Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 Feb, 2025

| The Kansas City Chiefs and Philadelphia Eagles will face off in Super Bowl 2025. Source: Chris Graythen/Staff/Getty Images Sport via Getty Images. |

This year's Super Bowl battle between the Kansas City Chiefs and Philadelphia Eagles is aiming to break records on three fronts.

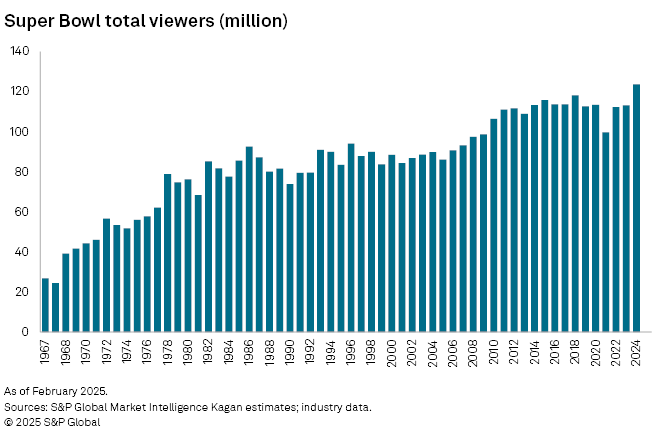

First, the NFL's Feb. 9 showdown from the Caesars Superdome in New Orleans could set a new audience record, boosted by its carriage on English-language linear networks, Spanish-language linear networks and digital platforms. The current record stands at 123.7 million viewers, set in 2024, with the Chiefs' overtime triumph over the San Francisco 49ers.

Second, with high viewership projected, Fox Corp. is looking to set a single-day ad revenue record. The company has seen strong advertiser interest and sold several 30-second spots for $8 million apiece.

Finally, on the field, the two-time defending champion Chiefs could become the first team in the Super Bowl era to three-peat. It would delight not only their fans but also Pat Riley, president of the NBA's Miami Heat, who trademarked "three-peat" before the 1988–89 NBA season. Riley, who coached the LA Lakers to successive titles, reached a deal with the Chiefs to use "three-peat" should the team make history.

Audience amelioration

Coverage of the Chiefs' 25-22 overtime triumph over the 49ers in Super Bowl 2024 was shared across CBS (US), Nickelodeon, Univision (US), streamers Paramount+ and ViX, and NFL digital platforms. Citing data from Nielsen Holdings PLC and Adobe Analytics, Paramount Global said the game was the most-watched telecast in history.

That delivery was up 7.4% from the 115.1 million average audience for Chiefs-Eagles in Super Bowl 2023, which aired on Fox (US), Fox Deportes (US) and digital outlets.

This year, Fox and FOX Deportes will be joined by Fox's free ad-supported TV (FAST) platform Tubi in covering the Super Bowl. Tubi will stream its first major live sporting event. Telemundo (US) will also televise the game in Spanish, with the contest further available via Fox and NFL digital outlets.

The audience for the NFL championship could also benefit from Nielsen's expansion of its out-of-home measurement system. With additional portable people meters now in play, Nielsen says it can approximate full TV household coverage across the nation.

The out-of-home viewing contingent in restaurants, bars and clubs is substantial. Super Bowl 2024's record audience included some 25 million out-of-home viewers, S&P Global Market Intelligence Kagan principal analyst Scott Robson said on a recent "MediaTalk" episode.

Ad ascension

With wide viewership comes strong advertiser interest. Fox took in some $650 million in gross Super Bowl ad revenue across various platforms with Chiefs-Eagles in 2023. In 2024, a Paramount Global source told S&P Global Market Intelligence the company would exceed that total as Super Bowl 2024 would rank as "the highest day."

In addition to spots running in the contest, units have been sold in the expansive pre- and post-game across FOX, FOX Deportes, Tubi, digital outlets and local TV stations. Fox is eyeing a new single-day ad revenue record that could push toward $700 million or more.

A Fox source said Fox Sports is "celebrating its most lucrative Super Bowl to date, with a double-digit number of spots selling for north of $8 million."

Fox sold 85% of its Super Bowl inventory during its upfront negotiations. Subsequently, brands that secured 10 Super Bowl spots in the upfront backed out, enabling the company to command higher prices for the spots.

All told, the average cost of a 30-second advertisement has jumped to over $7 million. This reflects an increase of at least 30% compared to the $5.5 million average rate five years ago, according to Kagan.

Although there will be fewer streaming, studio and auto ads, viewers will see messages from consumer product brands, restaurants and food and beverage marketers. AI and pharmaceutical companies also have in-game positions.

Investment in a Super Bowl ad delivers "an unmatched level of cultural impact, memorability and scale," said Jason Wiese, executive vice president of strategic insights and measurement at the Video Advertising Bureau.

Wiese said brands benefit from the Super Bowl's pronounced co-viewing environment "since ad recall significantly increases 23% when people are watching TV together on a big screen. This combines to make the Super Bowl an extremely valuable cross-platform marketing opportunity for brands to connect with a mass audience."

|

|

|

Spanish-language duo

Further boosting the game's potential reach is the fact that for the first time, there will be not one but two Spanish-language networks covering the Super Bowl in the US. FOX Deportes, presenting its fifth NFL championship game, has aired the three highest-rated Spanish-language cable telecasts in Super Bowl history. It will be joined this year by NBCUniversal Media LLC's broadcast network Telemundo. Both channels will provide their own production and announcing teams.

Angelina Losada, vice president of business development and growth initiatives at FOX Deportes, said the pair will "reach a greater Hispanic audience than ever before. It is part of a long-term strategy to accelerate the rapid NFL Hispanic fan growth and allow more fans to become hooked on Spanish-language coverage of the league."

In 2024, Univision aired its first Super Bowl in the US, drawing a record Spanish-language audience of 2.3 million for the NFL title tilt. This surpassed the 1.9 million who watched Super Bowl 2022 on Telemundo.

Losado said the biggest sporting event of the year in US sports is "an ideal opportunity" to unite generations within the Spanish or bilingual audience.

The national ad lineup, airing on Telemundo and FOX Deportes, will mirror what airs on FOX from the kickoff show through the presentation of the Lombardi Trophy, Losado said. Telemundo has been able to sell the locally available spots.

Losado said advertisers with in-game inventory can present the spot in Spanish.

"For advertisers, this Super Bowl represents a special opportunity due to the record Hispanic audience reach," Losado said, adding that both Spanish-language telecasts will stream on Tubi, which attracts younger viewers.

Tubi time

Fox Executive Chairman and CEO Lachlan Murdoch spoke about Tubi's role in the Fox game plan on the company's Feb. 4 earnings call.

"We have always unlocked our digital platform for the Super Bowl. But this year, it's a unique opportunity, and we're going to focus that audience on Tubi," Murdoch said, noting the simulstream would necessitate low incremental costs relative to technology, but "it's tiny compared to the opportunity in front of us."

Murdoch said the Super Bowl coverage will not only provide tremendous exposure for Tubi, but enable it to capture first-party data: "We'll be driving people to register on Tubi, many of them for the first time. And that first-party data obviously is really critically important to our programmatic and other advertisers and partners and will help us drive our [cost per mille] as we go into the future."

That future will also include Fox introducing an aggregate subscription streaming service later this year. The company long reserved its highest-profile sports content for its linear networks, but Murdoch said Feb. 4 that Fox's upcoming streaming service will include sports, news and entertainment fare.

Presumably, it will include Fox's coverage of Super Bowl 2029, the next time the company holds rights to the NFL championship. That year the NFL can also reopen its contract with current rights holders and look to extract additional rights around streaming. Fellow media NFL rights holders Paramount Global and NBCU have streamed the Super Bowl on their Paramount+ and Peacock streaming platforms.

Bets down

The American Gaming Association estimates that Americans will wager some $1.39 billion in legal sports betting on Super Bowl 2025. The projection represents an uptick from the estimated $1.25 billion for Super Bowl 2024, as per research from Eilers & Krejcik Gaming.

That still represents a small percentage of the total wagered on the big game when including all betting — legal or otherwise. Based on that methodology, the American Gaming Association estimated that the Chiefs-49ers battle in 2024 attracted $23.1 billion.