Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 Mar, 2025

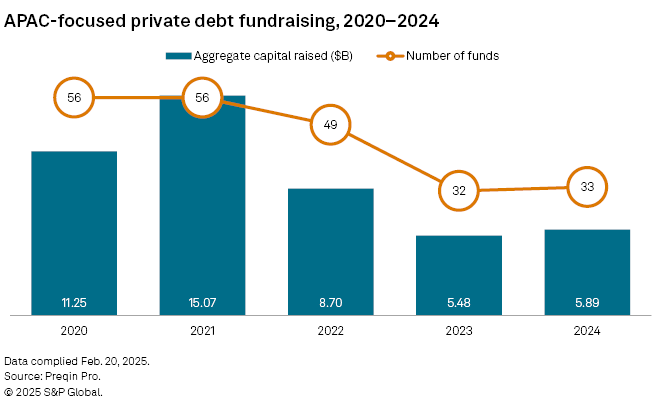

Asia-Pacific-focused private credit fundraising inched higher to $5.89 billion across 33 funds in 2024, slightly higher than the $5.48 billion raised from 32 funds in the prior year, according to Preqin Pro data.

The fundraising bucked the downtrend in Asia-focused private equity fundraising, which sank to a 12-year low in 2024.

So far in 2025, two Asia-Pacific-focused private credit funds have already raised $120 million, Preqin data showed.

Private credit in the region is seeing growing demand due to stricter bank regulations and limited funding sources, and investors are weighing the attractive risk-adjusted returns, according to Michel Lowy, CEO and co-founder of SC Lowy Financial (HK) Ltd.

The Hong Kong-based financial firm expects to see the biggest growth in Asian private credit in select countries and certain sectors.

"The real action is happening in markets like South Korea and India, where banking constraints make private credit an increasingly essential funding source," Lowy wrote in an email to S&P Global Market Intelligence. "We're seeing massive demand for private credit in industrials, infrastructure, and real estate-backed credit."

"In South Korea, regulatory changes and capital constraints have made it tougher for traditional lenders to provide financing, even for high-quality assets," Lowy wrote, adding that he expects the line between private equity and private credit to continue to blur. "The same trend is playing out in India and Indonesia, where businesses require more flexible funding than banks can offer."

Institute of International Finance Inc. Director Mary Frances Monroe believes that the implementation of Basel III — a global regulatory policy that will enforce higher capital requirements on banks and subsequently reduce lending activities — has also played a part in the rising popularity of private credit and alternative financing for Asia-Pacific companies as a means to finance businesses.

"Some of the smaller companies are not finding sufficient access to the credit markets so they're looking for alternatives to traditional bank financing," Monroe told Market Intelligence.

"Banks are facing the prospect of stricter capital rules under Basel III," Monroe said, adding that banks are already under intensive supervision.

Monroe expects more interconnections between private equity and private credit firms amid growing concerns among regulators regarding the risks of private market structures.

"There's a very good prospect for a lot of synergy between the private equity players and private credit players," Monroe said. "They can be creative with structuring and have more flexibility."

– Download a spreadsheet with data featured in this article.

– Read up on private capital inflows to the asset management sector.

– Learn about private equity investments in the consumer industries.

Singapore's SeaTown closes largest debt fund in 2024

The largest Asia-Pacific private debt fund closed in 2024 was the SeaTown Private Credit Fund II sponsored by Seatown Holdings International Pte. Ltd., Preqin data showed. The direct lending fund geographically focuses on Asia and closed in August 2024 with a fund size of $1.34 billion. Seatown Holdings is a subsidiary of Singapore-owned asset manager Temasek Holdings (Pvt.) Ltd.

The second-largest was India Special Assets Fund III (Onshore) sponsored by India-headquartered Edelweiss Alternative Asset Advisors Pte. Ltd., Edelweiss Financial Services Ltd.'s private equity arm. The special situations fund, which belongs to Edelweiss Financial Services Ltd.'s private equity arm, closed in January 2024 with $617 million and geographically focuses on India.