Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Mar, 2025

By Ranina Sanglap and Beenish Bashir

Singapore's three largest banks are shifting focus to neighboring countries as they brace for potentially protectionist policies in the US.

DBS Group Holdings Ltd., Oversea-Chinese Banking Corp. Ltd. (OCBC) and United Overseas Bank Ltd. indicated that they are now focused on their regional franchises, and are looking to tap opportunities that will likely open up at the Johor-Singapore Special Economic Zone, a project in Malaysia that aims to increase the flow of investment and goods between the two Southeast Asian nations.

"Singapore banks have healthy financial buffers, including capital ratios that are comfortably above the regulatory minimum. We believe their well-established franchises in their key [Association of Southeast Asian Nations (ASEAN)] markets and recurring revenue from their core business lines will mitigate external headwinds from geopolitical uncertainties," Ivan Tan, a banking analyst at S&P Global Ratings told S&P Global Market Intelligence in an email.

Overseas growth

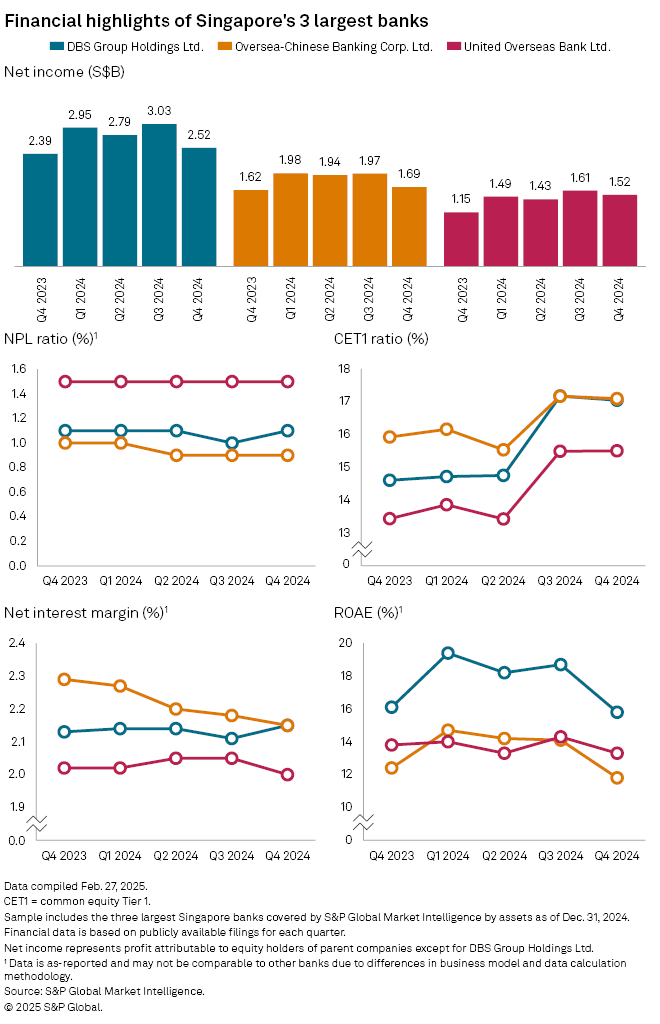

Singaporean banks have benefited from expanding their businesses overseas as their small, but high-value local operations limit their growth potential. That strategy has allowed banks in Singapore to distribute risks while growing their income. All three lenders posted record profits in 2024, driven by high interest income and robust wealth management fees.

DBS Group, the biggest bank by assets in Southeast Asia, reported a net income of S$2.52 billion for the fourth quarter of 2024, up 5.43% year over year from S$2.39 billion. Its full-year net profit rose 11% year over year in 2024 to S$11.4 billion from S$10.06 billion and its fee income crossed S$4 billion for the first time during the year.

OCBC reported a record net profit of S$7.59 billion for the full year ended Dec. 31, 2024, up 8% from S$7.02 billion, while United Overseas Bank's net profit came in at S$6.05 billion for the financial year ended Dec. 31, 2024, up 6% year over year from S$5.71 billion.

Rise of protectionism

US President Donald Trump's trade policies are being closely watched in the city-state, where external trade exceeds GDP. According to the World Bank, the trade-to-GDP ratio of Singapore was 311% in 2023.

Incoming DBS CEO Tan Su Shan, who will assume the role on March 28, expects the "Trump policy swings" to "create more volatility in markets, rates and [foreign exchange]."

"Our markets in Asia, particularly China and Southeast Asia, are looking more resilient and prepared for Trump 2.0, and we expect more intraregional trade. We will be focusing more on the trade opportunities between ASEAN and North Asia, as well as Europe," Tan said during the bank's Feb. 10 earnings call.

OCBC CEO Helen Wong echoed concerns about the potential impact of heightened trade tensions and said this could "impede global growth" and slow down trade activities. However, Wong said that the bank will stick to its corporate strategy of focusing on four growth pillars: cryptocurrency, China, ASEAN investment and trade growth.

Southeast Asia focus

DBS, OCBC and United Overseas Bank are looking at growth opportunities in Southeast Asia. DBS is reportedly eyeing M&A deals with Malaysian banks with a possible stake acquisition in Alliance Bank Malaysia Bhd. OCBC already has seven branches in Johor, Malaysia, and plans to add resources in Southeast Asia. United Overseas Bank has scaled its business in the region following its acquisition of Citi's consumer business in Indonesia, Malaysia, Thailand and Vietnam.

"We are confident that ASEAN economies are resilient and continue to expand. We are committed to our ASEAN strategy," said UOB CEO Ee Cheong Wee on the bank's Feb. 19 earnings call. "Our long-term investments in the region are paying off with early results. The momentum is picking up, and we expect to see sustained revenue growth this year."

The three banks declared multibillion capital returns following their record earnings. DBS announced a dividend capital return plan of 15 Singapore cents per share per quarter, to be paid out in 2025. United Overseas Bank announced a S$3 billion package to return surplus capital to investors, while OCBC will return S$2.5 billion in excess capital to investors.

"Share buybacks are a means to achieve a bank's capital-efficiency objectives. Singapore banks are sitting on healthy capital buffers post the Basel reforms, and we believe they would strike a balance between a measured strategy to trim some capital but still maintain a sufficient buffer," S&P Global Ratings' Tan said.