Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

03 Mar, 2025

By Bea Laforga and Marissa Ramos

France's three largest banks expect operating conditions to improve in 2025 as headwinds dissipate, following strong full-year 2024 results.

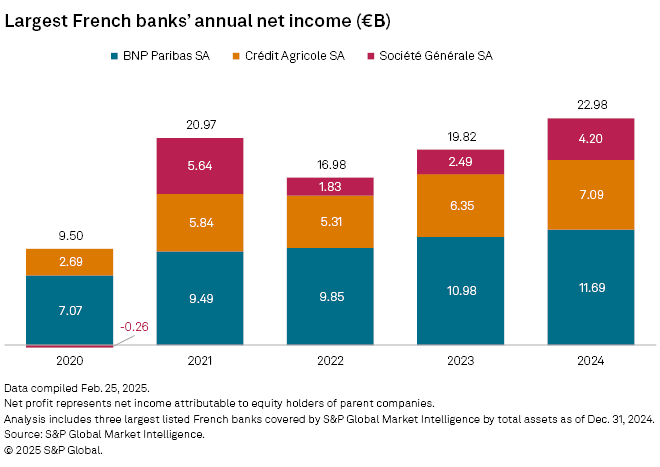

The aggregate 2024 net profit of BNP Paribas SA, Crédit Agricole SA and Société Générale SA grew 16% year over year to €22.98 billion, according to S&P Global Market Intelligence. Higher fee income offset a drop in their domestic lending income.

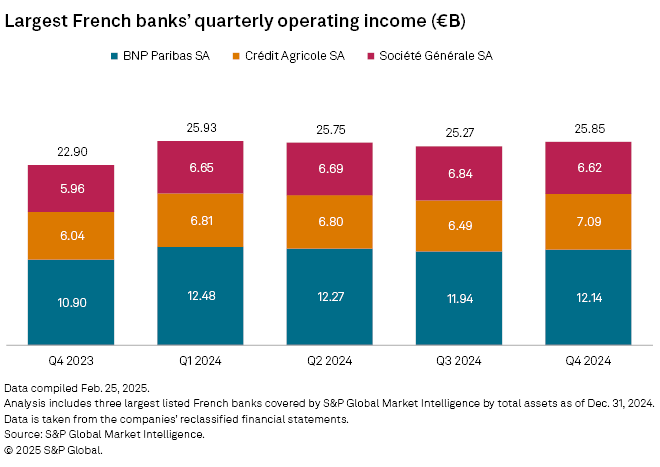

S&P Global Ratings estimates large French banks' 2025 revenue to grow by about 4% in 2025 on average. The companies appear to have overcome headwinds with higher lending rates, lower deposit costs and diversified revenue models, the agency said in a bulletin in February.

BNP Paribas has said headwinds will no longer affect growth for 2025 and 2026 at its commercial and personal banking services business in the eurozone. "Our 2025–2026 trajectory is built on strong growth drivers already in place, and that will continue to build benefits beyond 2026," CEO Jean-Laurent Bonnafé said during the bank's latest earnings call.

Crédit Agricole, meanwhile, expects a 2025 net profit roughly around the same level as the €7.09 billion generated in 2024, according to Deputy CEO Jérôme Grivet. The group's underlying annual income was €7.2 billion, already exceeding its target of more than €6 billion for 2025. "What we can tell on this point is that we are far ahead of the curve in terms of reaching our medium-term targets," Grivet said.

Fourth-quarter recovery

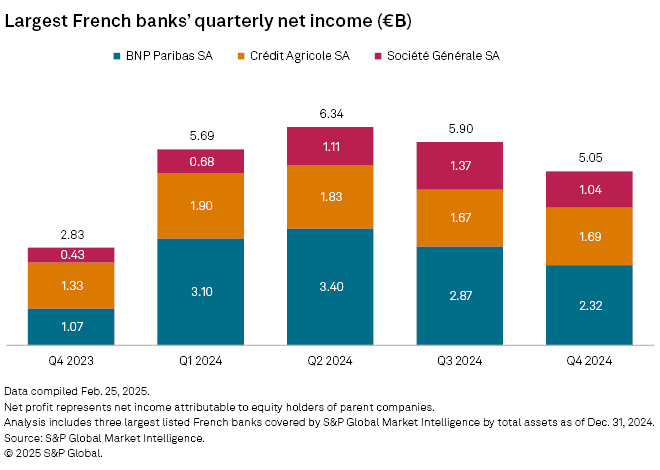

The banks' aggregate fourth-quarter 2024 net income grew by more than 78% year over year to €5.05 billion, Market Intelligence data shows.

SocGen, which was weighed down by lower income and elevated expenses due to integration and transformation charges in the year-ago quarter, saw its group net income more than double year over year to €1.04 billion.

SocGen CEO Slawomir Krupa said that for 2025, drivers would be revenue, commercial momentum and investments paying off. These should offset a normalization in the bank's global markets division, he said.

French banks are also focusing on cost efficiency measures to improve profitability, with BNP projecting approximately €600 million in yearly cost savings in 2025 and 2026.

Ratings cautioned that political uncertainty in France and geopolitical tensions abroad continue to pose risk to the country's lenders and "may weigh on the business climate and lending volumes."