppy environment, that kind of diversification is an asset."

HSBC announced a share buyback of up to $3 billion with its first-quarter results, which topped estimates. Profit attributable to ordinary shareholders was $6.93 billion in the period, down by nearly a third from the year-ago $10.18 billion but ahead of analysts' estimate of $6.07 billion, according to Visible Alpha data.

Net fee income rose on a yearly basis to $3.32 billion from $3.15 billion, while net interest income (NII) fell to $8.30 billion from $8.65 billion, reflecting disposals in Canada and Argentina and an adverse impact of about $300 million from foreign currency translation differences.

HSBC's London-listed shares were up 2.2% in late morning trading. Its Hong Kong-listed stock closed 3% higher.