Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Feb, 2025

| The first phase of Arevon Energy's Eland solar-plus-storage project in California, above, came online in 2024. A second phase is planned for completion in 2025, part of a massive US pipeline of solar and battery projects. Source: Arevon Energy Inc. |

Going into the 2024 US general election, solar and battery storage executives voiced unwavering optimism that the nation's two most prolific new power sources — often paired as hybrid assets — would continue to thrive even under a second Trump administration and Republican-controlled Congress.

Kevin Smith, CEO of privately held solar and battery storage power plant developer Arevon Energy Inc., was among them, pointing to a massive influx of investment flowing into power plants, factories and thousands of associated jobs, largely in Republican strongholds.

But the fundamentally sunny outlooks of Smith and his clean energy peers are being put to the test by the abrupt change of political climate in Washington, DC, which is casting shadows over some solar and storage companies, even as others continue to shine.

"It appears that some of the executive orders may be a little bit more politically based than fundamentals-based, which is ... unnerving," Smith said in an interview. "But like I said [before the election], the job creation and the investment that's been going on and is expected in the future, that's going to be very, very difficult for Republican lawmakers to walk away from."

And yet, on his first day back in the White House, President Donald Trump unleashed a barrage of executive actions, partly aimed at dismantling what he has dubbed his predecessor's "new green scam," freezing billions of dollars in clean energy grants and loans under the 2022 Inflation Reduction Act and 2021 Infrastructure Investment and Jobs Act. Although two federal judges have subsequently restored the funds, some recipients have remained unable to access their awards amid ongoing legal uncertainties.

The president also promptly announced sweeping tariffs on imports from Canada, Mexico and China, compounding supply chain challenges for US solar and battery project developers still largely reliant on foreign components and materials. Congressional Republicans, meanwhile, are moving ahead with legislation that could include deep cuts in Inflation Reduction Act tax credits, worth roughly $800 billion to $1.2 trillion over 10 years, according to private and public sector estimates.

But US solar and battery suppliers remain largely unflappable, touting strong demand from US utilities and corporate customers, and overall favorable community support, regardless of political leanings.

"We're still very bullish, and we're bullish because it's a great story," Smith said.

"Solar projects, and solar plus battery storage, [are] very cost-competitive with natural gas and, in my view, [are] easier to implement," added the veteran of both the renewables and gas industries. "They create more jobs and more tax revenue in the communities where they're built."

Arevon is a large customer of Tesla Inc., whose CEO Elon Musk has emerged as a close Trump adviser. Tesla said in January that it expects at least 50% growth in energy storage deployments in 2025, fueled by utility-scale Megapack systems, such as those Arevon purchased for its more than $2 billion Eland solar-plus-storage power plant in Kern County, California.

One of the biggest solar-battery hybrids in the US, Eland combines 758 MWdc of solar with 300 MW/1,200 MWh of storage. The first phase of the project started commercial operation in late 2024, underpinned by a long-term contract with the Southern California Public Power Authority, on behalf of municipal utilities Los Angeles Department of Water and Power and Glendale Water & Power. The second phase is under construction, part of a long queue of solar and battery plants poised to provide a significant portion of America's growing appetite for electricity in the years ahead.

"There are literally thousands and thousands of projects in various stages of development," Smith said.

|

Tesla and Arevon workers at the Eland solar-storage project in California. |

'What Trump wants'

Scottsdale, Arizona-headquartered Arevon is expanding its presence eastward. It has deals with Meta Platforms Inc., Facebook's parent company, supporting solar farms in Indiana and Missouri, and projects under construction for the Indiana Municipal Power Agency and Northern Indiana Public Service Co. LLC, a utility subsidiary of NiSource Inc.

"There were no mandates in those states to build renewable," Smith said. "They chose those technologies, and we won bids because they were the least-cost option."

Arevon has been participating in a clean energy lobbying blitz to convince Congress to preserve the valuable Inflation Reduction Act tax credits. The effort, mobilized by the Solar Energy Industries Association (SEIA), includes over 2,000 companies making the case that Republican districts are the primary beneficiaries of hundreds of billions of dollars in private investment and hundreds of thousands of clean energy jobs.

"It's really hard to see lawmakers actually overturn the fundamental parts of the Inflation Reduction Act and turn that back against their own voters," said Smith. "It just would defy logic."

Solar and storage executives emphasize manufacturing, with solar and battery factories sprouting up across the South and Midwest.

"Basically, what Trump wants is local manufacturing, and we're [doing] that," said Badri Kothandaraman, president and CEO of California-based Enphase Energy Inc., which supplies solar and battery equipment for small-scale projects, increasingly from factories in Texas and South Carolina.

"If you don't provide incentives for manufacturing, no one is going to be able to make it here because the costs are quite high," Kothandaraman said.

The US solar industry has achieved nearly 50 GW of domestic panel production capacity, more than quintupling since former President Joe Biden signed the Inflation Reduction Act into law. Once ramped to full potential, that could be enough to cover near-term demand. Other links in the US solar and storage supply chains are also emerging, including factories for battery systems, solar trackers and power electronics, such as those supplied by Enphase.

Smith, Kothandaraman and other executives view the IRA's core investment tax credits for solar and energy storage as durable, citing a long track record of bipartisan support. But Congress could reduce tax credit timelines or change conditions, such as requiring certain levels of domestic content to qualify for base incentives, as some analysts have suggested could happen.

For projects already under construction, however, "you've essentially locked in the tax credit structure and the guidance that goes along with that," Smith said, effectively

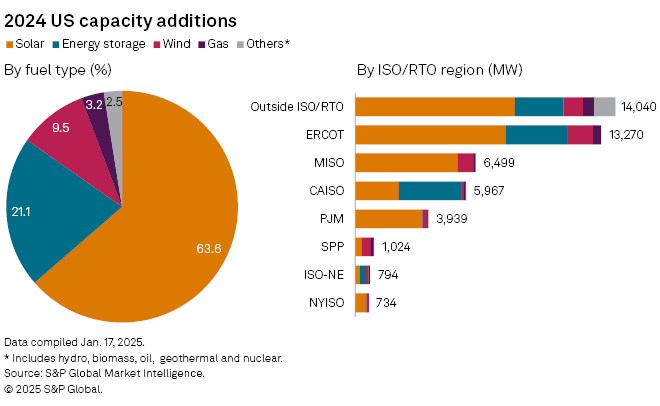

Based on developer input, the US Energy Information Administration expects renewables and battery additions — especially solar — will continue to drive the growth of the country's power generation over at least the next two years after accounting for more than 94% of large-scale capacity additions in 2024.

Tariffs, policy risks 'won't break solar economics'

Many of the companies involved in SEIA's lobbying effort are part of large enterprises with investments across the energy sector.

Among those calling on Congress to retain clean energy tax credits are US power generation giant AES Corp.; Lightsource BP Renewable Energy Investments Ltd., a subsidiary of British oil and gas major BP PLC; and RWE Clean Energy LLC, a US affiliate of German power supplier RWE AG. Others include French oil and gas supplier TotalEnergies SE and Georgia-based solar manufacturer Qcells, a unit of South Korea's Hanwha Solutions Corp.

The companies are positioning to meet surging demand for power, fueled by artificial intelligence, datacenters, new factories, and electrification of vehicles and buildings.

"Over the past two years, the five-year load growth forecast has increased almost 500%," SEIA said in a Feb. 5 letter to Congress, citing a new report from consulting firm Grid Strategies. "Increasing domestic energy production with solar and storage will be a key part in meeting this increasing demand, helping to improve grid reliability and lower consumer electricity prices."

But as discussions over potential tax credit reforms heat up, it remains unclear which clean energy tax credits could be on the chopping block and which might survive.

"I cannot predict any outcome, but I think we are fortifying the energy security of the country," said Kothandaraman.

Smith fears severe consequences if Congress cuts too deep.

"If all of a sudden you stopped those projects that are going to be coming online year on year, you don't just immediately turn the switch on and decide you're going to build a natural gas-fired project," the Arevon CEO said. "You would probably see significant shortages in power ... or reduced growth in areas."

Reduced tax credits and rising import tariffs would also push up electricity prices, Smith added. "If they repeal the tax credits, it's just higher prices for consumers."

But tariffs and policy uncertainty "won't break solar economics," Bank of America analysts said in a Feb. 10 report. "We believe utility-scale solar economics remain attractive across even the worst range of cost outcomes in play from a policy and tariff perspective."

Developers "will continue to execute on the massive utility-scale pipelines," they added, pointing to project permitting and interconnection bottlenecks as the bigger barriers.