Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Feb, 2025

Private equity investment in asset management soared to a three-year high in 2024 as deals targeting wealth managers combined with strategic acquisitions to drive transaction activity.

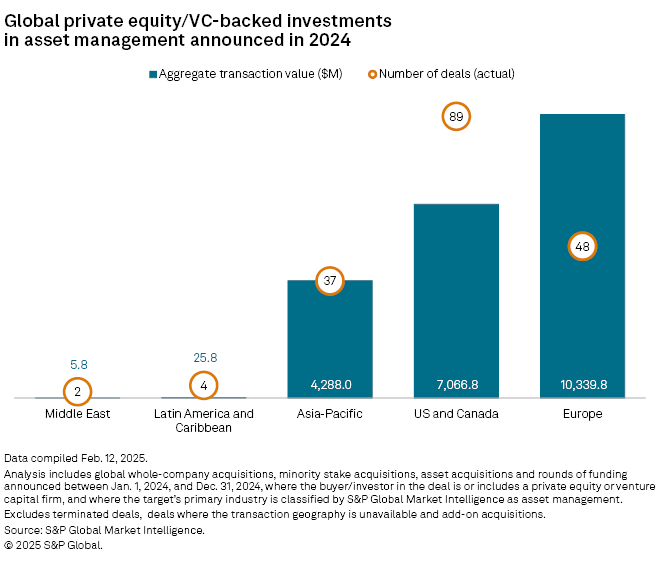

Private equity and venture capital firms invested $20.29 billion in asset management deals globally in 2024, an 89% increase over the prior-year total of $10.78 billion, according to S&P Global Market Intelligence data. It was the highest annual total recorded since private equity firms invested $22.01 billion in asset management deals in 2021.

The uptick was driven in part by private equity's ongoing consolidation of the fragmented wealth management industry. However, not all deals fit into private equity’s game plan of buy, build and sell.

Strategic acquisitions of asset managers by private equity firms seeking to expand their slate of investment strategies and quickly grow their roster of investors also play a role, according to Kellie Bobo, partner in the investment management and M&A practice groups of law firm Haynes Boone.

"If their goal is to grow, there's only so much internal growth that you can continue to do. It's an easy way, just like with any other sort of strategic M&A, to grow through acquisition," Bobo said in an interview.

Expanding their reach

Diversifying investment strategy and investor base are often key motivating factors behind the strategic acquisitions of asset managers, Bobo said.

"You're able to grow your AUM [assets under management] strategically and in different asset classes in different geographies ... that the private equity sponsors hadn't already had exposure to," she said.

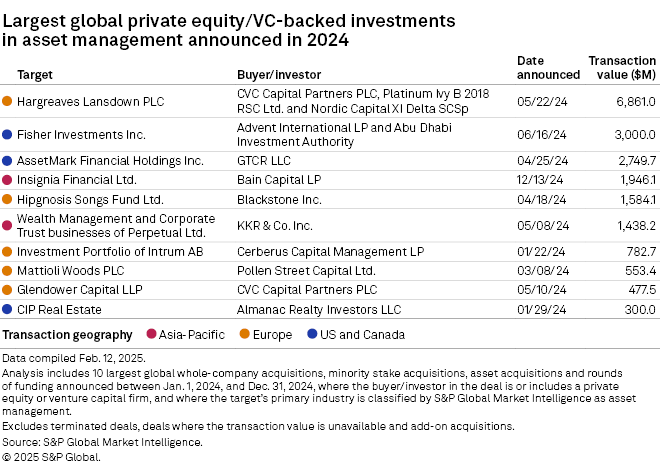

Ranking among the 10 largest PE investments in the asset management industry last year was CVC Capital Partners PLC’s acquisition of the final 20% share in Glendower Capital LLC. CVC, a private equity and venture capital firm with $207 billion in assets under management, gained full control of the private equity secondaries investor, later rebranding the firm CVC Secondary Partners PLC.

– Read about global private equity entries in January.

– Catch up on private equity investment in biotechnology.

CVC built out its infrastructure investing platform much the same way, providing a commitment to acquire DIF Capital Partners in 2023. In 2024, CVC completed the acquisition of an initial 60% stake in DIF, which was rebranded CVC DIF. CVC is set to acquire an additional 20% of the business shortly after Dec. 31, 2026, and the final 20% shortly after Dec. 31, 2028.

"The addition of these two platforms is pivotal to our strategy, enhancing our capabilities and expanding our reach," CVC CEO Rob Lucas said in a statement last year.

Targeting wealth managers

Still, a larger share of the top private equity deals in the asset management industry reflects a different trend: private equity's ongoing consolidation of the wealth management industry.

Private equity-backed investments powered a record year of wealth management M&A in the US in 2024, investment bank Echelon Partners LLC reported. Private equity firms completed 50 direct investments in US wealth managers, setting the table for more private equity-backed M&A and tuck-in acquisitions in 2025 and beyond, according to the investment bank.

Consultant DeVoe & Co. reported deals targeting US registered investment advisers (RIAs) surged in 2024 as falling interest rates brought down the cost of deal financing. DeVoe estimated PE firms were involved in 78% of RIA transactions in the US in the fourth quarter of 2024, either as direct investors or as the backers of serial acquirers within the industry.

Largest deals

In 2024's largest private equity-backed transaction in the asset management industry, an investor group that includes CVC agreed to buy private investor platform Hargreaves Lansdown PLC for $6.86 billion.

Europe secured the largest amount of private equity-backed funding in 2024 at around $10.34 billion, driven by the Hargreaves Lansdown deal. The US and Canada recorded the highest number of deals, totaling 89.

Outlook

Private equity investments in asset management are expected to further increase in 2025, driven by the aim of democratizing access to private markets. Global wealth held by individuals who qualify to invest in alternative assets has been estimated at $75 trillion to $85 trillion.

Additionally, given the amount of dry powder, limited partners want to see their capital put to use, Bobo of Haynes Boone said.

Dry powder totaled $2.49 trillion as of February, down from $2.55 trillion in December 2024, according to Market Intelligence data.