Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Feb, 2025

By Hailey Ross and Jason Woleben

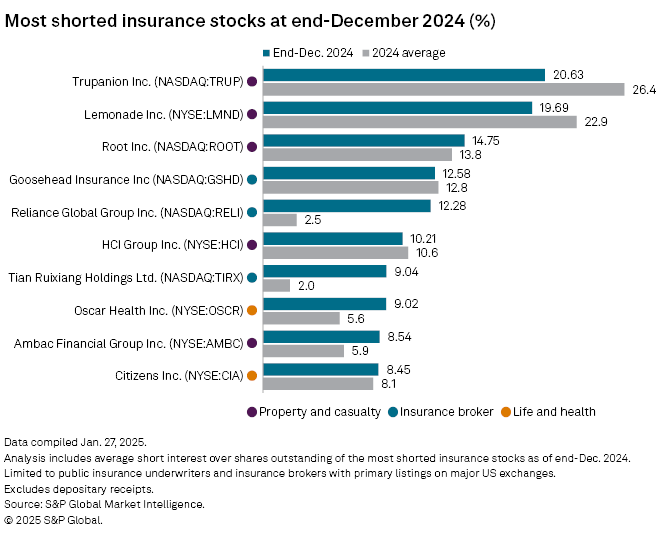

Pet insurer Trupanion Inc. had the highest average short interest among US insurance stocks in 2024, a ranking that it frequently held in 2023, according to an analysis by S&P Global Market Intelligence.

The Seattle-based insurer saw an average short interest of 26.4% in 2024 and ended the year at 20.6%. Trupanion experienced its highest short interest in 2024 in mid-February, at 31.8%.

However, Trupanion's stock performed well in 2024, hitting $48.20 a share as of the close of business Dec. 31, up from $30.51 on the last trading day of 2023. This represents an increase of roughly 58% over the course of 2024.

Newcomers to the 2024 list who were not among the most shorted insurers in 2023 include Oscar Health Inc., Ambac Financial Group Inc., Citizens Inc. and insurance broker Tian Ruixiang Holdings Ltd.

A short seller favorite

Among the analysts that cover Trupanion listed in S&P Capital IQ Pro's analyst coverage database, the majority have the pet insurer's stock rated as either "buy" or "outperform."

In a note, Piper Sandler analyst John Barnidge said that the insurer's fourth-quarter 2024 results indicated that revenue growth has been "slower than anticipated," but he added that there was a "meaningful level of improvement" in Trupanion's underwriting results.

"With Trupanion approaching rate adequacy and normalization of pricing expected as 2025 progresses, we believe the earning in of significant rate increases will drive meaningful growth in earnings that we find attractive at current valuation multiples," Barnidge said.

Trupanion's stock price has declined since the start of 2025, falling to $33.59 as of the close of business Feb. 27, down from $48.20 on Jan. 2.

Trupanion did not respond to a request for comment.

Short interest in insurtechs

Short sellers continued to place bets against insurance technology companies in 2024, a trend that carried over from 2023.

Lemonade Inc. and Root Inc. were the second- and third-most shorted insurance stocks in 2024, respectively.

Lemonade saw an average short interest of 22.9% in 2024 and as of the end of December held a short interest of 19.69%. Lemonade experienced its peak short interest for 2024 in mid-January at 24.32%.

Meanwhile, Root had an average short interest of 13.8% in 2024 and held a short interest of 14.75% as of the end of December. Root saw its 2024 short interest peak in mid-August at 18.62%.

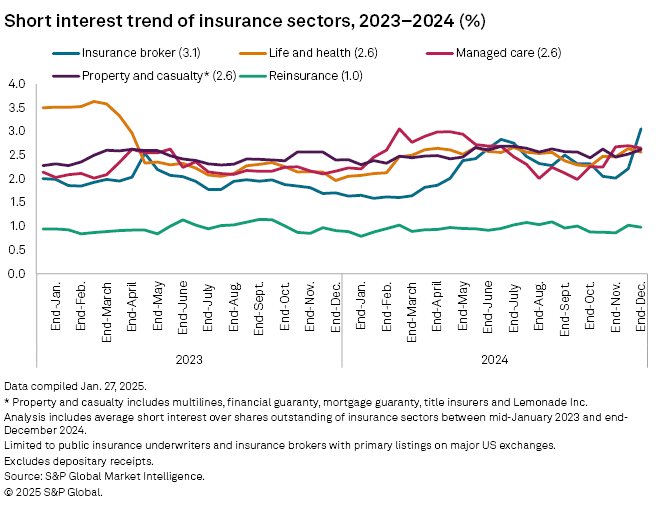

As of the end of December 2024, short interest in the life and health space booked the biggest decrease since the start of January 2023, falling 90 basis points to 2.6%. The sector had a short interest of 3.5% in mid-January of 2023.

Short interest in the insurance broker space grew the most year over year, rising 110 basis points to 3.1% over the same time period.