Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Mar, 2025

By Jason Woleben and Noor Ul Ain Adeel

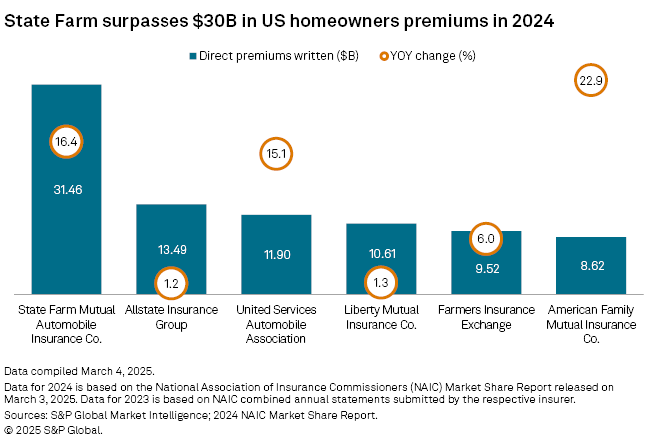

State Farm Mutual Automobile Insurance Co.'s direct homeowners premiums grew at their fastest pace in more than two decades in 2024, according to preliminary data released by the National Association of Insurance Commissioners (NAIC).

The Illinois-based insurer's direct homeowners premiums written rose to $31.46 billion in 2024, a 16.4% year-over-year increase compared to historical data from S&P Global Market Intelligence's consolidation of combined annual statement data. That marked State Farm's strongest yearly increase since 2002, when it also reported a 16.4% rise from the prior year.

State Farm accounted for an estimated 19.4% of the total homeowners direct premiums collected by US underwriters in 2024, according to preliminary NAIC data. This market share figure is expected to change based on incorporating data from additional filers and potential methodology differences between S&P Global Market Intelligence and the preliminary NAIC-reported results.

The initial NAIC report is based on 84.4% of the expected individual property and casualty filers and is missing one of the largest homeowners insurers in the country. The published results do not reflect Citizens Property Insurance Corp., one of the 25 largest US homeowners writers in 2024. Florida's insurer of last resort reported $2.16 billion in direct premiums written in the homeowners line through the first nine months of 2024, making it the thirteenth-largest US underwriter in that period.

|

– Read about rate increases taken in 2024 by the largest US homeowners insurers. |

American Family Insurance Group's calculated year-over-year increase of 22.9% was the largest increase among the country's six largest homeowner underwriters in 2024. Its premiums reached $8.62 billion in 2024, compared to $7.00 billion a year earlier.

The nation's second-largest homeowners writer, The Allstate Corp., recorded a calculated yearly increase in direct premiums written of 1.2%, the smallest increase in the group. Allstate's premiums were $13.49 billion in 2024.

United Services Automobile Association replaced Liberty Mutual Holding Co. Inc. as the country's third-largest homeowners underwriter in 2024. USAA's direct premiums written jumped 15.1% to $11.90 billion in 2024. Liberty Mutual's direct premiums written were $10.61 billion in 2024, compared to $10.48 billion in the prior year.

When combined, the six largest underwriters accounted for roughly half of the US homeowners market in 2024.

Loss ratio improvement

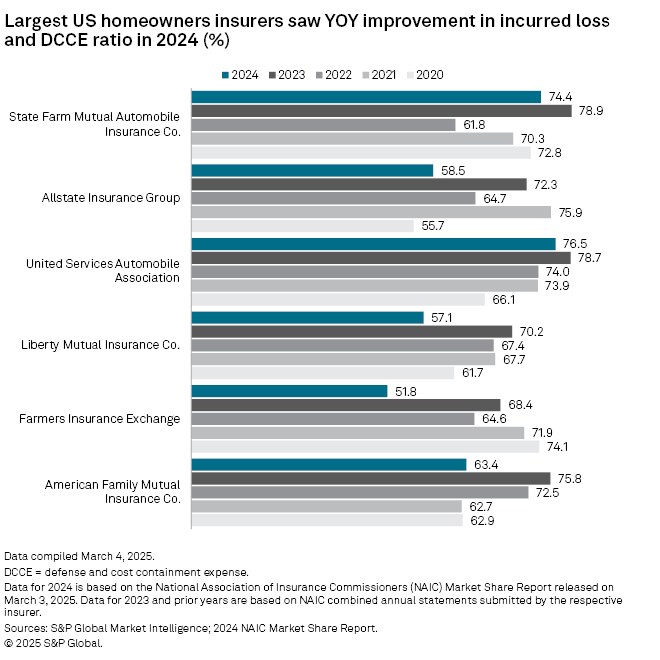

The six largest homeowners insurers all reported year-over-year improvements in their direct incurred loss and defense and cost containment expense (DCCE) ratio in 2024. The loss and DCCE expense ratio measures claims, including reserves, plus costs such as legal expenses, which include lawyers fees, court costs and paying for experts and investigators.

Four of the top six underwriters had improvements in excess of 10 percentage points, with the roughly 17 percentage point improvement from Farmers Insurance Group of Cos. being the largest. Farmers' homeowners direct incurred loss and DCCE ratio, as calculated by the NAIC, was 51.8% in 2024.

The three other insurers with the double-digit improvement in their direct incurred loss and DCCE ratio were Allstate, Liberty Mutual and American Family.

Underwriting results for some insurers stand to take a hit during the first quarter of this year due to the Southern California wildfires. State Farm General places its direct incurred losses from the fires at $7.9 billion, with approximately $212 million expected to be retained by the company, with an additional $400 million for its portion of the $1 billion FAIR Plan assessment. Other State Farm entities, State Farm Mutual Auto and Oglesby Reinsurance Co., are projected to retain the majority of State Farm General's losses.

Liberty Mutual reported its preliminary estimated fire losses to be $1.20 billion, while Allstate said its losses are $1.07 billion. Farmers' places its net loss estimate at $600 million, which excludes its share of the FAIR Plan assessment.