Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 Feb, 2025

By Tom Jacobs

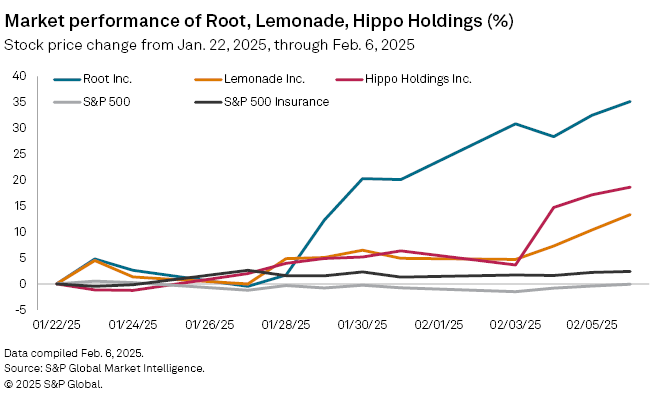

Root Inc.'s stock price has surged to an all-time high since the start of the 2024 fourth-quarter earnings season as the company and others in the property and casualty insurance segment brace for volatility, uncertainty and a more competitive market in 2025.

The Columbus, Ohio-based insurance technology company's stock value has risen 35.10% since Jan. 22 to $109.71 as of market close Feb. 6, the highest closing price ever for Root. Its previous high was $109.40 on Nov. 21, 2024.

Fellow insurtechs Hippo Holdings Inc. and Lemonade Inc. rose 18.62% and 13.35%, respectively, over the same period. The S&P 500 Insurance Index rose 2.41%, while the broader S&P 500 was down 0.05%.

Root is likely to post its second-straight profitable quarter when it reports earnings Feb. 26, though Keefe Bruyette and Woods analyst Tommy McJoynt said challenges facing the broader insurance market, such as a more competitive environment, could impact the company's performance down the road.

"You have an intensifying competitive environment as some of the larger national carriers that are reaching rate adequacy in more states are going to look to turn back on their growth engines," McJoynt said in an interview. "That just naturally means higher customer acquisition costs, more marketing expenses around clamoring for those policyholders to come onto their books. So it will be interesting to see how Root competes in that new environment."

Root declined to comment for this story.

McJoynt said retention will be one of the competitive elements investors will look at in Root's financial results.

The insurer's policies in force grew to 341,764 in 2023 from 220,354 in 2022 and reached 407,313 by the end of the third quarter of 2024. McJoynt said analysts and shareholders will be looking for numbers that indicate how many of the new customers are being retained.

"Did they just come for one term and now they're leaving Root, or are they actually buying into the Root product and potentially going to become customers for life?" McJoynt said. "That is drastically important as we think about the financial model and see if Root is able to retain the customers that they're spending on."

External influences

In addition to concerns about profitability and market presence, Root, like other auto insurers, faces uncertainties surrounding tariffs imposed by US President Donald Trump on Mexico, Canada and China.

The tariffs on goods from Mexico and Canada, which are on hold, and China could increase costs for auto replacement parts imported from those nations, such as vehicle bumpers, auto glass and airbags, according to an S&P Global Market Intelligence analysis.

The tariffs will affect auto sales and the price of repairs, said Insurtech Advisors analyst Kaenan Hertz. It will also affect Root and its partnership with online auto dealer Carvana Co., which has its auto insurance underwritten by Root.

"If the prices go up and fewer people are buying or trading in their cars, then [Root] will definitely have a slowdown in premium growth," Hertz said in an interview. "If they have a slowdown in premium growth and they don't have a slowdown in their expense base, they will end up in a challenging place where chances are they will no longer show profitability."

Root's share price surged to its Feb. 6 close of $109.71 from $7.35 on Feb. 7, 2024. Hertz said the challenge is that "any small dislocation, especially when your stock has run up so high, has the potential of just crashing down and burning."

"I do think that there's an inherent risk," Hertz said. "If they hit a troubling spot and show a quarter of an equally large loss, I think a lot of that steam is going to be let out of the engine."