Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Feb, 2025

By Tyler Hammel

Shares in Humana Inc., Molina Healthcare Inc. and Centene Corp. are down following the release of mixed fourth-quarter 2024 results that showed the managed care insurers facing high costs and low membership growth.

With the release of Humana's fourth-quarter earnings Feb. 11, all the major managed care insurers have reported their figures for 2024-end, painting a complicated picture marred by high costs associated with government-subsidized plans such as Medicaid and Medicare Advantage.

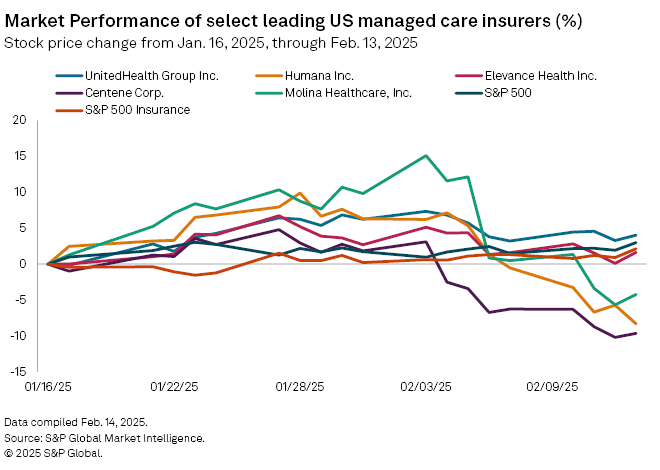

Humana's stock declined 8.3% from Jan. 16, the day UnitedHealth released its fourth-quarter earnings, to Feb. 13. Other managed care insurers, such as Molina and Centene Corp., have seen similar declines during the same period, falling 4.2% and 9.6%, respectively.

Not all managed care insurers saw a decline during the period, however, with Elevance Health Inc. posting a 1.6% growth and UnitedHealth Group Inc. reporting a 4% growth. The S&P 500 and insurance index saw similar growth during the period, rising 2.99% and 2%, respectively.

A volatile period

Humana has been beset by high costs for several quarters, and the insurer's fourth-quarter 2024 results were no exception. The company posted a fourth-quarter 2024 adjusted net loss of $296 million, or a loss of $2.16 per share, compared with an adjusted income of $79 million, or a loss of 11 cents per share, in the prior-year period, per an earnings release. The insurer expects to see about a 10% decline in individual Medicare Advantage annual memberships and record adjusted EPS of about $16.25 for 2025, per the release.

"It's been a volatile couple of years, and more so, it's been a volatile few months," CEO James Rechtin said on a fourth-quarter 2024 earnings call. "The US healthcare system is complicated, it's fragmented and it's expensive."

Despite Humana's lower 2025 EPS guidance and low Medicare Advantage star ratings, which measure the quality of an insurer's offerings, JP Morgan analyst Lisa Gill said in a research note that the company was taking the correct steps.

"While Humana's 2025 guidance came in below the Street's estimate, management articulated the key drivers, including the continued investment in recovering stars," Gill wrote. "Coming out of the call, we think investors are focused on Humana's assumption of trend normalizing in 2025 as a potential swing factor in guidance."

For Molina, its recent decline led to a 52-week low on Feb. 13, trading at $262.32 a share before closing the day at $270.67, a far cry from its 52-week high of $423.92 in March 2024.

Centene has also felt the pressure in recent quarters of state-led Medicaid redeterminations, which have adversely impacted its earnings figures. Now nearly two years into the lengthy, varied redetermination process, CEO Sarah London said during a fourth-quarter earnings call that Centene is reaching some stability.

Humana, Molina and Centene did not respond to requests for comment.

Investment gives SelectQuote a bump

SelectQuote Inc. saw a notable jump in its stock price following the announcement of a sizable investment from some major private equity investors.

On Feb. 10 the insurer announced it signed a $350 million strategic investment from funds managed by Bain Capital, Morgan Stanley Private Credit and Newlight Partners.

The investment will allow the SelectQuote to recapitalize its balance sheet, lower its annual cash debt service, provide liquidity and increase operating flexibility to fund growth initiatives, according to a news release.

"This strategic investment provides the financing we need to capitalize on the robust growth opportunities we foresee in both the senior health insurance and healthcare services marketplaces," SelectQuote CEO Tim Danker said in the announcement.

The impact on SelectQuote was immediate, with the insurer hitting a 52-week high of $6.86 on Feb. 11, before closing at $5.73 a share. The impacts have largely remained, with the insurer's stock closing Feb. 13 at $5.91 a share.