Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

08 Apr, 2025

By Tom Jacobs and Noor Ul Ain Adeel

|

A homeowner inspects damage to his house in Horseshoe Beach, Florida, after Hurricane Helene made landfall Sept. 28, 2024. |

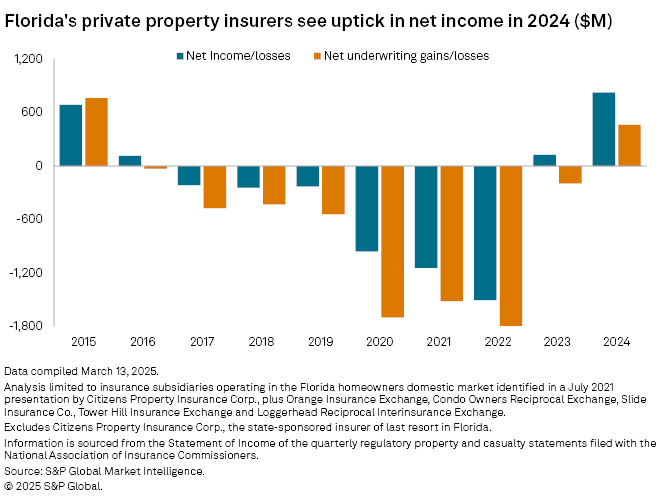

Florida domestic residential property insurers' underwriting and net incomes both finished in positive territory in 2024 for the first time in almost a decade as the state's long-suffering insurance market showed continued signs of recovery.

Net income for insurance subsidiaries operating in the Sunshine State's homeowners domestic market jumped to $824.9 million, its highest level since 2015, from $126.8 million in 2023, according to an S&P Global Market Intelligence analysis.

The analysis, which excludes Citizens Property Insurance Corp., the state's insurer of last resort, also found that underwriting income increased to $465 million. That is a significant turnaround from a loss of $194.4 million a year ago and the first time it has been in positive territory since 2015.

Legislative reform

The legislative reforms contained in HB-837, enacted in March 2023 and aimed at reducing frivolous litigation, have been one of the catalysts for the turnaround, Piper Sandler analyst Paul Newsome said. Combined with rate increases and insurers becoming more disciplined with their pricing, the reforms "have worked together to give [insurers] the profitability that they need," Newsome said.

"We're looking at a market that ... will be a normal, stable, profitable insurance market where you don't have crazy changes in terms and conditions and pricing, and we have stability in the people who write and provide insurance," Newsome said in an interview.

Newsome said the positive changes in the market are notable considering catastrophe losses have not abated. The Sunshine State had a record-tying three hurricanes make landfall in 2024 — Debby near Steinhatchee on the Big Bend coast Aug. 5, Helene near Perry on the Big Bend on Sept. 26, and Milton at Siesta Key on the Gulf Coast on Oct .9.

Legal costs declining

The enactment of HB 837 was the line of demarcation for curbing the excessive litigation that had been plaguing the state's insurance market. The law modified the state's comparative negligence system by mandating that a plaintiff found to be more than 50% responsible for their own injury cannot recover damages and changed the state's bad-faith rule.

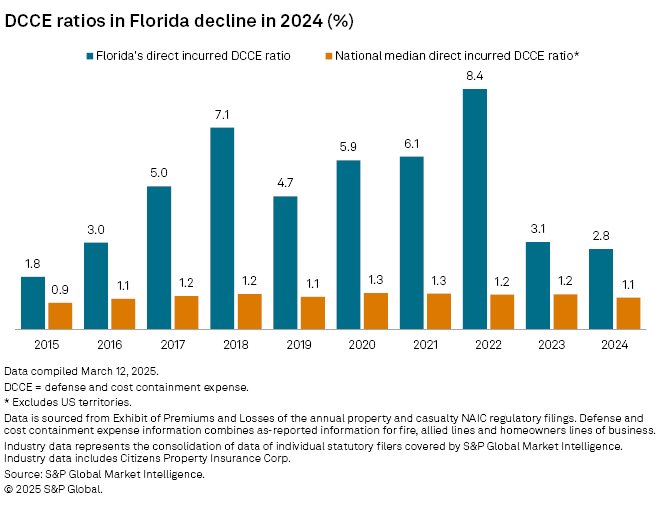

The changes have helped slash the Florida market's Defense and Cost Containment Expense (DCCE) ratio to 2.8%, the lowest since 2015, from 3.1% a year ago and an all-time high of 8.4% in 2022. The ratio is determined by dividing DCCE expenses by premiums earned.

Insurers' expenses grew 5.4% year over year to $791.6 million from $751 million, but direct premiums earned improved 14.2% to $28.0 billion from $24.5 billion in 2023, driving the DCCE ratio down. Since 2022, expenses are down 50.6% from $1.6 billion while premiums are up 47.5% from $18.96 billion.

Risk consultant Guy Fraker said the enactment of SB-2A in December 2022, which eliminated the one-way attorney fee, was a key first step in repairing the market.

"Not only did the reforms curtail the innovation that was being used to do damage, but the reforms ... returned [insurers] to an operating environment where they didn't have to look over their shoulder and whisper, 'I have no idea how to run my company anymore.'"

According to Citizens, the number of lawsuits filed in 2024 against Florida insurers fell 23.8% year over year to 57,120 from 74,995. The 2024 total also represents a 42.6% drop from the all-time high of 99,519 in 2021.

Citizens shrinking

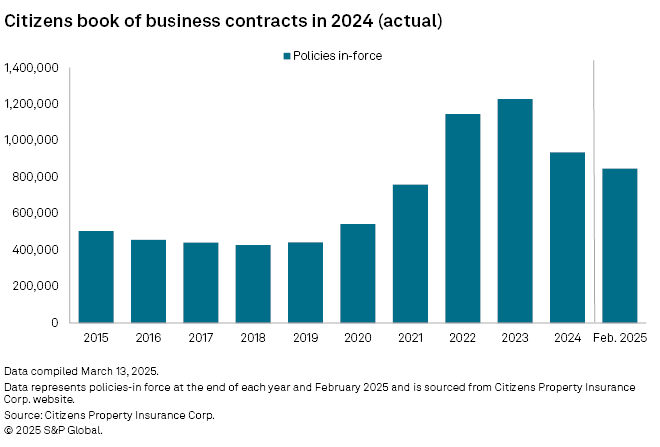

The upturn in the market's fortunes has led to progress on another goal of the legislative reforms: the depopulating of Citizens' book of business and tightening the eligibility rules for obtaining or retaining coverage.

Policies-in-force in 2024 for the state's insurer of last resort fell to 936,182 from 1,228,718 in 2023, a 23.8% year-over-year decrease. As of February this year, that total had fallen to 847,571, the lowest since 2021.

Tim Cerio, president of Citizens, said during the March 12 Board of Governors meeting that the insurer projects a further decrease to "just under 738,000 policies" by the end of 2025. Cerio said in his report that 477,821 policies were removed from the insurer's rolls and that it expects to remove an additional 293,353 by the end of this year.

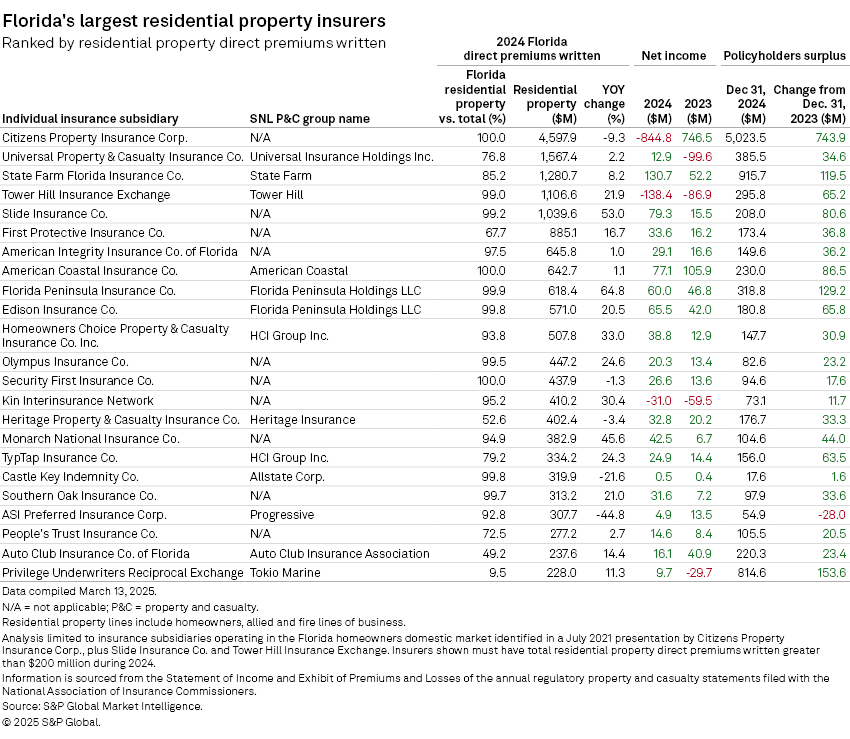

Citizens, at the end of 2024, remained the largest residential property insurer in the Sunshine State by a wide margin, with nearly $4.6 billion in direct written premiums. Universal Property & Casualty Insurance Co., a subsidiary of Universal Insurance Holdings Inc., was second with $1.57 billion.

While the private market's net and underwriting incomes both moved into positive territory in 2024, it was the opposite for Citizens.

Earned premiums of $3.18 billion were booked in 2024, but that was offset by net losses and loss adjustment expenses of $3.73 billion, which includes an estimated $2.46 billion in losses from hurricanes Debby, Helene and Milton. The insurer ended the year with a net loss of $844.75 million, down from income of $746.45 million a year ago.