Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 Feb, 2025

By Karl Angelo Vidal and Joyce Guevarra

S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

Demand for life sciences space in the US is expected to rise in 2025 due to more favorable capital market conditions, an improving macroeconomic landscape and growth in life sciences employment, according to a CBRE Group Inc. report.

"Capital markets are generally thawing as the macroeconomic environment demonstrates unexpected strength, inflation moderates and short-term interest rates veer lower," CBRE said in the report.

In the third quarter of 2024, venture capital funding grew 10% year over year, with nearly 60% of the capital invested in later-stage companies.

Life sciences employment climbed to a record 2.1 million workers in October 2024. This was driven by record-high employment in the biotechnology research and development subsector, although the pharmaceutical and medicine manufacturing subsector experienced sluggish growth.

In the third quarter of 2024, total life sciences lab and R&D leasing activity in the 13 largest US markets grew to 2.9 million square feet from 2 million square feet in the same quarter in 2023.

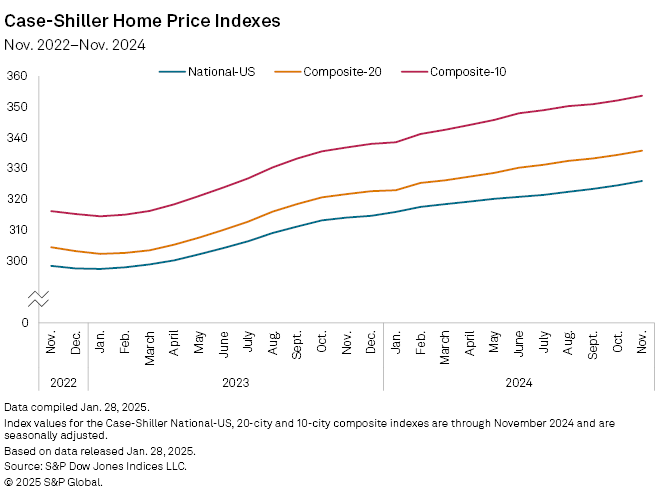

CHART OF THE WEEK: US home price growth accelerates

⮞ The pace of US home price movement accelerated to a 3.8% year-over-year increase in November 2024 from a 3.6% annual gain in October 2024, according to the S&P CoreLogic Case-Shiller US National Home Price NSA Index.

⮞ Among 20 cities, New York recorded the largest annual growth, at 7.3%.

⮞ Tampa, Florida, posted a 0.4% decline in November 2024, the first annual drop for any market in more than a year.

TOP DEALS

– Canadian shopping center real estate investment trust Primaris REIT completed the acquisition of a 50% stake in Southgate Centre in Edmonton, Alberta, and a 100% ownership interest in Oshawa Centre in Oshawa, Ontario, for a total consideration of C$585.0 million.

– Brookfield Property Partners LP closed the sale of the PGA National Resort & Spa in Palm Beach Gardens, Florida, to a joint venture among Henderson Park, Salamander Hospitality LLC and South Street Partners LLC. The property spans 807 acres and includes 360 hotel rooms.

– An affiliate of multifamily REIT Equity Residential sold the 678-unit Town Square at Mark Center apartment and townhome community at 1401 and 1459 N. Beauregard St. in Alexandria, Virginia, to DSF Group for US$237 million, the Washington Business Journal reported. The property is 98% leased.

– Diversified Healthcare Trust closed the US$159.0 million sale of the three-building life sciences property called MUSE in Torrey Pines, San Diego. The 186,000-square-foot property was 49% leased at the time of sale, with a weighted average lease term of more than eight years.

US HOTEL PERFORMANCE

US hotels performed well across three key metrics during the week ended Feb. 1, STR reported, citing data from CoStar, which provides information and analytics on property markets.

Revenue per available room (RevPAR) saw the highest year-over-year improvement, up 4.1% to US$84.90. Occupancy was 56.5%, 2.3% higher than the comparable week in 2024. The average daily rate (ADR) rose 1.8% to US$150.25.

Among the top 25 markets, Minneapolis posted the largest gains in occupancy and RevPAR. Orlando, Florida, logged the highest ADR increase.

Explore key people moves in North American real estate.

REIT Replay: REIT share prices tick down during final week of January

NAV Monitor: US equity REITs end January at 13.8% median discount