Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 Mar, 2025

By Tyler Hammel and Jason Woleben

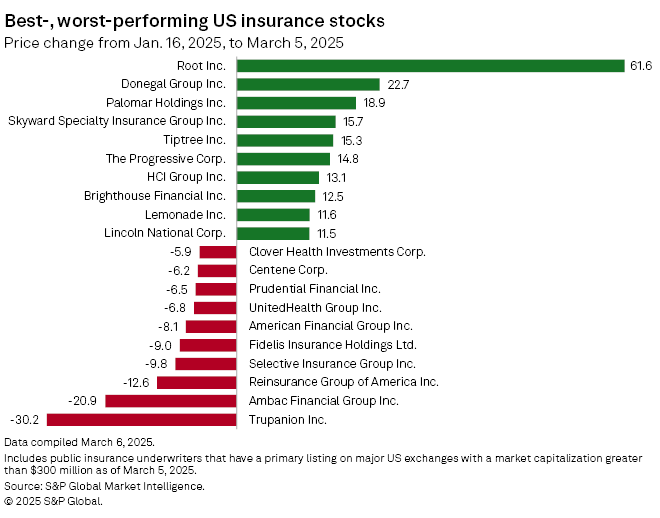

Root Inc. shares recorded the largest increase among listed US insurers following the start of the most recent earnings season through March 5, driven by strong fourth-quarter 2024 results.

In the weeks since UnitedHealth Group Inc. kicked off the earnings season for insurers on Jan. 16, Root shares have surged over 60%, closing at $142.75 on March 5. The auto-focused insurance technology company, which reported fourth-quarter and full-year 2024 earnings results on Feb. 26, ended the most recent reporting period with 414,862 policies in force, a 21% increase compared to the fourth quarter of 2023. It added more than 7,500 policies to its overall count during the quarter.

Root has continued to generate much stronger-than-expected operating and underwriting profitability for the last several quarters, according to Keefe Bruyette & Woods analyst Tommy McJoynt.

"That's been a story for the past four to six quarters in a row now," McJoynt said in an interview with S&P Global Market Intelligence. Whereas consensus expectations were generally pretty negative in the past, the company took action in the second half of 2023 to raise rates, McJoynt added. "Now they're reaping the rewards from that."

Root's success is company specific, McJoynt said, and is not the result of broader trends in the insurance technology and property and casualty sectors. However, as the year goes on, Root may face challenges as it seeks to grow, the analyst said.

"Across the personal auto landscape, most competitors — from the big guys like Progressive, all the way down to some of the regional carriers — are largely getting to rate adequacy through the rate actions they've taken over the past years," McJoynt said. "Most personal auto insurers are going to be looking to grow their policies-in-force count, and for a company like Root, which has also communicated that it plans to grow next year, it means it's going to be a somewhat competitive market to fund that growth."

The Progressive Corp. was also among the publicly traded US insurers to do well on Wall Street after this previous earnings season, with its stock rising 14.8%.

The auto insurance giant's shares recently reached a record $285.08 as of market close March 3 following strong growth in its personal auto business.

In January, the Mayfield, Ohio-based carrier's net premiums earned increased 22% year over year to $6.59 billion and net income rose 59% to $1.12 billion. Personal auto policies in force in the agency channel grew to 9.88 million as of Jan. 31, up 18% from a year ago, while policies in force in the direct channel rose 25% to 14.22 million, according to an earnings release.

Mixed bag for managed care

High medical costs continued to mar the earnings results of managed care insurers, putting pressure on several stocks. Major players such as UnitedHealth and Centene Corp. being among the worst-performing stocks during the period between Jan. 16 and March 5.

UnitedHealth's stock dropped 6.8%. Besides dealing with high medical costs, the sector powerhouse came under public scrutiny for its pricing practices following the killing of UnitedHealthcare Inc. CEO Brian Thompson in December 2024.

UnitedHealth and other managed care companies have faced public and legislative pushback against their pharmacy benefit manager subsidiaries. Drug middlemen such as UnitedHealth's Optum Inc. have been accused by politicians and the Federal Trade Commission in recent months of raising prices, which UnitedHealth CEO Andrew Witty pushed back against during an earnings call.

"America faces the same fundamental health care dynamic as the rest of the world: the resources available to pay for health care are limited, while demand for healthcare is unlimited," Witty said.

Centene's stock price dropped 6.2% during the same period. The company was similarly beset by the mounting pressures of Medicaid costs in recent quarters, as state-led redeterminations have procedurally disenrolled millions from the low-income health plans held during the COVID-19 pandemic.

However, now nearly two years into the lengthy, varied redetermination process, CEO Sarah London said during an earnings call that Centene is reaching some stability.

"As we move through 2025, we are looking forward to turning the page on the redeterminations era, returning to overall Medicaid program stability and working closely with our state partners on innovations that deliver not only health care, but also better health within our communities," London said.

Another leading health insurer, Humana Inc., posted a 5% decline in its stock price from Jan. 16 to March 5, while The Cigna Group's stock gained 10.3% and Elevance Health Inc.'s stock gained 3.2%.

Trupanion Inc.'s stock fell the sharpest among publicly traded US insurers, declining 30.2%. Much of the decline occurred since Feb. 18, when the pet insurer closed at $48.69 a share before gradually declining to $33.88 by close of trading on March 5. The company had the highest average short interest among US insurance stocks in 2024.