Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Feb, 2025

Almost every publicly traded US equity real estate investment trust is trading at levels significantly lower than consensus price target estimates.

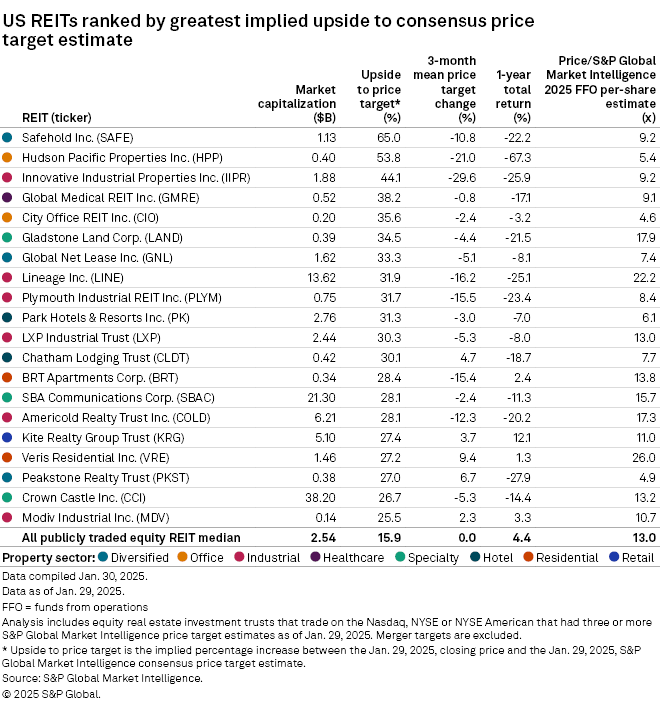

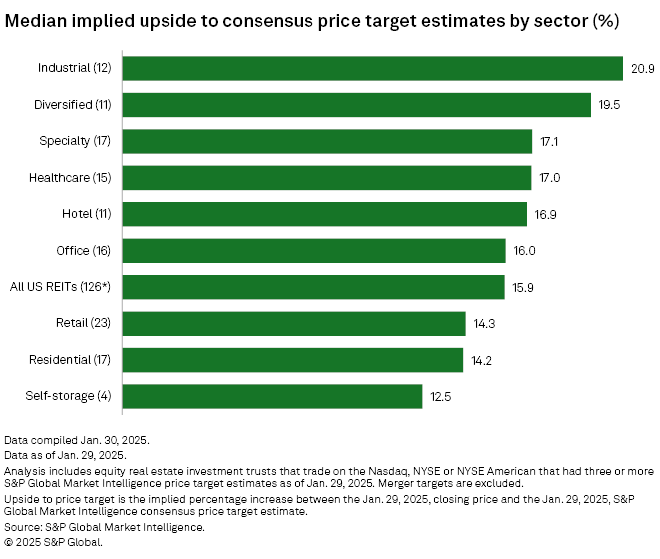

US equity REITs traded at a median 15.9% implied upside to their consensus S&P Global Market Intelligence price target estimates as of Jan. 29. Of the 126 companies with at least three price target estimates, only one REIT traded above its consensus estimate: office-focused Vornado Realty Trust

Vorando Realty Trust finished the Jan. 29 trading session at $40.74 per share, a 6.1% implied downside to its price target of $38.35. The office landlord posted a one-year total return of 42.1% as of Jan. 29, more than 9x higher than the entire REIT industry's median return of 4.4%.

Industrial discounts

The industrial sector traded at the largest median implied upside to its consensus price target estimate at 20.9%. Within the industrial segment, Innovative Industrial Properties Inc. had the greatest implied upside at 44.1%. The cannabis-oriented REIT traded at the third-largest discount to its price target across all US REITs. Lineage Inc. had an implied upside of 31.9%, putting it eighth in the overall top REIT implied upside rankings.

Four other industrial-focused companies were among the top 20 REITs with the greatest implied upside: Plymouth Industrial REIT Inc. at 31.7%, LXP Industrial Trust at 30.3%, Americold Realty Trust Inc. at 28.1% and Modiv Industrial Inc. at 25.5%.

The diversified segment traded at a 19.5% discount, while the specialty and healthcare sectors were close behind at 17.1% and 17.0%, respectively.

– Set email alerts for future Data Dispatch articles.

– For further capital offerings research, try the REIT Consensus Estimates Model template.

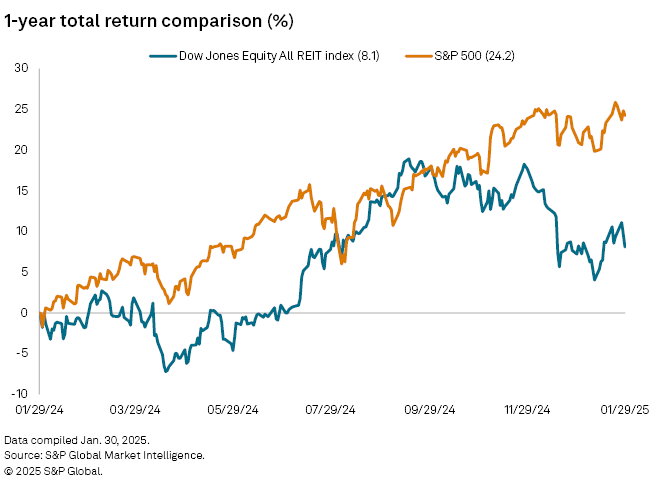

US REITs generally underperformed the broader market over the past year. The Dow Jones Equity All REIT index reported a one-year total return of 8.1% as of Jan. 29, lower than the S&P 500's return of 24.2% over the same time period.

Safehold, Hudson Pacific with most room to run

Ground lease-oriented Safehold Inc. topped the list of REITs with the greatest implied upside to its price target estimate. It closed at $15.76 per share Jan. 29, barely more than half of its consensus price target estimate of $26. Landing in the second spot was office-focused Hudson Pacific Properties Inc., with its consensus target 53.8% above its share price as of Jan. 29.