Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Feb, 2025

| Rising electricity demand from datacenters is giving hope to coal producers who see a brighter future for the fossil fuel. Source: Alan J. Nash. |

Advancements in some of the hottest new technologies might boost the prospects for one of the world's oldest sources of electricity.

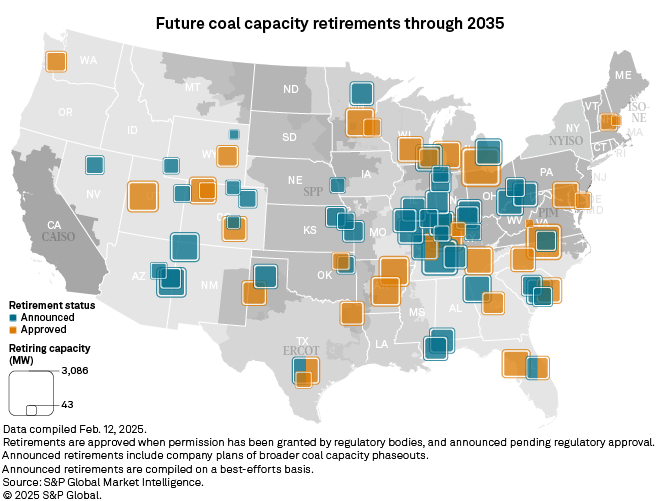

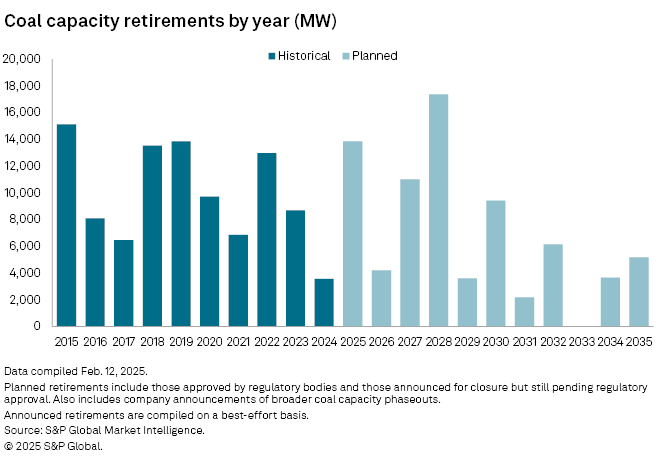

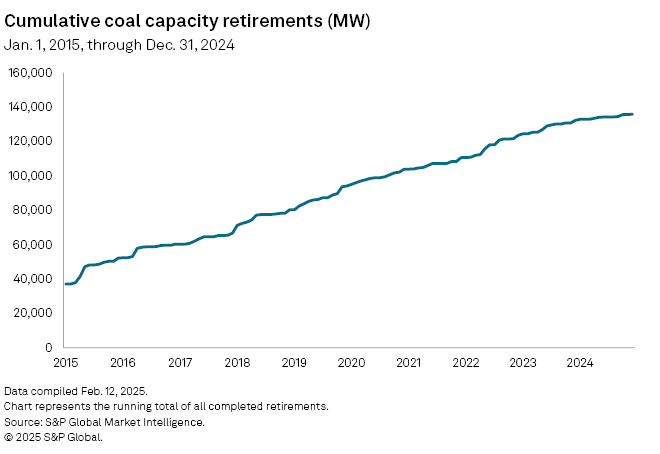

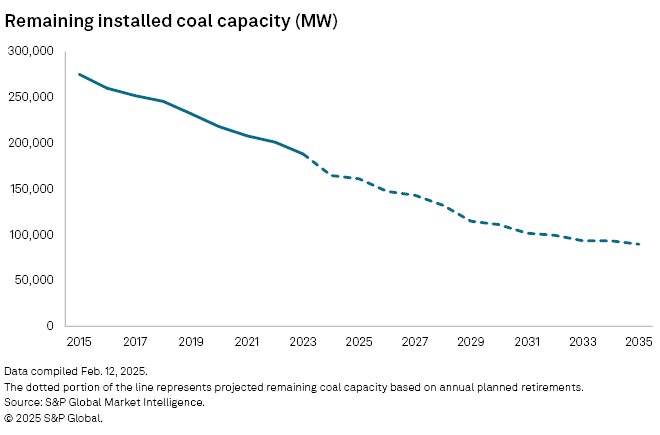

Coal company executives see the rise in electricity demand from the datacenters used for AI and cryptocurrency driving a return to coal as a cheap and reliable fuel source, particularly given signs of support from the Trump administration. While US power producers will retire nearly four times as much coal capacity in 2025 as they did in 2024, the 13.9 GW booked for retirement this year is about 16.2% lower than what was estimated in December 2023 as power producers push retirements into the future, according to an S&P Global Market Intelligence data analysis.

"To the extent coal producers are going to push a growth narrative, that's a pretty obvious one to push," Steve Piper, director of energy research with S&P Global Commodity Insights, said in a recent interview with Platts, part of Commodity Insights. "It's a near- to midterm demand boost story for coal that, frankly, this year, we see going hand-in-hand with just a straight-up gas-to-coal switching [due to economic factors]."

US datacenter power demand grew to 46,000 MW in the third quarter of 2024, according to S&P Global Market Intelligence 451 Research. That could more than double in the coming years, with analysts expecting another 59,000 MW of new datacenter to come online by 2029.

The electricity demand growth for datacenters is outpacing the buildout of new power-generating assets and transmission, a December 2024 report from S&P Global warned. While datacenters typically take about two to three years to develop, the timelines for power generation resources often take five years or longer, the report said.

The need to meet AI demand could upend the traditional, stereotypical narrative of where left-right politics fall on matters of energy and climate, former Federal Energy Regulatory Commission Chairman and Trump appointee Neil Chatterjee said in a recent interview with the Platts Energy Evolution podcast.

"On the political left, I think there has to be an understanding that we cannot win the AI race without fossil fuels," said Chatterjee, who now works for Palmetto Solar LLC, a software company accelerating a transition to clean energy. "On the political right, I think there has to be a recognition that we cannot possibly win the AI race with only fossil fuels."

Some large technology companies already have electricity consumption profiles comparable to small countries, said Bruno Brunetti, head of S&P Global's Low Carbon Electricity Analytics. For example, Google needs about as much power as all of Ireland while Amazon's annual energy consumption is in the same ballpark as Hungary.

"There's been a clear trend towards greater renewable procurement to the point that globally, we can say the leading buyers of renewable power are really datacenters," Brunetti said. "At least in the case of the US specifically, there are risks there that while power demand grows more because of AI, the renewable generation doesn't ramp up by the same degree."

As that demand grows, pressure to get power from where it is available could take a backseat to sustainability goals in the US.

While Duke Energy Corp. unveiled a plan to "fully exit coal by 2035" in February 2022, its utility subsidiary Duke Energy Indiana LLC has filed an integrated resource plan with state regulators that calls for keeping two units at its 3,157-MW Gibson coal plant online until 2038.

Southern Co. utility subsidiary Georgia Power Co. has also proposed extending the operations of some coal-fired units to help meet "extraordinary" load growth projections. Talen Energy Corp. in late January reached an agreement to keep operating the 1,273-MW Brandon Shores coal-fired power plant and the 828-MW Herbert A Wagner oil-fired plant beyond a May 2025 retirement date.

Coal producers see opportunity

The possibility of even further gains, thanks in part to a more supportive US government, is spurring coal producers. Trump brought up the possibility of co-locating datacenters with coal generation in a speech at the World Economic Conference in Davos, Switzerland. US Energy Secretary Chris Wright has also publicly said coal is critical to meeting rising energy demand.

While the Trump administration would likely try to repeal as many regulations as possible in an attempt to block clean energy, that is unlikely to change coal's destiny, Daniel Tait, a research and communications director for the watchdog organization Energy and Policy Institute, told Platts. States and even some utilities will likely continue to push forward renewable energy technologies to meet growing demand, he added.

"Ultimately, I don't think we will see some resurgence in coal for power. Some plants will continue to shutter as expected, and even those that are delayed will close," Tait said. "Some will co-fire and mostly fire gas. After all, most of these coal plants are aging anyway."

"We're seeing every [resource plan] that's coming out from our utility customers, they're all extending the life of their plants," Joseph Craft, CEO of US coal producer Alliance Resource Partners LP, said on a Feb. 3 earnings call. "We also see that they plan to not only extend the lives of the plant[s] but actually use them more in order to meet the demand that they've got for their customers."

Since the second half of 2020, Alliance has been using the excess power load it already paid for at its River View mine in Kentucky to mine bitcoin. As of Dec. 31, 2024, the company reported holding 482 bitcoins valued at about $45 million.

Hallador Energy Co. has been shifting from its historical focus on mining Illinois Basin coal to becoming a vertically integrated power producer. In January, the company announced it signed an exclusive commitment agreement to support the delivery of energy and capacity to a datacenter development in Indiana through a utility partner.

Executives of Peabody Energy Corp. told investors on a Feb. 6 earnings call that interested parties are looking to cooperate with the US coal producer to serve rising electricity demand. While Peabody CEO James Grech said there likely is nothing "imminent or breaking" on that front, interest in coal has increased noticeably in the last month or two with "household name private equity funds" seeking "creative means to match up reliable, low-cost coal plants with growing datacenter needs."

Not all roses

There is a range of customers, all with different views on balancing energy consumption and sustainability, Commodity Insights' Piper noted. While some think "burn tires, burn coal, I don't care" when it comes to meeting rising electricity demand, most of the larger companies are committing to natural gas, nuclear or renewable energy resources instead, Piper said.

"Every generation segment stands to benefit from this outright race to demand. However, I don't think at the end of the day the hyperscalers really want to be associated with keeping coal around," Piper said. "I think they know that could be a liability for them in the marketplace. But you could definitely see hyperscaler or datacenter folks contracting with existing coal."

Todd Snitchler, president and CEO of the Electric Power Supply Association, said Trump's efforts to improve the reliability of the electricity grid and meet surging power demand, including the president's declaration of a national energy emergency, "will be beneficial for all asset owners" of wires, power stations and "anything in between."

"In the short to medium term, of course, it is the existing resources that are already on the system that may have announced retirements or were looking to retire that may need to hang around longer. And that might be some of the coal plants that were expected to go offline that may hang around for more years now because they're going to be needed to keep the system reliable," Snitchler said in a recent phone interview with Platts. "I think the same is true of gas units."