Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Feb, 2025

By Hailey Ross and Noor Ul Ain Adeel

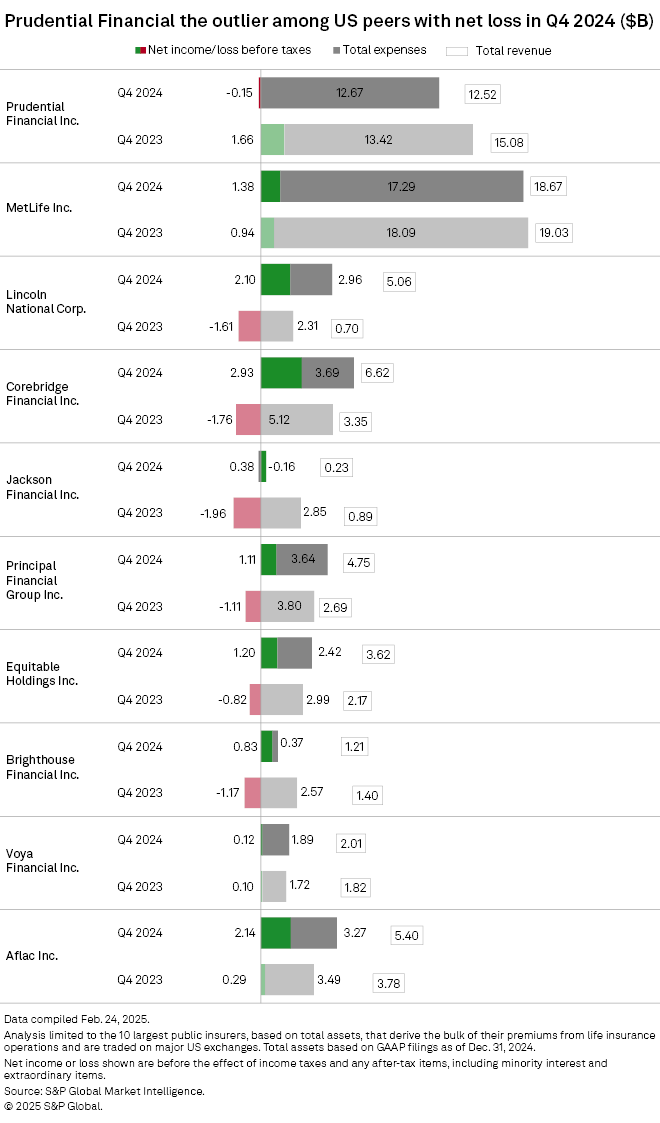

The 10 largest US life insurers fared well in the fourth quarter of 2024, with most reporting higher year-over-year revenues and only one reporting a net loss.

For six of the top 10 life insurers, revenue rose year over year in the fourth quarter. Eight of the top 10 saw fourth-quarter expenses decline year over year, with Jackson Financial Inc. seeing the sharpest drop of about $3 billion.

Prudential Financial Inc., the only life insurer in the group to report a net loss for the fourth quarter, noted in its earnings release that its roughly $150 million pretax net loss was driven by $1.53 billion of pretax net realized investment losses and related charges and adjustments in the quarter.

Fourth-quarter results also reflected a swing back to profitability from the preceding third quarter, a rough period for the industry when half of the largest US life insurers reported a net loss.

Revenue growth

Lincoln National Corp. saw the most drastic improvement in fourth-quarter year-over-year revenue, growing to $5.06 billion from $700 million in the prior-year period.

Lincoln executives put the company on a multiyear transformation plan after reporting a net loss of $1.6 billion before tax in the fourth quarter of 2023. Prior to that, the insurer had already been under investor scrutiny with a $2 billion reserve charge that it took in the third quarter of 2022, which was related to updated lapse assumptions in the company's guaranteed universal life block.

However, during Lincoln's fourth-quarter earnings call, CEO Ellen Cooper touted the insurer's advancement on its strategic growth plan, noting that the company reached a risk-based capital ratio of more than 430% at the end of 2024. The company also increased its registered index-linked annuity sales for both the quarter and full year and completed the first deal through its Bermuda-based reinsurance subsidiary LPINE, Lincoln executives said.

"Since embarking on our multiyear journey to transform Lincoln, we have demonstrated substantial progress as we evolve into an organization characterized by businesses, market segments and products with more stable cash flows and higher risk-adjusted return," Cooper said.

Meanwhile, MetLife, Inc. posted the highest overall revenue in the fourth quarter at $18.67 billion, a decrease from $19.03 billion in the year-ago period. During the fourth quarter, the life insurer also announced a partnership with General Atlantic Service Co. LP to form Chariot Reinsurance Ltd., which will be based in Bermuda.

The use of offshore reinsurance sidecars — vehicles designed to attract third-party capital to reinsure targeted liabilities — is expected to grow in 2025.

Globe Life Inc. used its fourth-quarter earnings call to reveal that it is also following its peers and is working to put together a Bermuda-based reinsurance platform that would operate as a subsidiary of the company.

Strong earnings

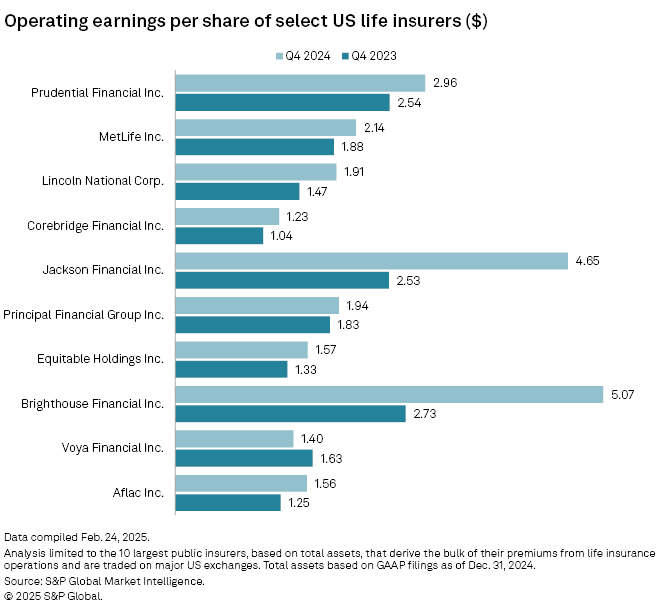

All but one of the 10 largest US life insurers reported stronger earnings year over year. Voya Financial Inc. was the lone insurer that saw its earnings decline, with an operating earnings per share of $1.40 in the fourth quarter, down from $1.63 in the year-ago period.

Voya executives used the company's fourth-quarter earnings call to share that it plans to be more active in pursuing M&A opportunities, with an emphasis on growing partnerships.

Brighthouse Financial Inc. booked an operating EPS of $5.07 for the quarter, making it the life insurer with the highest EPS out of the group.