Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Feb, 2025

By Yuzo Yamaguchi and Marissa Ramos

Japan's three megabanks are likely to grow their margins and profits as the nation's central bank expects to stay on its rate hike trajectory in 2025.

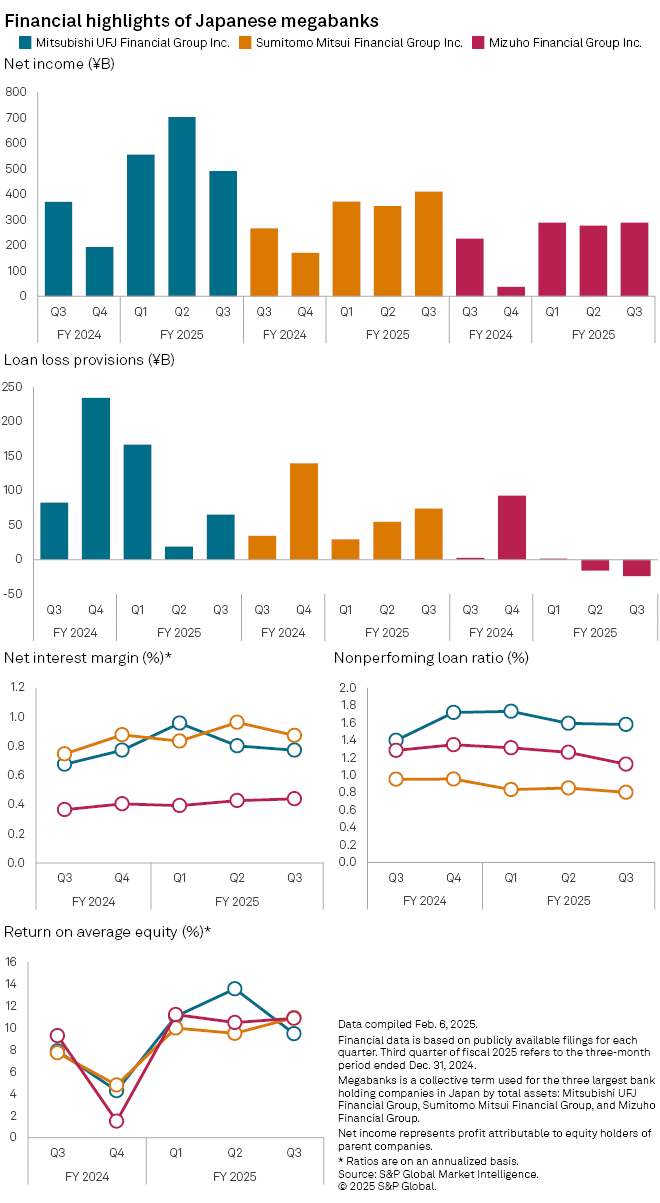

Net interest margin (NIM) at Mitsubishi UFJ Financial Group Inc. (MUFG) grew to 0.77% in the December 2024 quarter, from 0.68% a year earlier, according to S&P Global Market Intelligence data. Sumitomo Mitsui Financial Group Inc. (SMFG) increased its NIM to 0.87% from 0.75% over the same period, while Mizuho Financial Group Inc. improved its NIM to 0.44% from 0.37%.

"Their NIMs will improve more and more," as lenders benefit from higher interest rates, said Toyoki Sameshima, a senior analyst at SBI Securities Co.

The Bank of Japan (BOJ) has raised its benchmark rate three times since it abandoned its negative interest rate policy in March 2024. The central bank is expected to stay on a path of monetary policy normalization after raising its policy rate to 0.5% from 0.25% in January. Most economists expect the BOJ's benchmark rate to rise to 1.0% by the end of 2025. The sentiment was echoed by Naoki Tamura, a member of the BOJ's policy board, who said at a Feb. 6 event that the central bank would need to raise the rate to at least 1.0% by the second fiscal half.

Trump effect

Analysts are watching the rapid pace of global developments under US President Donald Trump. The threat of potential US tariffs will remain a factor in Japan's monetary policy normalization.

"The BOJ will continue its rate hike cycle unless a clear risk emerges" that US President Donald Trump's tariff policy will become a drag on the Japanese economy, said Tsuyoshi Ueno, a senior economist at NLI Research Institute.

SMFG also expects the rate increase in January to contribute about ¥100 billion to net interest income per year, in addition to a total of ¥100 billion added from previous hikes in July and March 2024. The lender said a 25-basis-point rate increase will generate an additional ¥100 billion.

Mizuho said the three rate hikes so far will likely add ¥105 billion in net interest income for the fiscal year ending March 31 and estimates this to more than double to ¥225 billion in the next fiscal year.

Loan demand is strong for the megabanks. MUFG's outstanding loans in and outside Japan increased 6% from a year earlier to ¥125.6 trillion in December 2024, while SMFG's global outstanding lending grew about 9.3% to ¥106.7 trillion. Mizuho increased its total loans by 6.5% to ¥97 trillion during the same period.

As of Feb. 14, US$1 was equivalent to ¥152.07.