Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

05 Mar, 2025

By RJ Dumaual

State-owned life insurers could infuse over a hundred billion yuan into China's equity markets if a government directive to invest 30% of new premiums into stocks is fully implemented, according to an S&P Global Market Intelligence analysis.

Authorities expect major state-owned insurers to invest 30% of newly added insurance premiums in yuan-denominated equities from 2025.

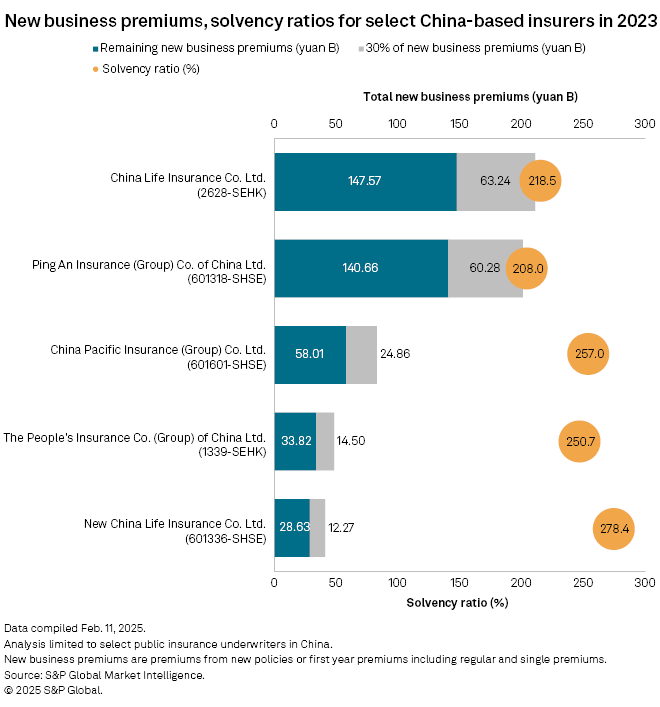

According to an analysis by S&P Global Market Intelligence of the companies' new business premiums in 2023, China Life Insurance Co. Ltd. would invest 63.24 billion yuan, China Pacific Insurance (Group) Co. Ltd. 24.86 billion yuan, The People's Insurance Co. (Group) of China Ltd. 14.50 billion yuan, and New China Life Insurance Co. Ltd. 12.27 billion yuan.

The solvency ratio of China Life stood at 218.5%, China Pacific Insurance at 257.0%, People's Insurance at 250.7%, and New China Life at 278.4%.

Based on static 2024 data, which includes aggregate premiums of 1.35 trillion yuan from five state-owned life insurers — China Life, China Pacific Insurance, New China Life, People's Insurance and China Taiping Insurance Group Ltd. — the estimated allocation of additional funds to yuan-denominated equities in 2025 is 404.1 billion yuan, Sun Ting, chief analyst for the nonbank financial sector at Jiangsu-based Soochow Securities, said in a report.

Aggregate equity assets in insurance funds increased to 4.1 trillion yuan in September 2024 from 3.5 trillion yuan at the end of 2023, with the proportion of total assets increasing to 13.2% from 12.8%, according to Sun.

As of the end of June 2024, the share of China Life's total assets invested in stock market securities increased by 4.3 percentage points to 7.7%. The proportion of stock assets for Ping An Insurance rose by 4.6 percentage points to 57.8%, China Pacific Insurance by 6.4 percentage points to 20.8%, New China Life by 7.0 percentage points to 12.5%, and People's Insurance by 5.3 percentage points to 40.5%, compared to the beginning of the year.

All five insurers did not respond to requests for comment from S&P Global Market Intelligence.

Market boost

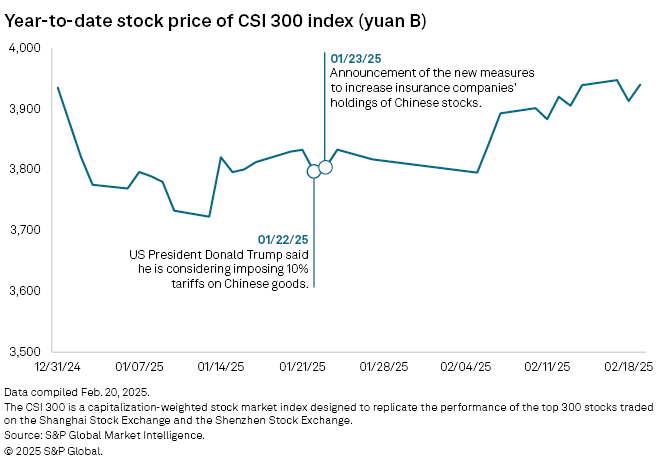

The Chinese government's directive appears to have boosted equity markets, with the CSI 300 index nearing the 4,000 mark recently. It reversed a dip in the index that came after US President Donald Trump said he was considering imposing tariffs on Chinese goods. The policy was announced one day after Trump's statement.

The CSI 300 is a capitalization-weighted stock market index designed to replicate the performance of the top 300 stocks traded on the Shanghai Stock Exchange and the Shenzhen Stock Exchange.

China's equity markets could receive an even bigger boost if private insurer Ping An Insurance (Group) Co. of China Ltd. steps up its stock investments alongside its state-owned counterparts.

"Life insurance investment is a long-cycle process," Ping An's company secretary, Ruisheng Sheng, said in a call to discuss third-quarter 2024 earnings. "Recently, the state launched a package of incremental plans, effectively boosting market confidence. We will continue to pay attention to the staging opportunities for stocks. Meanwhile, we will respond to the call and actively research and apply for the new tools, to provide more options in the future investment process and enhance the company's investment returns."

In 2023, 30% of Ping An Insurance's new business premiums amounted to 60.28 billion yuan, and its solvency ratio stood at 208.0%.