Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Feb, 2025

By Dylan Thomas and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

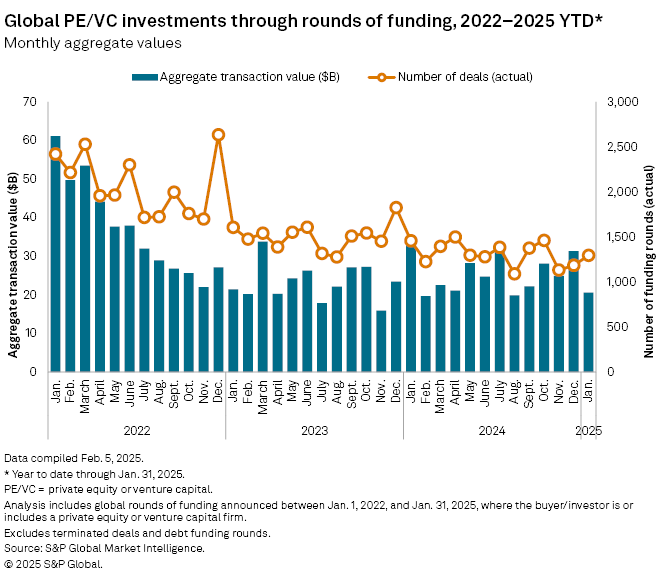

Private equity- and venture capital-backed deal value jumped 25% higher in 2024 after two down years. But the rebound appears to be losing steam.

The combined value of private equity-backed M&A and venture capital funding rounds totaled $35.28 billion globally in January, down nearly 30% from $50.33 billion in December 2024, according to S&P Global Market Intelligence data. The lackluster January results followed a fourth-quarter 2024 private equity and venture capital investment total of $147.18 billion, down about 18% from the third quarter of 2024.

On an earnings call earlier in February, KKR & Co. Inc. co-CEO Scott Nuttall attributed slower M&A activity in the back half of 2024 to the "distraction" of a US presidential election. Since then, there has been no shortage of developments for M&A markets, including the Trump administration's announcement of new tariffs and higher-than-expected US inflation data that is tempering expectations for interest rate cuts in 2025.

Nuttall maintained a positive outlook in his public comments. Uncertainty can slow M&A, but it can also open opportunities for private equity, the executive said.

"We are expecting there will be some volatility [in 2025], but we think that will make the investment environment even more interesting for us. And so, we remain optimistic," Nuttall said.

Read more about private equity-backed M&A and venture capital funding rounds in January.

CHART OF THE WEEK: Slow start for venture funding rounds

⮞ The value of private equity- and venture capital-backed funding rounds totaled $20.59 billion globally in January, declining 38% from $33.27 billion for the same month in 2024, according to Market Intelligence data.

⮞ Funding round value also declined on a monthly basis, falling 34% from $31.32 billion in December 2024, even though the number of funding rounds increased to 1,296 in January from 1,184.

⮞ The technology, media and telecommunications sector absorbed 34.8% of the capital deployed by private equity and venture capital firms via funding rounds in January, more than any other sector.

TOP DEALS AND FUNDRAISING

– Turn/River Management LP agreed to buy observability and IT management software company SolarWinds Corp. from shareholders, including Thoma Bravo LP and Silver Lake Technology Management LLC, for roughly $4.4 billion in an all-cash transaction. SolarWinds shareholders will receive $18.50 per share.

– Bain Capital Private Equity LP agreed to carve out Mitsubishi Tanabe Pharma Corp. from Mitsubishi Chemical Group Corp. in a deal that values the Japanese pharmaceutical business at roughly ¥510 billion. The deal is expected to close during the third quarter.

– Funds managed by Apollo Global Management Inc. affiliates purchased a majority stake in natural gas treatment solutions provider Bold Production Services LLC.

– Blackstone Life Sciences agreed to sell biotechnology company Anthos Therapeutics Inc. to Novartis AG for up to $3.1 billion. Novo Holdings A/S is also a seller in the deal.

– Funds managed by KKR & Co. Inc. agreed to sell lifting and securement provider Kito Crosby Ltd. to Columbus McKinnon Corp. for $2.7 billion in an all-cash transaction. As part of the deal, Clayton Dubilier & Rice LLC will invest in Columbus McKinnon.

– A group led by Cinven Ltd. will sell Kurt Geiger Ltd. to Steven Madden Ltd. in a cash deal valuing the London-based footwear, handbag and accessories brand at about £289 million.

– Portfolio Advisors LLC raised $622 million in total commitments for PA Co-Investment Fund V LP at final close. The vehicle seeks to partner with private equity sponsors to invest in US midmarket companies undergoing buyout or growth equity transactions.

– Ulu Ventures Management Co. LLC raised $208 million for Fund IV. The seed-stage venture capital firm focuses on IT and internet companies.

– IMB Partners raised $125.5 million in total committed capital at the final close of its first investment fund. The IMB Partners SBIC I LP fund will invest in lower-middle-market companies in the utility and government contracting sectors.

– Morphosis Capital secured more than €100 million for its second investment fund. Morphosis Capital Fund II seeks to make nine to 10 investments in small and medium enterprises in Romania and nearby countries.

MIDDLE-MARKET HIGHLIGHTS

– Gemspring Capital LLC made a strategic investment in jobsite security and workforce management solutions provider Sitemetric LLC.

– Emerald Lake Capital Management LP sold Inno-Pak, a takeout food packaging supplier, to Handgards LLC. Handgards is a portfolio company of Wynnchurch Capital LP.

– McNally Capital LLC invested in filtration equipment and automation solutions provider Jewett Automation.

– Tiger Infrastructure Partners LP made a growth investment in tire recycling company Bolder Industries Inc.

FOCUS ON: CARLYLE'S PRIVATE EQUITY OUTLOOK

Private equity giant The Carlyle Group Inc. anticipates more private equity deals in 2025 as indicators surrounding economic growth and employment remain high, CEO Harvey Schwartz said during the firm's fourth-quarter 2024 earnings call.

So far in 2025, Carlyle has invested in a handful of private equity transactions, including a roughly €800 million strategic investment in Dutch online solutions provider Your.World BV.

Carlyle also expects a strong year of fundraising in 2025 and anticipates launching a US buyout fund in the latter part of the year.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter