Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Apr, 2025

Deutsche Bank AG expects to meet its 2025 financial targets despite the risks that ongoing global trade tensions pose.

The German lender, while reporting first-quarter earnings on April 29, sought to reassure markets that it will not be severely impacted by tariffs. "You can see that many of our businesses will actually be unaffected by what we have seen in early April, or are even benefiting from that over time," CEO Christian Sewing said, referring to the wider market selloff earlier in the month after the US announced higher tariffs on imports.

Sewing's comments came despite the bank warning in its earnings report that meeting its 2025 goals, including its roughly €32 billion revenue target, could be "adversely impacted" if risks relating to US trade policy, the response of China and other trading partners, and the "challenging" macroeconomic environment in Europe materialize.

The bank's first-quarter results already reflected some tariff-related effects, particularly on credit loss provisions. The bank booked about €130 million of provisions for loans at higher risk of default, which CFO James von Moltke said were related to weaker macroeconomic forecasts and overlays, including for direct tariff-driven impacts on some higher-risk clients.

Deutsche Bank said in its financial report that a one-percentage-point decrease in GDP growth rates would mean more than €77 million of higher expected credit losses. The bank's latest assumptions project the German, US and Chinese economies to grow 0.3%, 1.7% and 4.5% in 2025, respectively.

2025 financial targets "in sight"

Despite the risks, Deutsche Bank affirmed its 2025 financial targets, with Sewing saying these are now "in sight." Other targets include a return on tangible equity of more than 10% and a cost-to-income ratio below 65%.

Its first-quarter ROTE rose 3.1 percentage points year over year to 11.9%. The bank generated total net revenue of €8.5 billion, and its profit attributable to shareholders increased to €1.8 billion from €1.3 billion in the year-ago period. The S&P Global Market Intelligence consensus estimate for normalized net income was €1.72 billion.

"The geopolitical landscape is rapidly evolving, and uncertainty and volatility are likely to stay elevated for the time being," said Sewing. "We are particularly encouraged to see what is happening in our domestic market with regards to fiscal changes and structural reforms, leading to a much-needed economic boost for Germany and Europe."

Deutsche Bank delivered strong results, with costs and revenues coming ahead of expectations, RBC Capital Markets analyst Anke Reingen said in a research note. The bank was "delivering on what it can control" in the quarter but the impact of tariffs adds uncertainty to its outlook statement, which is "only realistic," Reingen said.

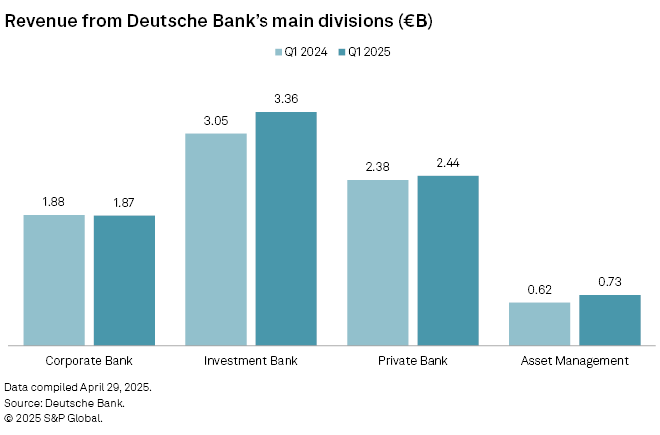

Deutsche Bank's investment banking division again contributed the most to group revenue, generating €3.36 billion in the quarter. The corporate bank and private bank divisions generated €1.87 billion and €2.44 billion, respectively.

In the investment bank's key fixed income and currencies (FIC) business, there has already been some recovery in the latter half of April from the volatility seen earlier in the month, von Moltke said. The FIC business accounted for the majority of the division's revenue, yielding €2.94 billion in the quarter.

Deutsche Bank's shares were up around 4% in early afternoon trading.