Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Mar, 2025

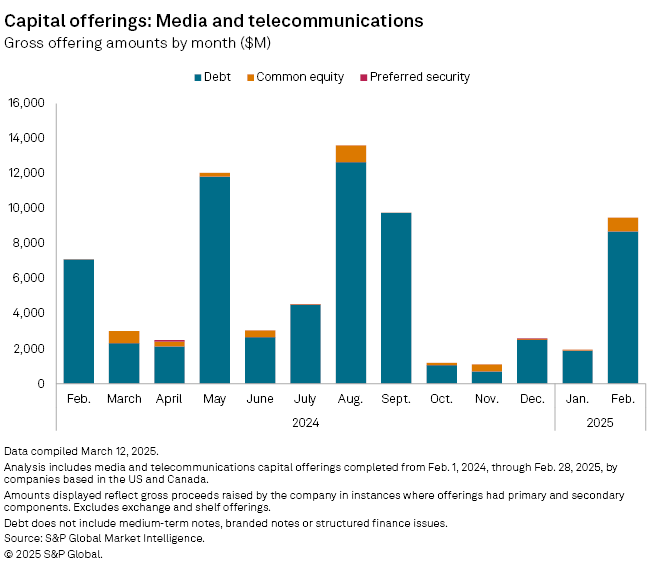

Capital markets activity in North America's media and telecommunications sector increased sequentially and year over year in February, raising a five-month high of $9.50 billion amid an influx of billion-dollar offerings.

Debt offerings raised the majority of the capital, totaling $8.70 billion, while common equity offerings brought in $794.7 million, according to S&P Global Market Intelligence data.

The monthly activity was a significant increase over the $1.96 billion recorded in January and reflects a nearly 34% jump over the $7.10 billion raised in February 2024.

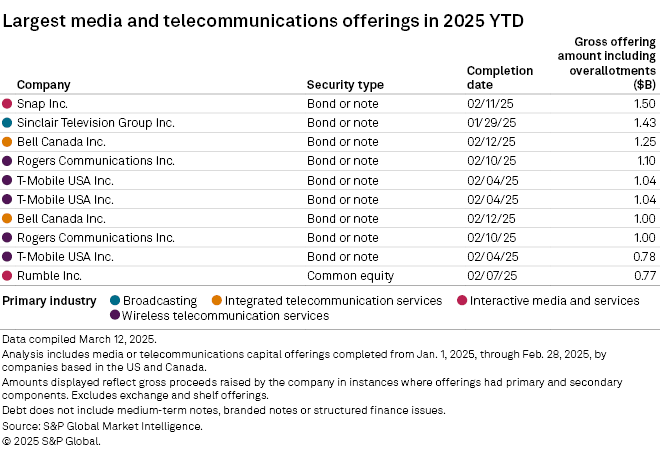

The largest offering by gross amount in February was Snap Inc.'s upsized offering of $1.50 billion in 6.875% senior notes due March 2033.

The Snapchat parent plans to use the proceeds to repurchase certain outstanding convertible senior notes, including $45.3 million of its senior notes due 2026, $797.4 million of its senior notes due 2027 and $800.0 million of its senior notes due 2028.

The company will use the remaining proceeds for general corporate purposes. Snap's offering is also the largest offering by gross amount year to date.

T-Mobile USA Inc. raised the highest amount overall in February. The T-Mobile US Inc. unit launched three offerings last month: €1.00 billion in 3.150% senior notes due 2032, €1.00 billion in 3.500% senior notes due 2037 and €750.0 million in 3.800% senior notes due 2045.

The proceeds are expected to be used for general corporate purposes, including share repurchases, dividends declared by T-Mobile's board and ongoing refinancing of existing debt.

|

– Read about how the rise of streaming services is impacting media companies' strategies – Run a custom screen of capital offerings by industry or geography on our Transactions Statistics page. |

Two Canadian telecommunications companies — Bell Canada Inc. and Rogers Communications Inc. — also tapped the debt market in February.

Bell Canada's offering consisted of two series of fixed-to-fixed rate junior subordinated notes: $1.00 billion in 6.875% series A notes due 2055, which will reset every five years, starting Sept. 15, 2030, and $1.25 billion in 7.000% series B notes due 2055, which will reset every five years, starting Sept. 15, 2035.

The BCE Inc. unit will use the net proceeds from the offering to repurchase, redeem or repay senior indebtedness and for other general corporate purposes.

Rogers Communications launched a US public offering and a Canadian private placement.

The US offering consisted of $2.10 billion in fixed-to-fixed rate subordinated notes, which included $1.10 billion in 7.0% notes due 2055 and $1.00 billion in 7.125% notes due 2055.

The Canadian private placement of C$1.00 billion in 5.625% fixed-to-fixed rate subordinated notes due 2055 did not contribute to Rogers' total for the month since the close date for the offering was not publicly available.

The net proceeds from the offerings will be used to repay certain outstanding indebtedness and fund part of the acquisition price for Rogers' purchase of BCE's indirect stake in Maple Leaf Sports & Entertainment Ltd.

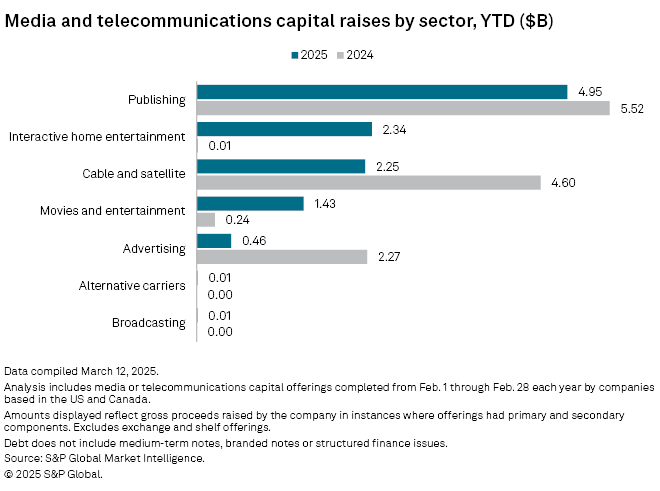

Among the media and telecom segments, publishing companies raised the highest amount of capital so far this year, securing $4.95 billion. Interactive home entertainment companies ranked second with $2.34 billion.