Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Feb, 2025

The significant upswing in global private equity and venture capital investments in the consumer sector seen in 2024 is continuing into this year, buoyed by rising economic confidence.

Sector dynamics, including rapid shifts in consumer preferences, a crowded competitive field, economic cycle sensitivity, and supply chain management issues, can make it difficult to acquire a stake in a consumer business.

Investors now see opportunities to analyze and modify the portfolio of consumer brands or products to align with market trends, mitigate risk and drive growth, Mike Ross, PwC US consumer markets deals leader, told Market Intelligence in an interview.

"[Consumer] will continue to be a sector where there are distressed M&A opportunities and, on the flip side, consolidation opportunities," Ross said.

Continued interest expected

Ross added that corporate carve-outs of specific consumer units are attracting private equity.

"We could potentially see club deals by private equity or deals where corporate parents go through the divestment process, but potentially keep stakes in some of these companies as they partner with private equity."

Soaring investment

The sector's deal value increased by 45.8% year on year to $81.4 billion in 2024. Of this total, consumer discretionary, or nonessential consumer goods and services, accounted for $69.58 billion, up 52.6% from 2023. Consumer staples' deal value increased slightly to $11.82 billion from $10.22 billion. The increases were driven by rising confidence in the economy and stabilizing interest rates.

A total 136 consumer sector deals worth a combined $720 million were inked in January, according to S&P Global Market Intelligence data, pointing to ongoing momentum.

– Download a spreadsheet with data featured in this article.

– Read up on private equity flows to biotechnology.

– Learn about private equity investments in India's healthcare sector.

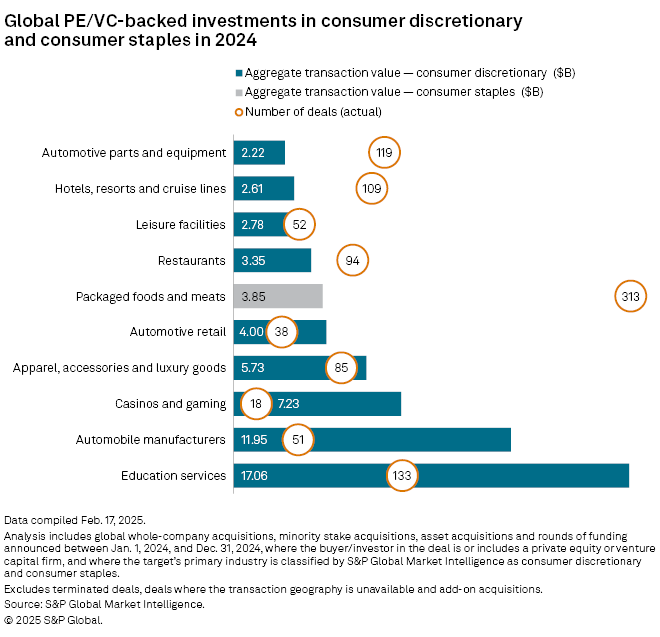

Within the consumer discretionary sector, the education services segment pulled in the most capital in 2024 at over $17 billion across 133 deals. Automobile manufacturers were the second-most sought-after businesses, drawing in nearly $12 billion across 51 deals.

Packaged foods, the only consumer staple industry in the top 10, ranked fifth in terms of deal value, but topped the transactions count with 313.

Private equity managers see opportunities in hospitality and hotel groups, which focus on experiences and partnerships while maintaining asset-light strategies, Ross said.

The largest private equity-backed consumer deal in 2024 was Canada Pension Plan Investment Board, EQT Private Capital Asia and Neuberger's $14.5 billion acquisition of London-headquartered school chain operator Nord Anglia Education Ltd. The megadeal accounts for most of the private equity-backed deal value in the education services industry for the year.

The second-largest transaction was the $5.6 billion series C round for Google's self-driving carmaker Waymo LLC by an investor group including Silver Lake Technology Management LLC and Andreessen Horowitz LLC. Waymo will use the proceeds to support its robo-taxi business, among other developments.

The largest private equity deal in consumer staples was Butterfly Enterprises, LLC's $1.97 billion buyout of US wine distributor The Duckhorn Portfolio Inc.