Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 Mar, 2025

By Dylan Thomas and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Private equity firms have backed more and larger take-private deals in recent years, but growing macroeconomic uncertainty threatens to upend the trend.

The value of private equity take-privates reached $149.86 billion globally in 2024, the highest total in at least five years, according to S&P Global Market Intelligence data. At least some of that momentum carried into 2025: Nine such deals totaling $16.08 billion were announced in just the first two months of the year.

Still, expectations for 2025 dealmaking are meeting harsh reality, with US tariffs and rising trade tensions clouding early-year M&A activity, including privatizations.

Private equity firms are still finding underappreciated and undervalued listed companies. But the path to growing that value in the private market are less certain.

Read more about the trends driving recent private equity-backed take-private activity.

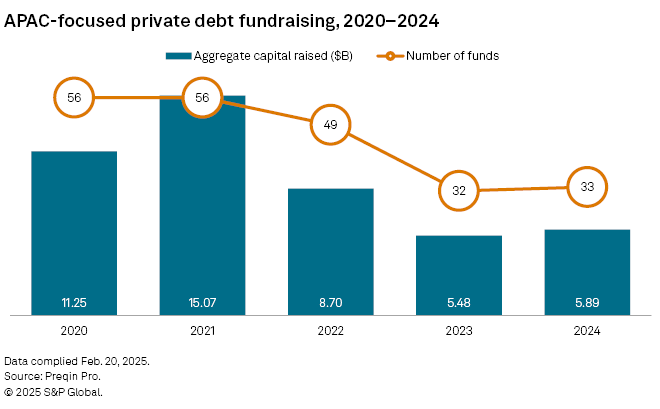

CHART OF THE WEEK: Asia-Pacific private credit fundraising inches up

⮞ Asia-Pacific-focused private credit funds raised $5.89 billion in 2024, up 7% from $5.48 billion in 2023, according to a Market Intelligence analysis of Preqin Pro data.

⮞ The increase contrasts with a drop in Asia-focused private equity fundraising, which dipped to a 12-year low in 2024 amid rising US-China trade tensions.

⮞ In Asia, the outlook for private credit is brightest in markets such as South Korea and India, where tight banking regulations are boosting the demand for alternative sources of debt, Michel Lowy, CEO of investment bank SC Lowy Financial (HK) Ltd., told Market Intelligence.

TOP DEALS

– Warburg Pincus LLC agreed to sell Sundyne LLC, a manufacturer of industrial pumps and compressors, to Honeywell International Inc. for $2.16 billion. The acquisition is expected to close in the second quarter.

– KKR & Co. Inc. entered into a definitive agreement to sell Seiyu GK, a Japan-based supermarket chain, to retail business operator Trial Holdings Inc. The transaction is expected to be completed in the second quarter.

– Thoma Bravo LP agreed to sell Quorum Software, an energy software provider to Francisco Partners Management LP.

TOP FUNDRAISING

– Intermediate Capital Group PLC raised $11 billion for ICG Strategic Equity Fund V, exceeding its hard cap. The fund will partner with private equity sponsors to invest in single-asset continuation vehicles for North American and Western European companies.

– CVC Capital Partners PLC raised €4.61 billion for CVC Capital Partners Strategic Opportunities III Ltd. The vehicle invests for a longer period than the broader private equity market's average hold period, aiming to maximize value creation initiatives.

– Eurazeo SE raised about €3 billion for Eurazeo Capital V program. The fund will focus on middle and upper-middle-market companies in Europe and North America.

– Adelis Equity Partners AB pulled in €1.5 billion for Adelis Equity Partners Fund IV at final close. The fund, which also secured a €116 million commitment from the firm's employees, will target growth-oriented investments in the Nordic region as well as in Germany, Austria and Switzerland.

MIDDLE-MARKET HIGHLIGHTS

– Rubicon Technology Partners made a majority investment in CollegeNET Inc., a software services provider for higher education.

– The Sterling Group LP sold Frontline Road Safety Group LLC, a provider of pavement marking and ancillary services in the US. Bain Capital LP was the buyer.

FOCUS ON: GROWING BUY-IN FOR JAPAN'S HEALTHCARE MARKET

Blackstone Inc. agreed to acquire a 60% stake in CMIC Co. Ltd., a Japanese contract research organization for clinical trial phases and therapeutic areas, from CMIC Holdings Co. Ltd.

The acquisition underscores Blackstone's increasing focus on the healthcare sector, which comprises 7.6% of its overall portfolio. Notably, Japan represents 60% of Blackstone's healthcare investments within developed Asia-Pacific markets, according to Market Intelligence data.

Earlier in 2024, Blackstone announced the sale of Tokyo-based Alinamin Pharmaceutical Co. Ltd. to MBK Partners for about $2.17 billion.

The activity highlights a growing interest among major private equity firms in Japan's healthcare market. In February, Bain Capital Pvt. Equity LP agreed to acquire Mitsubishi Tanabe Pharma Corp. from Mitsubishi Chemical Group Corp. for $3.36 billion, marking the largest transaction in the Japanese healthcare sector since at least 2020.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter