Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Feb, 2025

UK motor finance lenders have set aside nearly £1 billion of new provisions ahead of a key Supreme Court ruling that looks increasingly likely to result in heavy costs for the industry.

In early April, the country's highest court is due to hear appeals

The ruling goes beyond the scope of an ongoing probe into legacy car loan commission arrangements run by the Financial Conduct Authority (FCA), which analysts estimate could result in a compensation scheme of up to £44 billion.

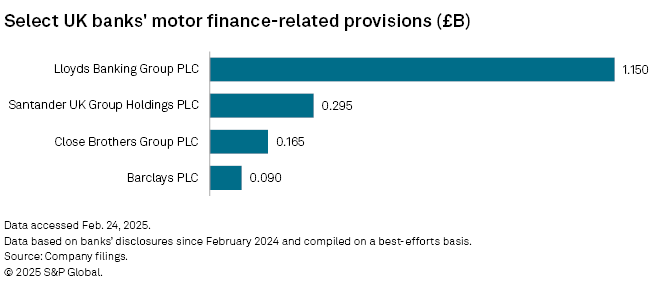

Lloyds Banking Group PLC, Close Brothers and Barclays PLC together set aside £955 million of new provisions for potential legal and remediation costs when reporting their latest earnings.

"The provisions reflect the banks' recognition of a materially higher likelihood of having to compensate customers," Fitch Ratings said in a Feb. 20 note.

High uncertainty

Lloyds, which owns the UK's largest motor finance lender, Black Horse Ltd., hiked car finance-linked provisions by a further £700 million to a total of £1.15 billion.

"The provision is built upon a number of key inputs, including the potential outcomes from the Supreme Court appeal, any subsequent FCA intervention and, depending on that, the potential remedy per case," group CFO William Chalmers said during a Feb. 20 earnings call. There is still significant uncertainty around all of these inputs, but Lloyds feels comfortable with its current provision level, Chalmers said.

Close Brothers Group PLC, the UK bank with the highest relative exposure to motor finance at roughly a fifth of its loan book, announced a £165 million provision in a preliminary earnings release Feb. 12.

Close Brothers had not previously taken any car finance-related provisions. Similar to Lloyds, the bank said it had considered a range of probability-weighted scenarios with multiple variables, changes that could lead to costs "materially higher or lower than the estimated provision."

Barclays, which has a smaller exposure linked to a legacy car loan unit, announced a £90 million provision in its latest report. Santander UK PLC kept its motor finance-linked provisions unchanged from £295 million booked in the third quarter of 2024. FirstRand Bank, which will report its 2024 earnings March 6, announced a £127.4 million provision in its motor finance business linked to the FCA review and another £12.7 million in fees linked to court cases.

The high uncertainty about the ultimate cost for lenders is a concern for the banks' outlook. "A prolonged look-back period and retroactive legislation, possibly across multiple lending segments, would raise the risk of more material redress processes and would weigh on banks' earnings and capital, and potentially on ratings," Fitch said.

Capital hit

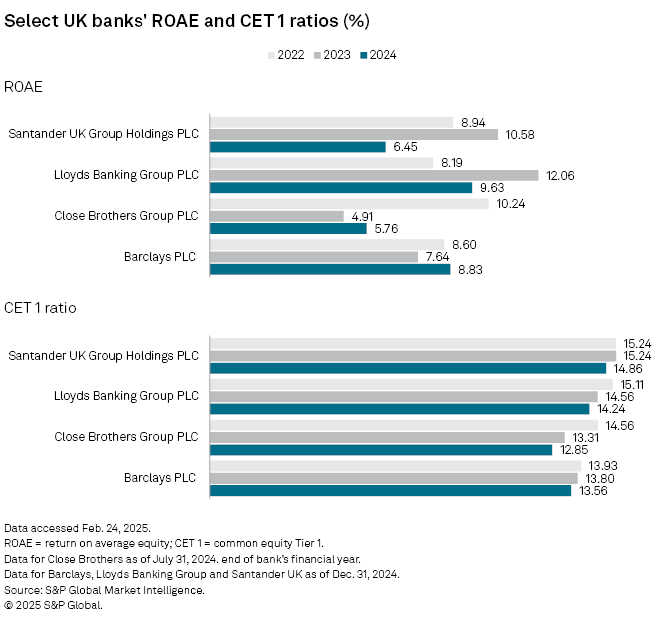

The motor finance provisions weighed on Lloyds' and Close Brothers' common equity Tier 1 (CET1) ratios. Lloyds posted a 29-basis-point hit to its ratio for full year 2024, which stood at 13.5%, while Close Brothers expects the extra provision to reduce its CET1 ratio for the six months of the financial year 2025 by 150 basis points to 12%.

Close Brothers had the weakest capitalization and profitability among major UK motor finance lenders in its latest financial year, Market Intelligence data shows. The bank, whose financial year ends in July, will release its full earnings report for the first six months on March 18.

Lloyds also said the motor finance provision hit its return on tangible equity (ROTE) for 2024, which stood at 12.3% but would have been 14% without the provision.

Santander UK said the £295 million motor finance provision taken out in the third quarter of 2024 accounted for 1.9 percentage points of the year-over-year decline in its ROTE for the full year. The bank's ROTE fell to 8.8% in 2024 from 14.4% in 2023.

Barclays CFO Anna Cross also cited the £90 million motor finance provision as one of the headwinds that prevented the group from boosting its full-year ROTE beyond 10.5% despite a busier fourth quarter of 2024.

Driving on

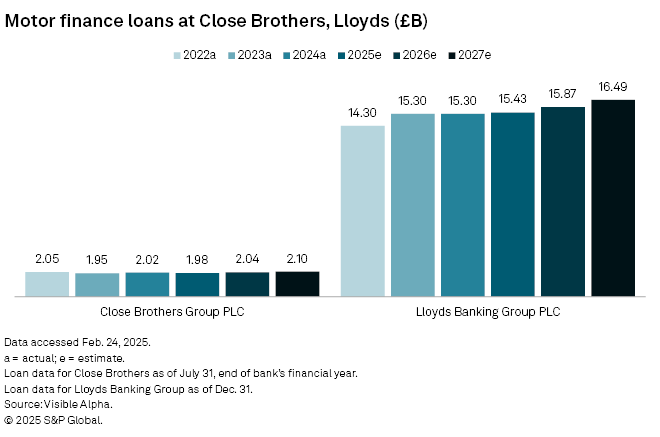

Despite the looming review, Lloyds' motor finance loan book is expected to grow over the next three years, while Close Brothers' car loan portfolio is set to remain broadly unchanged, Visible Alpha estimates data shows.

Lloyds' strong earnings capacity and capitalization would help the bank absorb further motor finance-related provisions, Morningstar DBRS said in a Feb. 21 note. Furthermore, the financial impact of any Supreme Court and FCA decisions will be spread over time, the rating agency said.

Analysts see bigger risks for Close Brothers. KBW analysts said the bank's provisions are hard to assess and noted management's warning of further potential legal and professional fees in the second half of its financial year, according to a Feb. 12 note carried by Dow Jones Newswires.

– Request access to Visible Alpha.

– Read the latest earnings transcripts for Lloyds and Barclays.