Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Apr, 2025

Banco Bilbao Vizcaya Argentaria SA's strong performance in the first quarter of 2025 is insufficient to warrant an upgrade to its forecasts for the rest of the year due to the economic and market uncertainty created by US import tariffs, its CEO said.

Spain's second-largest bank by total assets, which counts tariff-threatened Mexico as its largest source of profit, beat analysts' expectations for revenue and profit in the first three months of the year.

President Donald Trump's announcement on April 2 of larger-than-expected tariffs on all US imports caused a massive sell-off in European bank stocks as investors worried about the impact on borrowers and the global economy. A subsequent partial reduction of tariffs on most countries eased concerns, but uncertainty about the direction of US trade policy and its economic impact persists.

"The reason that we are not upgrading our activity or NII and we are maintaining our guidance is we don't know how sustainable this growth will be in the coming quarters," BBVA CEO Genç said during the bank's first-quarter earnings call. "There is a big uncertainty that circles us, all of us, and we have to see how things pan out."

BBVA would have upgraded its 2025 guidance "in a normal environment," Genç added.

Strong beats

The Spanish banking giant posted a 46% annual growth in profit to almost €2.7 billion, beating analyst consensus expectations by almost 17%,

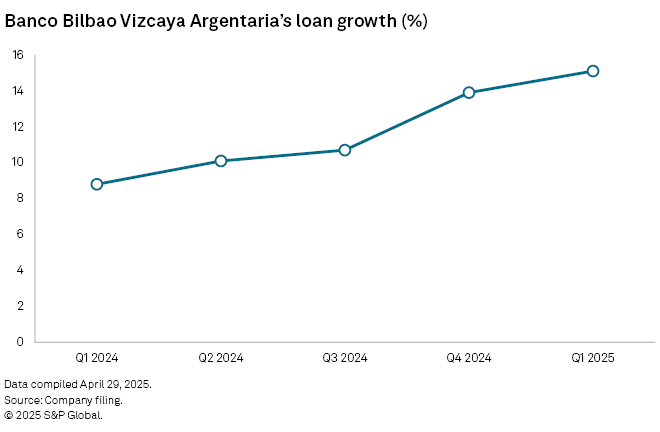

BBVA is encouraged about its prospects in the coming quarters based on the strong loan growth it recorded in the first three months of the year. Total loans across the group grew by more than 15% annually in the first quarter, accelerating by 120 basis points from the fourth quarter of 2024.

"The [loan origination] pipelines are quite strong," said Genç. "The activity levels continue to be strong, independent of all the uncertainties surrounding the world."

BBVA is upbeat about the growth prospects of its three main markets — Spain, Mexico and Turkey — in a climate of heightened trade tensions. Spain's leverage, based on its domestic credit to private sector over gross domestic product ratio, is lower than the eurozone average at 78%, according to BBVA's first-quarter earnings presentation. Mexico has a ratio of 33%, while Turkey's is 50%.

"Given the relatively low leverage levels in our footprint countries, we do believe in the potential of further credit growth without creating too much cost of risk," Genç said.

The impact of US tariffs could be beneficial to Mexico relative to other countries, Genç added. The 145% tariff on Chinese exports to the US makes Mexico, which has had a 25% tariff on its exports to the US since February, a more attractive source of imports for the US market.

"If the tariffs stay as is, Mexico, relatively speaking, will be benefiting from this," said Genç.

Still, the mostly short-term profile of the 17.2% annual increase in BBVA's lending in Mexico in the first quarter reflected the longer-term concerns of borrowers, Genç added.

Sunny Spain

Spain should also avoid the worst impacts of US tariffs, CFO Luisa Gómez said.

"Spain, within the context of the tariffs, is one of the countries in Europe that is least affected because it is a services economy, it is driven by [non-US] exports and services, by tourism," Gómez said.

BBVA's strong performance in Spain in the first quarter led the bank to "slightly" improve its full-year guidance for the country.

"We are expecting low to mid-single-digit loan growth for the year with a positive bias considering the strong start to the year," Gómez said.

BBVA's shares were broadly flat in early afternoon trading.