Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Apr, 2025

By Claire Lawson and Hussain Shah

As US banks increasingly make inroads to nonbank financial lending, the largest US banks are dominating the space.

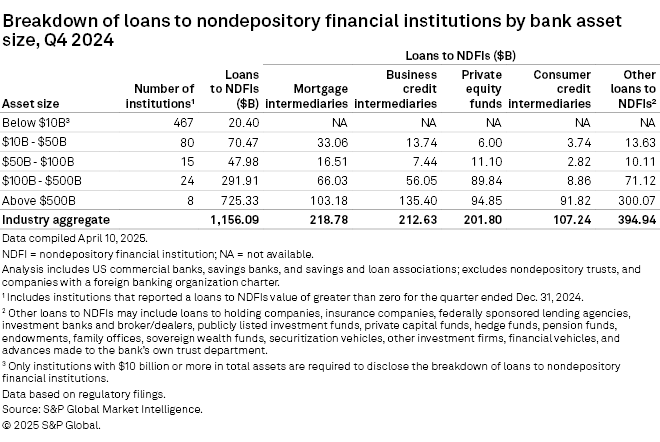

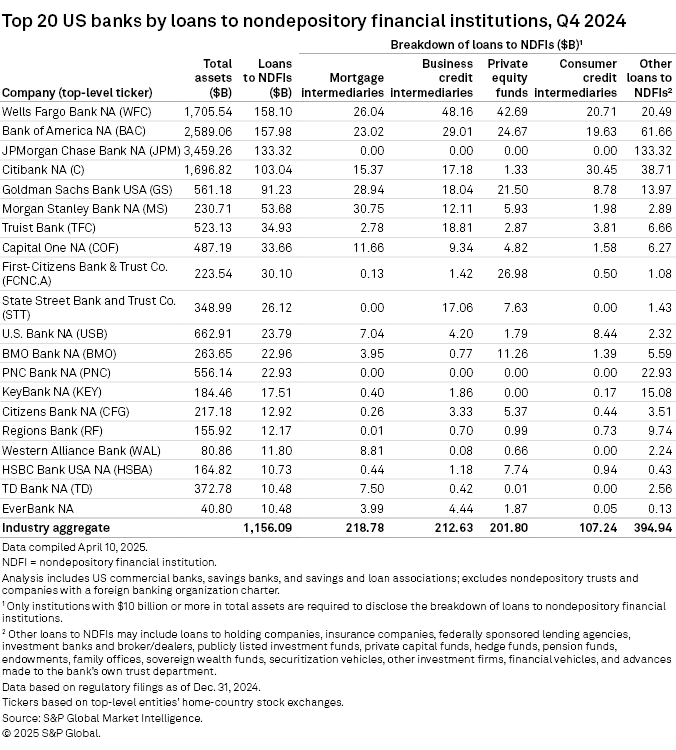

Banks with over $500 billion in assets held 62.7% of the industry's $1.156 trillion in loans to nondepository financial institutions (NDFIs) in the fourth quarter of 2024, well above their market share of just 40.9% of total US loans. The Big Four alone — JPMorgan Chase Bank NA, Bank of America NA, Wells Fargo Bank NA and Citibank NA — accounted for 47.8% of all NDFI exposure, each holding over $100 billion in NDFI loans.

The Federal Deposit Insurance Corp. in the fourth quarter of 2024 began requiring banks with more than $10 billion in assets to break down their loans to NDFIs into five categories: mortgage intermediaries, business credit intermediaries, private equity funds, consumer credit intermediaries and other loans to NDFIs.

The detailed disclosure requirement comes as the banking industry is increasingly lending to NDFIs such as private equity firms, mortgage and insurance companies, and investment funds.

"The FDIC is sounding an alarm on the increasing exposure of banks to non-depository financial institutions," Amanda Hofstetter, a principal with banking and financial services firm SolomonEdwards, wrote in a blog post. "While these loans offer potential opportunities, they also bring heightened risks that regulators expect financial institutions to address."

Lending to NDFIs is rapidly growing among US banks as it provides them an opportunity to diversify their lending lines and boost revenue, but it also comes with risks, S&P Global Ratings credit analyst Brendan Browne wrote in a Feb. 18 report.

"In our view, the fast pace of bank-nonbank interconnection growth ... opens the possibility for poor underwriting and credit losses, particularly if the valuation and quality of the assets held by [nonbank financial institutions (NBFIs)] were to decline amid a future economic downturn," Browne wrote. "Lending to NBFIs could also add to the competitive pressures that U.S. banks face from their nontraditional counterparts — as well as intensify systemic risk, particularly if potential problems that arise at NBFIs ricochet back on their bank lenders."

The FDIC is not the only agency that has shown concern and sought more information on banks' NDFI lending. The Federal Reserve announced in February that it will conduct an exploratory analysis in conjunction with stress tests in June on the risks that NDFIs pose to banks.

In the fourth quarter of 2024, Wells Fargo had the most loans to NDFIs at $158.10 billion, while Bank of America trailed closely behind with $157.98 billion. JPMorgan was the third highest with $133.32 billion in NDFI loans.

While lending to NDFIs is growing, 594 out of 4,000-plus US banks reported lending to the asset class in the last quarter of 2024. Banks with less than $10 billion in assets were most represented, with 467 banks reporting $20.40 billion in loans to NDFIs.

Category breakdown

Among the five categories that the FDIC required banks to break down their NDFI lending to, banks were the most exposed to the "other" category, with $394.94 billion in loans to the unspecified category.

JPMorgan accounted for $133.32 billion of the "other" loans, its entire NDFI exposure. The bank elected not to report a breakdown of the categories, citing "organizational risk" associated with reporting different values to the FDIC and the Fed, the Financial Times reported.

Mortgage intermediaries were the second-most invested in, at $218.78 billion.

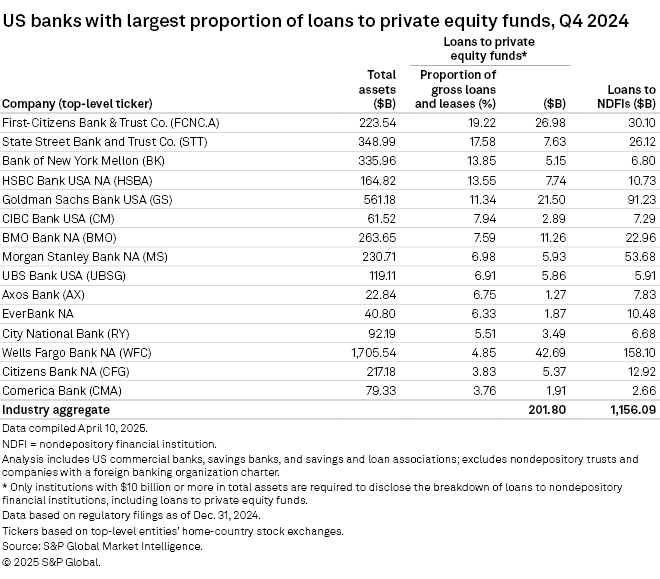

Private equity funds trailed mortgage and business credit intermediaries in bank funding at $201.80 billion in loans. The asset class gained attention in recent years as the private equity market has ballooned in size and drawn regulatory attention. Described as both friend and foe, banks have also been keeping an eye on the sector.

Private markets have grown rapidly since the end of the great financial crisis, with global total loan value up to over $1.2 trillion in 2024 from $100 billion in 2010 and outpacing other, more traditional asset class growth, according to the Bank for International Settlements quarterly review.

Loans to private equity funds accounted for nearly 20% of First Citizens Bank & Trust Co.'s loan book. At $26.98 billion, First Citizens had the highest proportion of private equity to gross loans and leases — 19.22% — among US banks.

State Street Bank and Trust Co. held the second-highest proportion of private equity loans at 17.58% of gross loans, lending $7.63 billion to the funds.

Three other banks had double-digit proportions of loans to private equity funds: Bank of New York Mellon, HSBC Bank and Goldman Sachs Bank USA.

Margin loan reporting changes

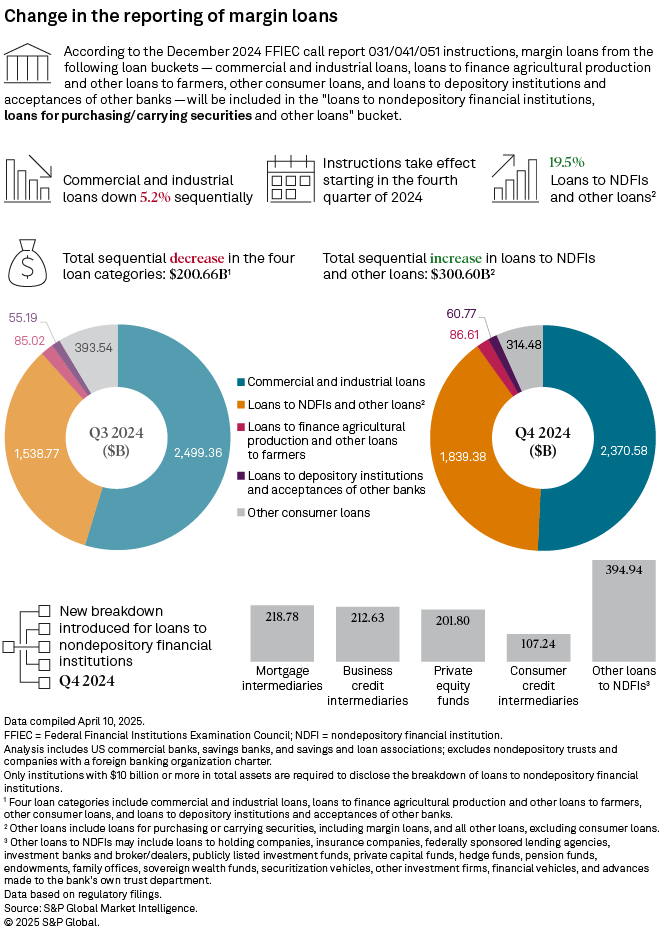

In the fourth quarter of 2024, the FDIC also directed banks to exclude margin loans from four categories: commercial and industrial loans, agricultural loans, consumer loans and loans to depository institutions. The margin loans were added as a separate line item under loans to NDFIs and other loans.

Changes in the loan categories' compositions affected the size of the reported portfolios from the third quarter of 2024 to the fourth quarter of 2024.

Commercial and industrial loans showed a marked decrease, down 5.2% quarter over quarter, which can be traced partially to the exclusion of margin loans.