Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Mar, 2025

By John Wu and Beenish Bashir

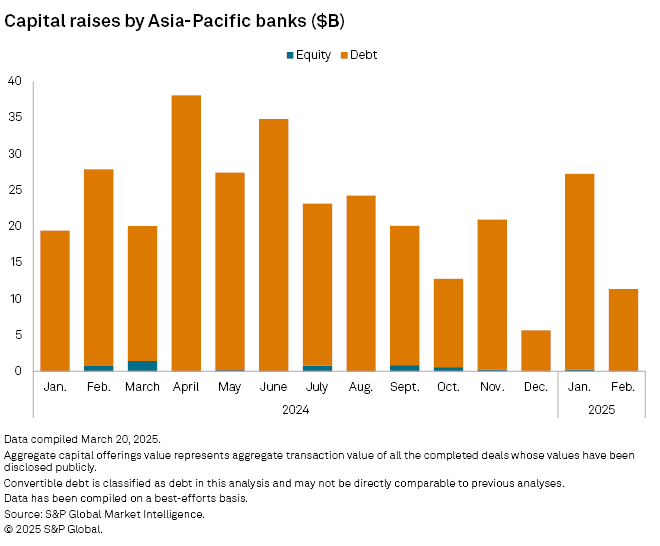

Banks in the Asia-Pacific region reduced capital raising in February amid uncertainty over global interest rates.

Lenders raised a total of US$11.32 billion through debt during the month, down 58.1% year over year, according to S&P Global Market Intelligence data compiled on a best-effort basis. The figure also marked the same 58.1% decline from January, when debt issuance hit a seven-month high.

"The drastic plunge in bank debt issuance [in Asia-Pacific] this February wasn't coincidental — it reflected deep-rooted anxiety driven by ongoing global inflation pressures and tense negotiation dynamics," said Steve Alain Lawrence, chief investment officer at Balfour Capital Group, in a March 25 email interview.

Several major banks in the region held back on debt issuance because "inflation remains stubbornly high, directly impacting borrowing costs and investor confidence," Lawrence said.

The broader caution stems from the US economic outlook and monetary policy, as the US Federal Reserve's rate decisions "directly ripple across global markets," Lawrence said, noting that Asia-Pacific banks are becoming increasingly cautious and are waiting for clearer signals from US policymakers.

On March 20, the Fed held its benchmark interest rate steady at 4.5% for a second consecutive meeting, citing slower growth and higher core inflation expectations for year-end. The People's Bank of China also kept rates unchanged the same day. In contrast, the Reserve Bank of Australia cut its benchmark rate by 25 basis points to 4.1% in February, its first move since November 2020.

Despite the slowdown, banks in the region are pursuing selective fundraising through targeted issuances and strategic deals, Lawrence said. Institutions in Singapore, Australia and India may be preparing to tap the market.

China Minsheng Banking Corp. Ltd. led February's regional debt issuance with a US$2.76 billion nonconvertible bond. Japan's Mizuho Financial Group Inc. followed with three deals totaling US$1.90 billion. United Overseas Bank Ltd. Sydney Branch's Australian unit raised US$1.28 billion denominated in Australian dollars, according to S&P Global Market Intelligence.

Five of the top 10 deals were completed by Japanese megabanks Mizuho Financial Group and Sumitomo Mitsui Financial Group Inc., while three came from Australian lenders, the data show.

Asian Development Bank, based in the Philippines, completed two Turkish lira-denominated deals totaling about US$736.5 million. PT Bank Negara Indonesia (Persero) Tbk raised US$860,000 through a debt issuance, according to the data.

Zero equity

Banks in the region raised no equity capital in February, the third time in four months with zero equity issuance.

The absence reflects caution amid ongoing credit market uncertainty, as lenders remain wary of potential contagion from missteps in an unpredictable financial environment, Lawrence said.

Still, the outlook for bank equity offerings appears more favorable in select markets, particularly Australia and China, he said.

As of March 26, US$1 was equivalent to 7.26 Chinese yuan.