Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Mar, 2025

By John Wu and Cheska Lozano

Capital positions of some of China's biggest state-owned lenders are near regulatory minimums as the nation's annual economic policy conclave opens in Beijing this week.

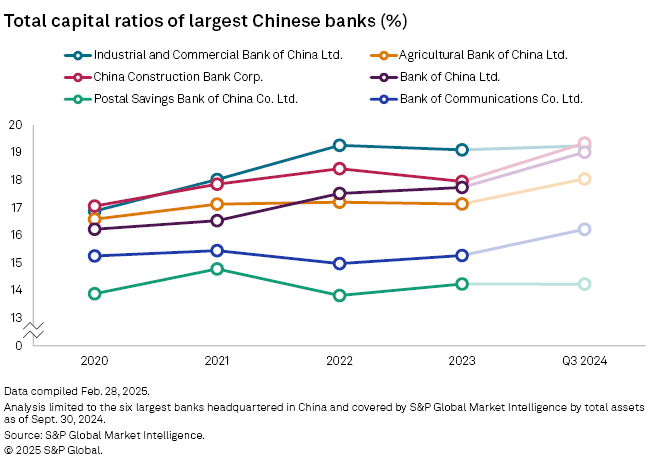

China's government is expected to announce details of capital injection into state-owned lenders at the weeklong annual National People's Congress, commonly known as Two Sessions, that started March 4. Li Yunze, head of China's National Financial Regulatory Administration, announced Sept. 24, 2024, that the country will increase the core Tier 1 capital of banks. Some media reports indicated that the government may inject 1 trillion Chinese yuan into the six biggest state-owned banks by assets, along with a GDP growth target of about 5% in 2025.

"Banks' recapitalization is likely to be front of mind for investors" after the Two Sessions conference and as lenders prepare to announce their 2024 results, Goldman Sachs analysts wrote in a report published Feb. 29.

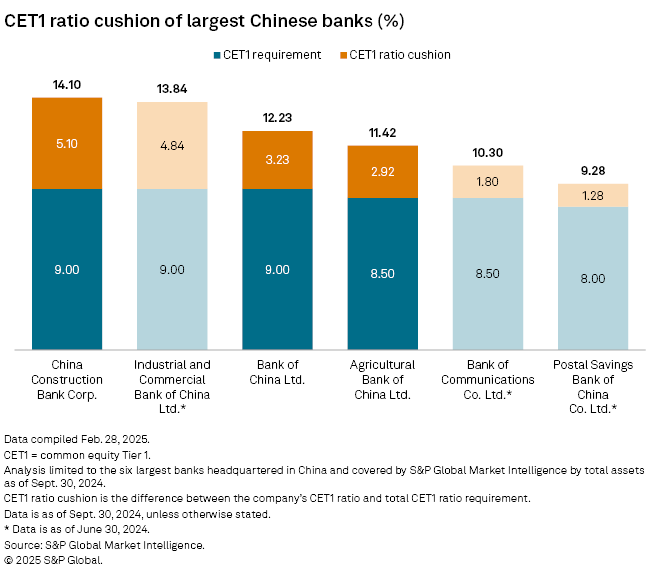

Postal Savings Bank of China Co. Ltd. had 1.28 percentage points of common equity Tier 1 (CET1) ratio above its regulatory requirement of 8%, as of June 30, 2024, followed by Bank of Communications Co. Ltd. with a 1.8 percentage point buffer, according to S&P Global Market Intelligence data.

China Construction Bank Corp. had the highest buffer, with its 5.10 percentage points of CET1 capital in excess of the regulatory requirement, as of Sept. 30, 2024. Industrial and Commercial Bank of China Ltd., the world's biggest lender by assets, had a buffer of 4.84 percentage points, as of June 30, 2024, according to the latest available data from the six biggest lenders by assets.

With a shot of capital for the state-owned banks, Goldman Sachs expects lenders' "capital positions to see sustained improvement, largely eliminating their capital shortfall and supporting dividends."

China is seeking to prop up its economic growth amid geopolitical tensions. US President Donald Trump announced a slew of tariff measures that could potentially disrupt global supply chains.

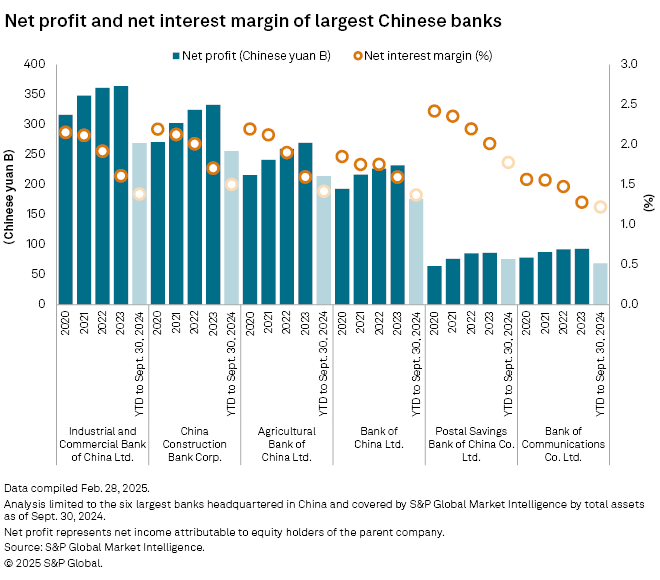

Chinese lenders are facing profitability pressure from decelerating loan growth and contracting net interest margins amid a prolonged downturn in the real estate market in the country. The world's second-largest economy expanded 5.0% in 2024 after a growth of 5.2% in 2023. For 2025, Nomura expects Beijing to keep its target of about 5.0% GDP growth.

As of March 4, US$1 was equivalent to 7.27 Chinese yuan.