Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Mar, 2025

Rising electricity demand from technology and a supportive presidential administration have boosted enthusiasm in the US coal sector, though plenty of hurdles remain, coal company executives said during the CERAWeek by S&P Global energy conference.

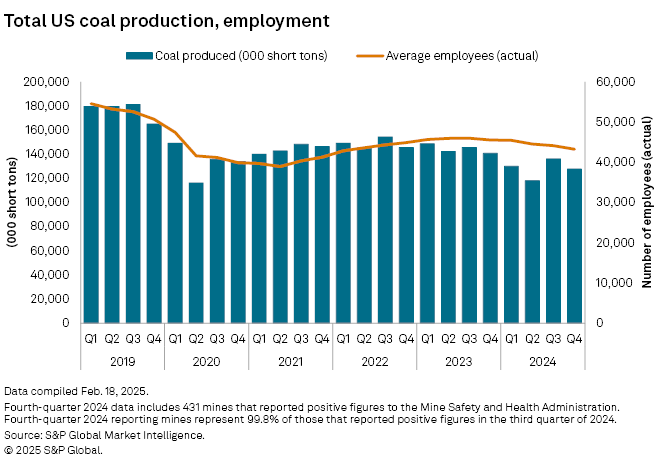

After years of production decline to match falling demand from domestic electricity generators, US coal producers hope that the electricity needed to feed new artificial intelligence technologies will keep retiring coal plants running at higher rates for a few more years. But increasing coal production after the industry's rapid contraction over the past several years may be difficult, coal executives said on a panel at the conference.

"You literally had customers asking for energy between now and 2031 and utilities telling them, I can't be ready for you until 2031," said Ernie Thrasher, CEO and chief marketing officer of coal marketing and logistics firm XCoal Energy & Resources LLC, on the sidelines of the conference. "Coal is the bridge. We have unused capacity sitting in coal plants that easily can be activated. So, I'm very encouraged about North American domestic coal opportunities."

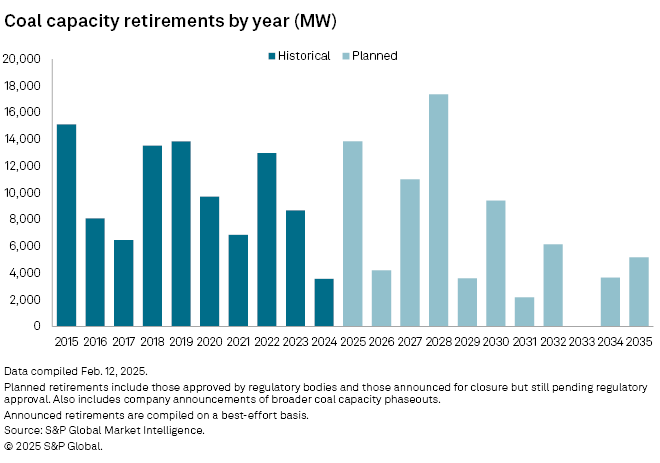

US coal production hit a 60-year low in 2024, according to a recent analysis of S&P Global Market Intelligence data. However, an analysis of planned retirements indicates that utilities are pumping the brakes on plant closures. For example, while US power generators are still retiring substantial amounts of coal generation in 2025, the 13.9 GW set for retirement is about 16.2% lower than what was scheduled at the time of of a December 2023 data analysis. Coal executives are hoping more delays are ahead.

"There are retirements scheduled over the next several years that they're very concerned on how are they going to support this growth with the resources they have," said Timothy Whelan, senior vice president of sales and marketing for coal producer Alliance Resource Partners LP, during a panel at the conference. "Coal is not going away. It's horribly needed to support the growth. It's baseload, and it's dispatchable, as is combined cycle [natural gas plants], as are nuclear units. We need it all.

For coal producers, that could translate into a reprieve from the steady loss of domestic power plant customers, said Jud Kroh, president of Robindale Energy Services Inc., a company that both mines coal and burns waste coal products for energy.

"I find it very hard to see how they're going to be able to retire if this growth materializes from AI," Kroh said. "I think every coal plant is going to have to stay on for the foreseeable future. ... It's going to be an incredible challenge just to keep the lights on without future retirements."

That said, coal plants do struggle in markets where renewable penetration is higher, Kroh noted. That is the case in many markets where vast amounts of solar and wind energy have come online in recent years.

Renewables accounted for 23% of US electricity generation in 2024, a figure that is expected to climb to 27% by 2026, according to the US Energy Information Administration's March short-term energy outlook. In contrast, coal's share of electricity generation was just 16% in 2024, a figure the agency expects to drop to 15% by 2026. When coal plants have to be cycled up and down to chase cheap renewables as the sun and winds shift rather than run at steady rates, they experience more wear and tear that reduces their reliability, Kroh said.

While producers are optimistic some underutilized coal plants could run harder or for a few years longer, the executives said the prospects for reopening coal plants or even loftier aspirations of building new coal-fired facilities remain dim.

Since the COVID-19 pandemic, the supply chain has been hit hard, the executives noted. For example, the firms that built steam turbine engines for coal-fired power plants have largely let go of the talent they had supporting those programs, Kroh said. Whelan noted that rail and barge infrastructure is also aging quickly.

"The whole fleet of railcars are very close to aging out; barges, same thing," Whelan said. "If the demand from AI is developed, then I think these problems are going to get fixed. If it doesn't, and we're still in this kind of slow-growth environment, then I think a lot of these infrastructure challenges are going to remain just because no one will be willing to invest in capital."

On the other hand, the Alliance and Robindale executives both said that access to capital, a persistent problem for the sector, is beginning to improve compared to years past. While many banks and insurance companies have distanced themselves from thermal coal producers, Whelan said the company's last bank deal, in the first quarter of 2024, was oversubscribed.

"That was very positive. It's critical because if the industry does not have access to capital, it goes away," Whelan said. "Thankfully, I think some major institutions have redirected their focus and are supporting our industry."