Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Feb, 2025

By Yuvraj Singh and Beenish Bashir

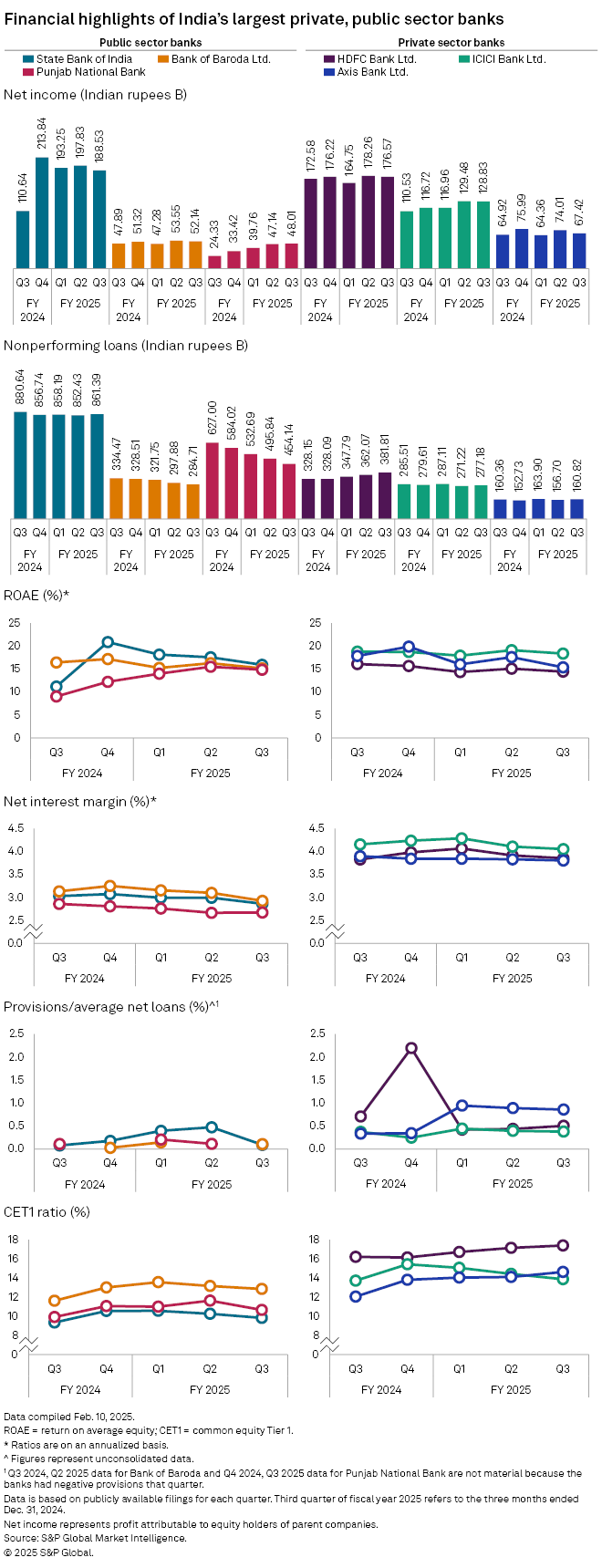

Indian banks face renewed margin pressures as interest rates are expected to fall after the country's central bank this month cut its benchmark rate for the first time in nearly five years.

Net interest margins (NIMs) at the six biggest private- and state-owned Indian banks by assets have edged lower in recent quarters as deposit rates caught up with lending rates, with the Reserve Bank of India (RBI) holding steady since its last hike in February 2023.

Still, five of the six lenders reported that loans grew by more than 12% each in the October-to-December quarter. That boosted net income at each of the six lenders year over year in the fiscal third quarter that ended on Dec. 31, 2024, according to S&P Global Market Intelligence data.

Policy easing

The RBI announced a slew of measures on Jan. 27 to inject liquidity into the banking system and said it would "continue to monitor evolving liquidity and market conditions" and take more steps if needed. The central bank followed through by cutting its benchmark repurchase rate by 25 basis points to 6.25% on Feb. 7.

Analysts at Nomura expect the central bank to cut its benchmark rate further through 2025, with the next move anticipated in April. "In our baseline, we continue to expect a terminal rate of 5.50% by end-2025," the analysts said in a note after the RBI policy decision.

Deposit rates are likely to stay elevated amid relatively tight liquidity conditions, while borrowers are likely to demand that banks pass lower interest rates to them, pressuring banks' NIMs.

State Bank of India's NIM shrank by 17 bps year over year to 2.86% in the fiscal third quarter, according to Market Intelligence data. Despite the margin squeeze, credit growth at India's biggest bank was "enviably higher" at 14% year over year "versus the system and some large private sector banks," according to Anand Dama, senior research analyst at Emkay Global Financial Services.

State Bank's credit growth "was primarily due to sustained strong momentum in the [retail, agriculture and micro, small and medium-sized enterprises] book and sequential improvement in the corporate book," Dama wrote in a Feb. 7 note.

Deposits lag

Indian lenders have grown loans and expanded their customer base. However, deposit growth has lagged, with a growing proportion of high-interest term deposits replacing low-cost deposits in current and savings accounts.

State Bank Chairperson Challa Sreenivasulu Setty attributed this to a "behavioral shift," where customers are moving their money from low-interest savings accounts to higher-yielding fixed deposits, putting stress on margins.

State Bank's cost of deposits shot up, Setty said during the lender's Feb. 6 earnings call, due to a relatively slower deposit growth of 10% in the fiscal third quarter, with the share of savings and current accounts in total deposits falling to 37.6% from 38.4% in the previous quarter.

State Bank faces "pressure on margins as the cost of funds remained elevated due to high competitive intensity for deposits [alongside] limited scope on the expansion of yields due to a slowdown in higher-yielding loan segments," Goldman Sachs said in a Feb. 6 note.

State Bank peer Bank of Baroda Ltd.'s margins declined by 20 bps year over year to 2.93%, while Punjab National Bank posted a 19-bps drop to 2.67%.

HDFC Bank Ltd., India's largest lender by market capitalization, was an outlier, with its NIM inching up by 2 bps to 3.85% in the quarter, supported by a 16% deposit growth. Private sector lenders ICICI Bank Ltd. and Axis Bank Ltd. each reported a 10-bps reduction in their margins. ICICI Bank's NIM stood at 4.05%, while Axis Bank's margin was 3.80%.