Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 Feb, 2025

By Dylan Thomas and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Private debt funds flexed their muscles in 2024, financing their largest share of private equity-backed leveraged buyouts in at least a decade.

The funds financed 77% of leveraged buyouts (LBOs) globally in 2024, according to an S&P Global Market Intelligence analysis of Preqin data. Banks financed the remaining 23% of LBOs, their lowest share of LBOs by volume since at least 2015.

Lending to private equity is private debt's primary business, and private debt funds have long controlled a larger share of the market for LBO financing. But a combination of factors shifted the balance even more in favor of the funds, including regulatory pressure on banks and private debt funds' speed advantage over traditional lenders when it comes to servicing deals.

The trend appears to have gained momentum in early 2025. Private debt funds financed 83% of the 53 LBOs announced globally between Jan. 1 and Jan. 22.

Read more about private debt's share of leveraged buyout financing rising to its highest level in a decade.

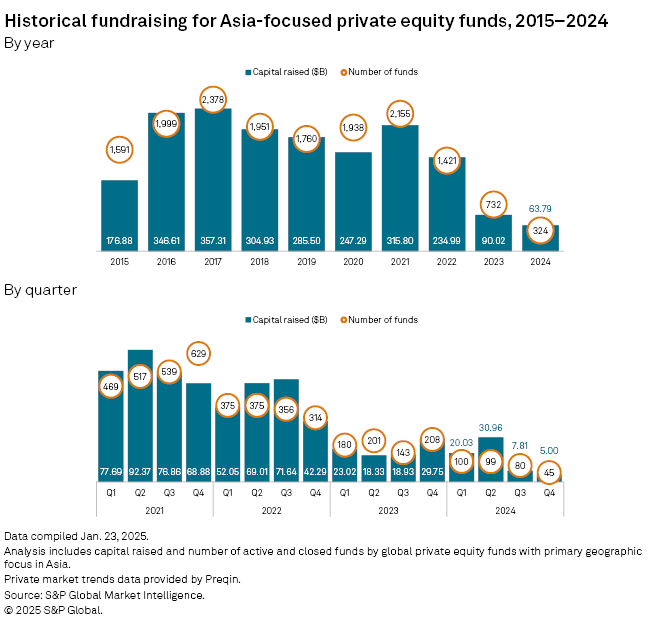

CHART OF THE WEEK: 12-year low for Asia-focused fundraising

⮞ Fundraising for Asia-focused private equity and venture capital funds dropped to a 12-year low in 2024, according to Market Intelligence data.

⮞ The $63.79 billion raised in 2024 by private equity and venture capital funds targeting Asia represented a 29% decline from the prior-year total.

⮞ US restrictions on some technology investment in China and a difficult exit environment factored into the decline, Siew Kam Boon, head of private equity practice in Asia-Pacific at Hogan Lovells, told Market Intelligence.

TOP DEALS AND FUNDRAISING

– Warburg Pincus LLC and Berkshire Partners LLC agreed to acquire aerospace and defense spare parts company Triumph Group Inc. at an enterprise value of about $3 billion. The buyers will pay Triumph shareholders $26 per share in cash, representing an about 123% premium over the company's unaffected closing stock price on Oct. 9, 2024.

– TPG Capital LP, through the TPG Rise Climate Transition Infrastructure strategy, agreed to buy Altus Power Inc. in an all-cash transaction valuing the solar energy company at about $2.2 billion, including outstanding debt. TPG will pay Altus shareholders $5 per class A common share in cash, representing a 66% premium to Altus' unaffected closing stock price on Oct. 15, 2024.

– Berkshire Partners made a significant growth investment in environmental services provider Triumvirate Environmental Inc., valuing the company at $1.8 billion.

– Bain Capital LP agreed to buy an about 51% stake in engineered plastic processing equipment and services company Milacron LLC from Hillenbrand Inc. for $287 million.

– Cherry Ventures Management GmbH raised a total of $500 million across two funds. The capital will be split between the firm's flagship early-stage fund and an opportunity fund focused on series B and later rounds of funding.

– Newly formed private equity firm Northcote Equity raised £160 million at the first and final close of its inaugural fund. Northcote Fund I will invest in technology and service companies in the UK and Ireland.

MIDDLE-MARKET HIGHLIGHTS

– BV Investment Partners LP agreed to sell Workday deployment services provider TopBloc LLC to ASGN Inc.

– An H.I.G. Capital LLC affiliate agreed to invest in German machine-tool maker Heller.

Private equity giants Blackstone Inc. and KKR & Co. Inc. are expecting more active M&A in 2025 despite the uncertainty surrounding the policies of the new US administration, according to the companies' fourth-quarter 2024 earnings calls.

Blackstone President Jonathan Gray said during the firm's earnings call that buoyant public markets and M&A momentum are clearing a path for more private equity exits in 2025.

Gray noted that private equity activity is "definitely going to be stronger" amid a widening window for IPOs and increased interest in deals from corporate strategic buyers.

The private equity dealmaking momentum of 2024 will likely continue in 2025, and fundraising is expected to pick up, KKR co-CEO Scott Nuttall said during the firm's earnings call.

However, Nuttall noted that the "distraction" of the US election in the second half of 2024 temporarily slowed deal activity and the background noise will likely grow louder in 2025.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter