Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Apr, 2025

By Bea Laforga

CaixaBank SA is in a good position to weather the impact of uncertainties in global tariffs, given Spain's relatively low exposure to the US and the bank's strong revenue generation at home.

Amid an uncertain global trade policy, CEO Gonzalo Gortázar said both the bank and the country are in a "position of strength" as its export goods to the US only account for 1% of economic output, which is one of the lowest in the region. This low exposure bodes well for Spain's largest lender by loans and deposits, he noted.

"We are quite confident that we will be able to deliver in a good number of scenarios," Gortázar said during the bank's April 30 earnings call.

CaixaBank reiterated its guidance for 2025 and noted that it would have upgraded its forecast on revenue from services if it were not for the volatility caused by the announcement of higher US tariffs in early April. This echoes comments from executives at domestic peer Banco Bilbao Vizcaya Argentaria SA a day earlier.

"We [will] wait for more visibility ... in order to reconsider a potential upgrade going forward," CFO Javier Pano said during the call.

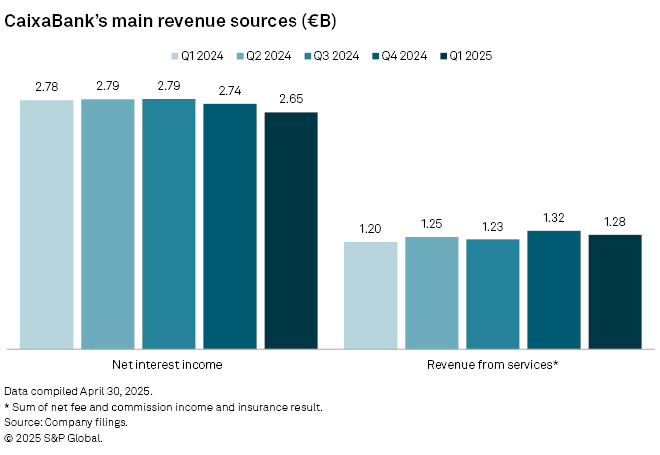

The bank guided for a mid-single-digit decline in net interest income (NII) for 2025, a low-to-mid-single-digit growth in revenues from services, and a cost of risk of below 30 basis points.

While lending income is still projected to dip this year as interest rates fall, Pano said the drag on the bank's NII will slowly ease in the second half before stabilizing in 2026 and improving in 2027.

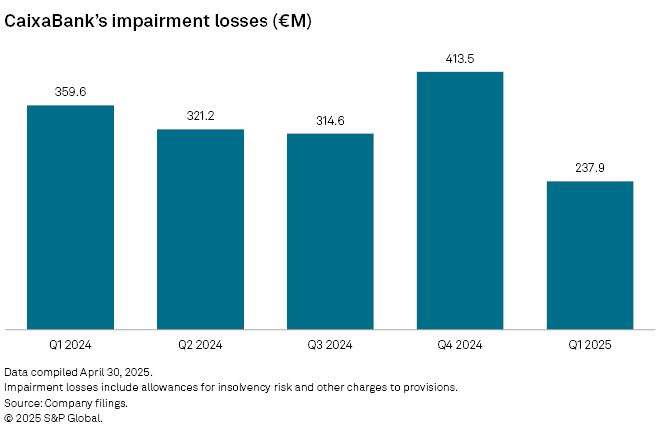

Gortázar was also positive on cost of risk, stating that there is "clear upside" potential to the guidance "even if there is a significant deterioration" or if tariff discussions yield unfavorable results.

Lower provisions also supported first-quarter profit with impairment losses falling by a third on a yearly basis to €238 million.

This helped offset the 4.9% drop in NII to €2.65 billion against the backdrop of falling interest rates. Revenues from other business lines rose nearly 7% to €1.28 billion, mainly driven by double-digit growth in wealth management. Inflows were at a record high in recent times at more than €1 billion per month during the quarter, according to Pano.

"April is going to be a little bit more subdued, but it's not going to be a negative month," he added.

More capital distribution underway

CaixaBank is prepared to make additional capital distributions as its common equity Tier 1 ratio was 21 bps above the minimum regulatory ratio at 12.46% by the end of March. The bank in March concluded a €500 million repurchase program and affirmed that it will execute another €500 million buyback as planned.

"We are aiming for frequent and regular distributions," Pano said, adding that "there is even room for more," without disclosing the timing.

The bank's current capital level leaves roughly €500 million in excess capital for potential additional distribution, analysts at Citi said in an April 30 note.

CaixaBank's shares were down 4.3% in late afternoon trading.