Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Apr, 2025

By Harry Terris and Xylex Mangulabnan

The biggest US banks attempted to give preliminary reads on an economic outlook that has been shaken by the Trump administration's tariff salvos, but bank executives themselves are waiting for the picture to clear.

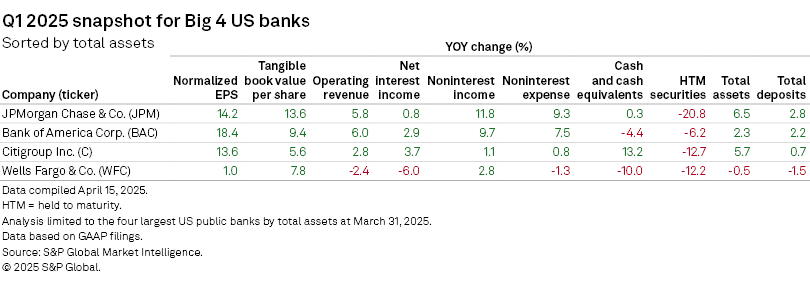

First-quarter numbers generally did not convey the scale of the potential damage implied by stock trading after the April 2 "Liberation Day" announcement. Across the Big Four banks, normalized EPS increased by a median of 13.9% year-over-year and tangible book value per share was up by a median of 8.6%, according to data from S&P Global Market Intelligence.

The banks generally maintained guidance for the year, though Wells Fargo & Co. moved toward the lower end of its forecast for net interest income (NII) and JPMorgan Chase & Co. added about $1 billion to its credit loss allowance amid an "unusually uncertain" environment.

The guidance feeds into analyst forecasts, which changed only modestly after the reports. For the four banks, the consensus forecast for normalized EPS in 2025 was down a median of 0.3% from April 10 to April 16, and down a median of 0.9% for 2026.

JPMorgan Chase Chairman and CEO Jamie Dimon said it is "impossible" to know what the economic cycle will look like. Some issues are likely to "resolve, for better or for worse, in the next four months," he added during a conference call. "So maybe when we're doing this call next quarter, we won't have to be guessing."

The "2025 outlook remains murky," Raymond James analysts said in an April 14 note. However, they expect other banks "to recognize the clear shift in credit risk due to tariffs and the increasingly uncertain economic outlook impacting borrowers."

|

Credit outlook

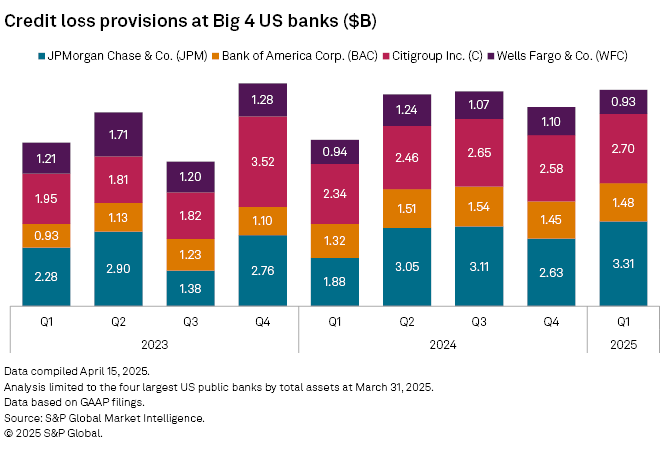

With its allowance build, JPMorgan Chase posted the largest sequential change in first-quarter credit expense among the Big Four.

Bank of America Corp.'s credit provision has been roughly steady at about $1.5 billion a quarter for several quarters, the bank observed in its earnings report. It said that year-over-year consumer spending growth across its debit and credit cards and other channels held in at about 4% to 5% in the first quarter and early April, a level that is supportive of a healthy economy.

Given the recession worries, however, BofA used a portion of its report to review its credit positioning broadly, outlining substantial shifts it has made over the past 15 years to reduce risk.

"Consumers are still solidly in the game," Chairman and CEO Brian Moynihan said during a conference call. "What they'll do next, different question."

|

|

– Set email alerts for future data dispatch articles. – Download a template to generate a bank's regulatory profile. – Download a template to compare a bank's financials to industry aggregate totals. |

In an April 14 note, analysts at Keefe Bruyette and Woods highlighted a 100 basis-point jump in high-yield credit spreads since April 2. "Widening spreads can foreshadow slowdowns or recessions as default risks rise," they said.

Consensus provision expense estimates for the Big Four in 2026 increased by a median of 3.4% from April 10 to April 16, according to data from S&P Global Market Intelligence.

Net interest income

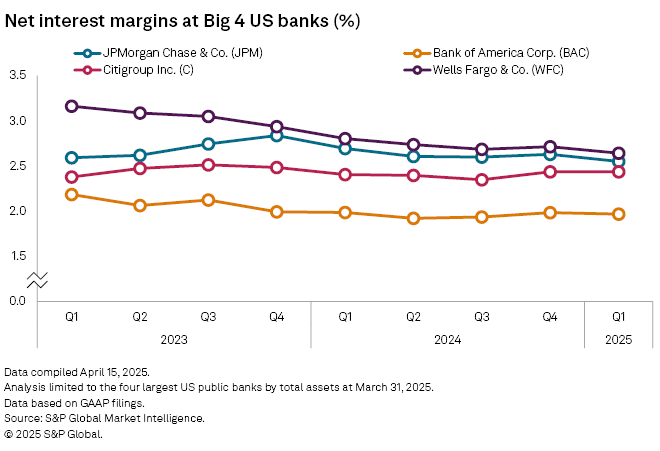

Both BofA and JPMorgan Chase maintained 2025 guidance for NII despite market expectations for more Federal Reserve rate cuts that would serve as a headwind for them.

JPMorgan Chase said it is generally asset sensitive in part because it has large amounts of deposits at the Fed that earn interest at overnight rates.

CFO Jeremy Barnum Barnum said the bank's NII forecast is actually "a tiny bit lower [but] not enough to warrant a change in the outlook." There are some offsets, he added, including better price performance on some certificates of deposit and wholesale deposits.

|

Deposits across the Big Four were up a median of 1.9% sequentially in the first quarter, including a 3.7% increase at JPMorgan Chase.