Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Feb, 2025

By Karl Angelo Vidal and Joyce Guevarra

S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

The number of property foreclosure filings in the US dropped 7% year over year in January, according to real estate analytics provider Attom.

Foreclosure filings, which refer to default notices, scheduled auctions and bank repossessions, totaled 30,816 for the month.

Banks repossessed 2,973 properties through completed foreclosures in January, down 25% on an annual basis.

Among major US metropolitan statistical areas, Detroit recorded the largest number of completed foreclosures in January, at 164. Chicago and Riverside, California, followed with 148 and 141 completed foreclosures, respectively.

Lenders began the foreclosure process on 20,994 US properties in January, down 4% from a year earlier.

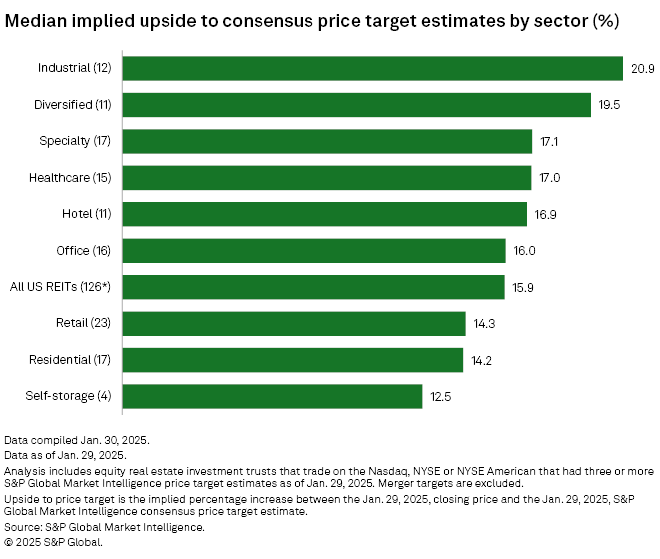

CHART OF THE WEEK: US REITs trade below consensus estimates

⮞ US equity real estate investment trusts traded at a median 15.9% discount to their consensus price target estimates as of Jan. 29.

⮞ The industrial sector traded at the largest median discount to its consensus price target estimate, at 20.9%.

⮞ Office-focused Vornado Realty Trust was the only REIT that traded above its consensus estimate at a 6.1% premium.

M&A

– Hyatt Hotels Corp. will acquire Playa Hotels & Resorts NV for US$13.50 a share, or about US$2.6 billion. Playa owns and operates resorts in Mexico, the Dominican Republic and Jamaica. Hyatt has beneficial ownership of 9.4% of Playa's outstanding shares.

– Blackstone Inc.'s Blackstone Real Estate Partners X LP platform completed the approximately US$4 billion privatization of Retail Opportunity Investments Corp.

TOP DEALS

– Tanger Inc. acquired the 640,000-square-foot grocery-anchored Pinecrest mixed-use center in Cleveland for approximately US$167 million.

– Quantum Pacific acquired the 26-story office building at 101 Greenwich St. in Manhattan, New York, from BentallGreenOak for more than US$100 million, Commercial Observer reported, citing unnamed sources.

– Millrose Properties Inc., which recently spun off from Lennar Corp., closed the acquisition of about 24,000 homesites from Rausch Coleman Homes for approximately US$900 million in cash. Millrose simultaneously executed option agreements with Lennar on all the homesites.

– Canadian Apartment Properties Real Estate Investment Trust finalized its 717-suite sale in Montreal for C$103.8 million and acquired two new rental apartment properties in Western Canada for a total purchase price of C$97.6 million. The REIT also completed two portfolio dispositions in Canada for combined proceeds of C$96.8 million.

US HOTEL PERFORMANCE

Key performance metrics of US hotels were down during the week ended Feb. 8, STR reported, citing data from CoStar, which provides information and analytics on property markets.

Revenue per available room (RevPAR) was down 2.7% year over year to US$87.22, and the average daily rate was 2.2% lower at US$156.03. Occupancy was 55.9%, down 0.5% from the comparable week in 2024.

Among the top 25 markets, New Orleans posted the biggest gains in the three key performance metrics.

Explore key people moves in North American real estate.

AEW Capital adds 5 new REITs to portfolio in Q4 2024, sells off 6 holdings

REIT Replay: US REIT stocks outperform broader market in 1st week of February

Top lenders cut CRE office exposure in 2024