Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Mar, 2025

By Tyler Hammel and Annie Sabater

Aspen Insurance Holdings Ltd.'s potential initial public offering will serve as a litmus test for the resilience of both the specialty insurance sector and the wider IPO market.

Reports emerged in December 2024 that the Bermuda-based specialty insurer resumed plans to go public, amending its previously filings with the SEC for a listing on the New York Stock Exchange. Apollo Global Management Inc., Aspen's owner, filed the paperwork needed for the IPO in December 2023 but then decided not to proceed in late April 2024, intending to reassess the market in the fourth quarter or early in 2025, Insurance Insider US reported at the time.

Filings indicate the company may go public in early 2025 and market conditions may be right for such a move, according to Brian Schneider, a senior director for Fitch Ratings' North American insurance rating group.

"Apollo took the company private back in 2019 and ... has been eager to turn the company around, which they've been successful at over the last year," Schneider said in an interview with S&P Global Market Intelligence. "When Aspen was looking to go to market for their IPO they weren't getting the valuation they wanted, so I think Apollo was willing to wait a little bit longer to get a better result."

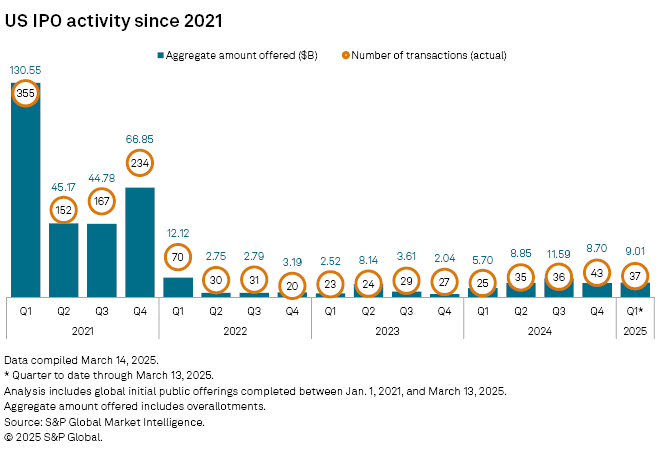

The decision to hold off on going public came amid a down period for US IPO activity, both in terms of frequency and the aggregate amounts offered, according to an analysis by S&P Global Market Intelligence. After 908 IPOs occurred in the US in 2021, that total dropped sharply to 155 in 2022 and has remained relatively low.

Specialty player

After several years under Apollo's care, Schneider said the two companies might feel that those market trends are better suited for specialty insurers, a sector that has received positive feedback from investors in recent years.

Aspen offers a variety of casualty and specialty insurance products, including insurance for credit and political risks, crisis management, natural resources and construction, and fine art.

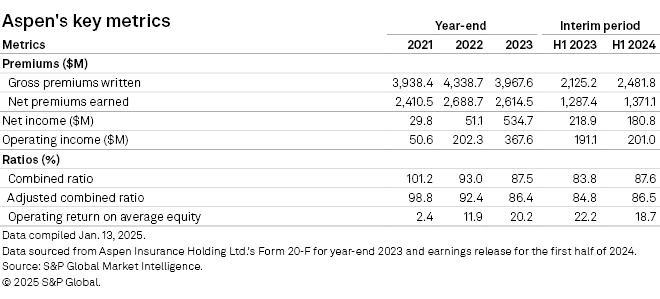

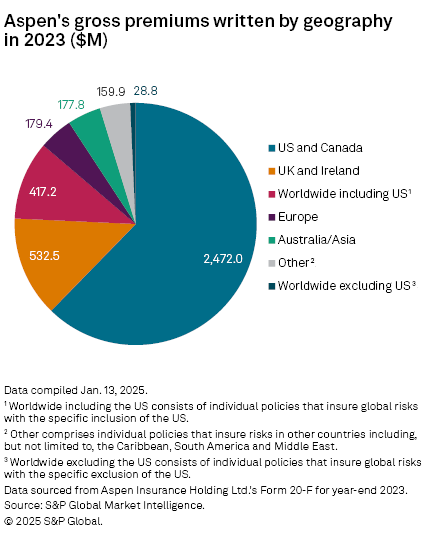

Aspen, which writes the majority of its premiums in the US and Canada, has seen some of its key metrics improve in recent years. Its combined ratio fell from 101.2% in 2021 to 87.6% in the first half of 2024, indicating higher profitability for the company.

"We've seen better valuations in the market for companies — particularly specialty type companies — that have access to good pieces of insurance business," Schneider said. "Those that have been able to take advantage of the hard market have been getting good price-to-book valuations in the market."

Apollo purchased Aspen in 2019 for $42.75 per share in cash, representing an equity value of about $2.6 billion. The deal came after months of discussion and after Aspen closed its US property insurance unit in Bermuda after posting an operating loss of $178.1 million for the fourth quarter of 2017. The company suffered heavy catastrophe losses that year, generally.

Aspen's poor results leading up to its acquisition by Apollo made them seek to go private, Schneider said, and now they have recovered after being shielded from the public view and turning around their results.

"Ultimately, given the longer history and the more high-profile nature of Aspen, they would feel more comfortable in the public market," Schneider said. "It's advantageous to be able to have that financial flexibility to access the equity markets on a go-forward basis for capital, versus being under Apollo."

Brokers dominate

While 2021 was a high point for insurance IPOs worldwide, US insurance IPOs have been relatively scarce since then.

Since 2021, there have been 13 insurance-related IPOs, nearly half of which involved insurance brokers. Only three went public for more than a billion US dollars.

Texas-based insurtech Ethos Technologies Inc. is also mulling going public this year, Bloomberg News reported, citing people with knowledge of the matter. Ethos operates as a third-party administrator that provides life insurance services.

Dual track

Given the recent stock market volatility related to the Trump administration's tariff policy, another path may exist for Aspen if they feel a stock market listing is too risky in the current environment.

Pursuing a dual-track strategy has become increasingly popular in recent years, whereby a company leverages a potential IPO to attract a buyer by showing viability on the public market, according to Matt Stevens, partner and M&A chair for Winston & Strawn.

"You have got to be big enough and meaty enough to be a real IPO candidate and so that that limits the playing field, but it sounds like [Aspen] is perfect to try to do both," Stevens said. "If it's a company that can credibly go through at least a bit of the underwriting process with investment banks, and get a little momentum on an IPO process, then it becomes a reality of being able to pitch a sale."

While a sale is never simple, Stevens said it can be more attractive than launching an IPO, which is lengthy and expensive.

Neither Aspen nor Apollo responded to requests for comment.