Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Mar, 2025

By Nick Lazzaro and Umer Khan

US consumer retail spending in February experienced little growth from January and missed projections against a backdrop of faltering consumer sentiment.

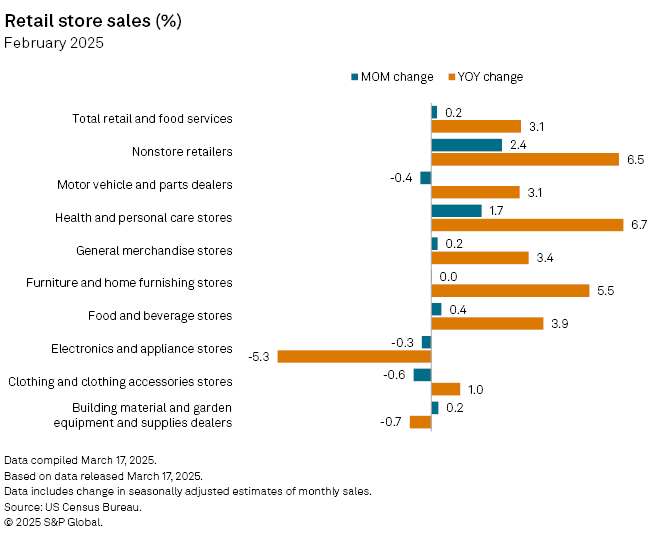

February total retail and food services sales in the US rose just 0.2% month over month, according to seasonally adjusted advance estimates from the US Census Bureau. The modest increase was well short of consensus expectations of a 0.7% improvement, according to economist forecast data compiled by Econoday. January retail sales were also revised down to reflect a 1.2% drop from December, weaker than the 0.9% decrease reported in preliminary estimates.

Soft retail sales coincided with pressure on consumer sentiment. The University of Michigan Consumer Sentiment Index and Conference Board Consumer Confidence Index, key benchmark surveys measuring consumer perception of economic conditions, both dropped by 7 percentage points in February. Both reports indicated that consumer outlooks were increasingly weighed down by uncertainty regarding economic policy and the impact of tariffs on price increases.

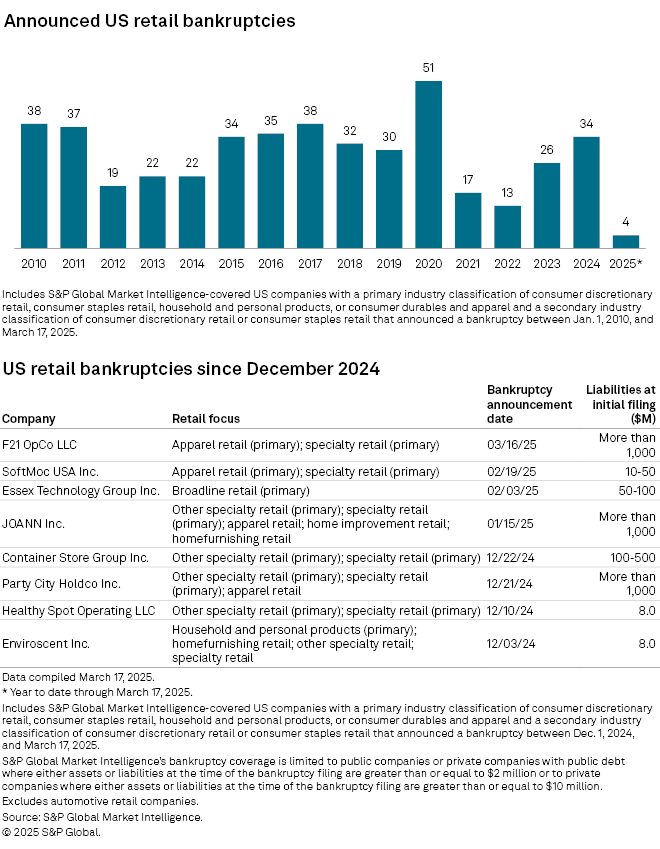

S&P Global Market Intelligence recorded two new bankruptcy filings among public and certain private retailers from Feb. 14 to March 17. The default risk for publicly traded retail companies rose in mid-March from mid-February.

Sales

Adjusted retail and food services sales totaled a combined $722.71 billion in February, up from $721.30 billion in January. Unadjusted total sales over the first two months of the year were up 1.8% year over year to $1.304 trillion.

Certain subsets of the Census Bureau retail data saw slightly stronger month-over-month improvements in February. Retail data excluding motor vehicle, automotive parts and gasoline station sales rose 0.5%. Core retail sales, which exclude the automotive and gasoline segments as well as building material and restaurant sales, climbed 1%. Core retail sales are used by the Bureau of Economic Analysis in its personal consumption expenditure estimates that factor into GDP measurements.

For February, consumer spending dropped from the previous month in seven of the 13 retail and food service categories tracked by the Census Bureau sales data. The largest decline was the 1.5% dip reported for food services and drinking places. This was followed by a 1% sales decrease at gasoline stations and a 0.6% decline in sales at clothing and accessories stores.

– Set email alerts for future Data Dispatch articles.

– For more bankruptcy analysis, check out the monthly bankruptcy series.

The biggest increase was reported for nonstore retailers with a 2.4% improvement, possibly triggered by an uptick in consumer spending ahead of the implementation of new tariffs.

"For now, consumers appear to be hanging in there," said Jim Baird, chief investment officer at Plante Moran Financial Advisors, in an email. "It's not a robust backdrop for household spending, but it's also not as bad as an array of soft measures of the consumer mood would suggest."

Bankruptcies

F21 OpCo LLC, which operates Forever 21 clothing stores, filed for bankruptcy protection March 16, seeking to wind down its operations and pursue a possible sale. The company listed more than $1 billion in liabilities in its bankruptcy petition, according to Market Intelligence data.

Similarly, footwear retailer SoftMoc USA Inc sought to liquidate its business in a Feb. 19 filing, accounting for the only other bankruptcy tracked by Market Intelligence filed since mid-February.

There were four retail sector bankruptcies in 2025 through March 17. This compares with six bankruptcies recorded in the sector over the same period in 2024.

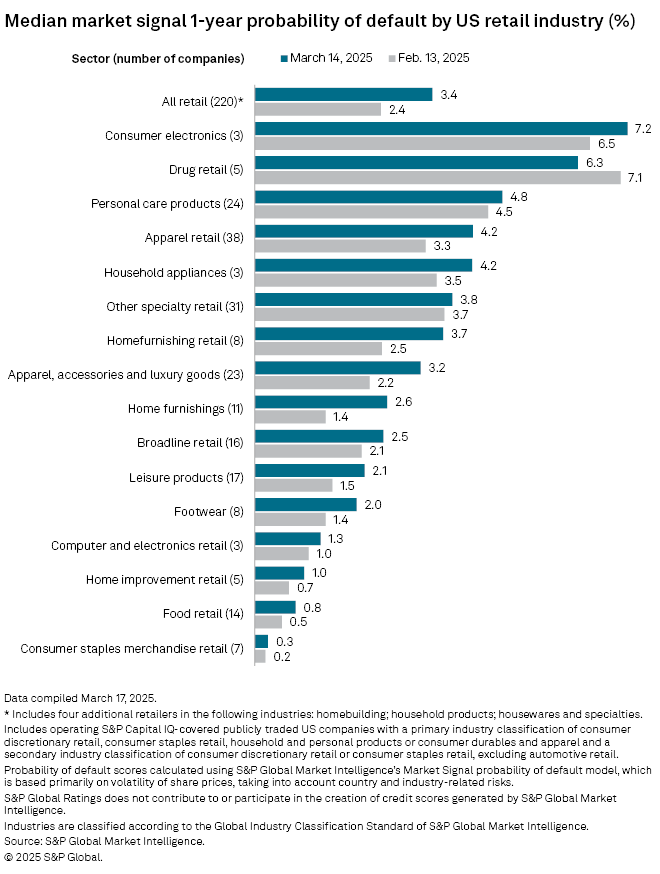

Default risk

The odds of default for publicly traded retailers climbed to 3.4 on March 14 from 2.4 on Feb. 13, according to Market Intelligence's market signal probability of default model.

The scores represent the median odds of default on debt within a year and are based primarily on the volatility of share prices for public companies on major US exchanges, accounting for country- and industry-related risks and other macroeconomic factors.

Of the 16 distinct retail industries tracked by Market Intelligence in March, the median probability of default scores increased for 15 retail categories and fell for only the drug retail sector. Drug retail's median default risk dropped to 6.3 in March from 7.1 in February.

Median default risk rose the most for the homefurnishing retail sector with a 1.2-percentage-point increase in March from February. Meanwhile, the consumer electronics segment had the highest overall median default risk at 7.2.