Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Apr, 2025

By Deza Mones, Cheska Lozano, and David Hayes

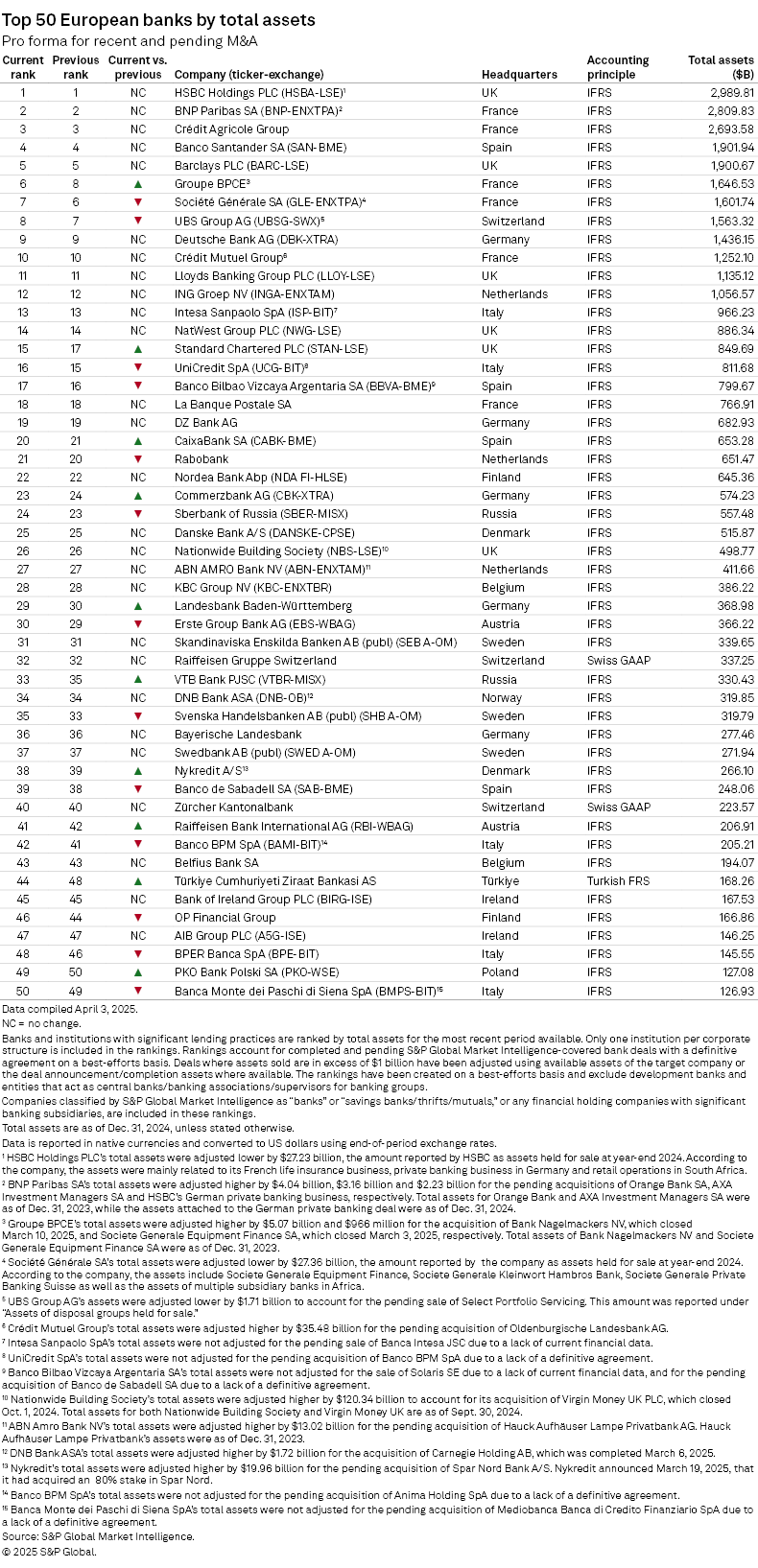

HSBC Holdings PLC retained its title as Europe's biggest bank by assets in 2025 as it shifted from restructuring to growth.

The UK-headquartered lender had assets of nearly $2.990 trillion as of 2024-end, comfortably surpassing France's BNP Paribas SA

HSBC has further strengthened its pivot toward Asia and away from businesses in other regions. Under new CEO Georges Elhedery, HSBC's latest overhaul includes growing its Asia wealth management business and doubling down on its investment banking activities both there and in the Middle East, while closing key parts of the business in the UK, the US and Europe.

The bank's shift from restructuring to growth comes at a time when interest rate-driven profit gains may have peaked and geopolitical tensions have intensified following the US' worldwide tariffs push.

BNP Paribas retained second place with assets of about $2.810 trillion and peer Crédit Agricole Group rounds out the top three with roughly $2.694 trillion.

BNP Paribas inked several deals in 2024, including the acquisition of French insurer Axa SA's

For the latest ranking, company assets were adjusted on a best-efforts basis for pending mergers, acquisitions and divestitures, as well as M&A deals that closed after the end of the period. To be eligible for inclusion in pro forma adjustments, the amount of assets being transferred had to be at least $1 billion, unless otherwise noted. Assets reported by non-US-dollar filers were converted to dollars using period-end exchange rates. Total assets were taken on an "as-reported" basis, and no adjustments were made to account for differing accounting standards. The majority of banks were ranked by total assets as of Dec. 31, 2024. In the previous ranking, published April 15, 2024, most company assets were as of Dec. 31, 2023, and were adjusted for pending and completed M&A as of April 24, 2023.

To view an Excel spreadsheet containing the top 50 European banks, click here.

M&A moves made by other French banking groups include Groupe BPCE's

Société Générale SA

Bank M&A deals in play

European banks, particularly in Italy and Spain, are pursuing acquisitions to expand scale and boost competitiveness due to strong profits and stable capital levels.

Leading the bank M&A boom in Italy is UniCredit SpA, which is targeting both smaller domestic peer Banco BPM SpA

Other Italian lenders chasing deals include BPER Banca SpA

In Spain, BBVA is eyeing midsized rival Banco de Sabadell SA

UniCredit and BBVA both slipped to place 16th and 17th, with assets of $811.68 billion and $799.67 billion, respectively.

In the Nordic region, Danish lender Nykredit A/S

Biggest movers

Türkiye Cumhuriyeti Ziraat Bankasi AS, Turkey's biggest bank, climbed four places and ranked 44th. It had assets of $168.26 billion.

UK-headquartered Standard Chartered PLC

Italy-based BPER Banca, which had $145.55 billion in assets, fell two places to the 48th spot. Sweden's Svenska Handelsbanken AB (publ)

Overall, 10 of the 50 banks on the list ranked higher than the previous year, 13 ranked lower and the rest retained their spots.

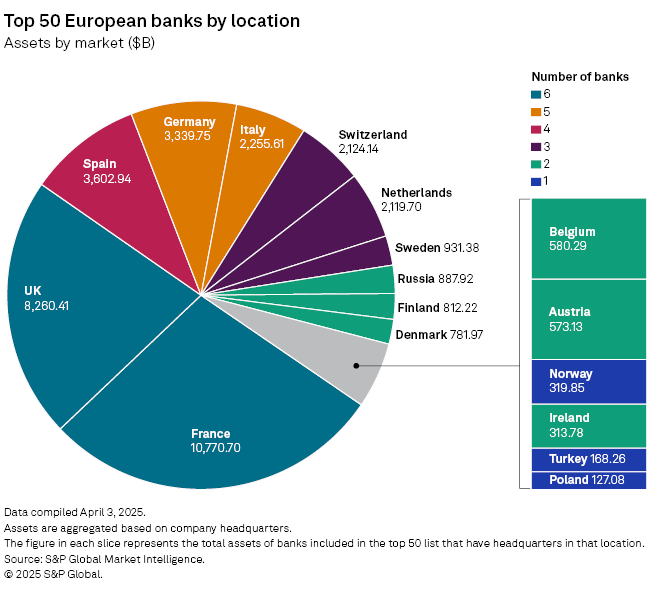

On a country level, France and the UK have the highest number of banks on the top 50 list with six each, followed by Germany and Italy each with five and Spain with four. The French banks, all in the top 20, had the highest combined assets at roughly $10.771 trillion, while the UK banks had $8.260 trillion.